(A)Prepare ratio analyses (for 2019, 2018, and 2017) for both companies.You should include the following ratios in your computations: 1. Profitability ratios Gross Profit margin Profit margin Return on assets Return on equity 2. Productivity Inventory Turnover Accounts Receivable Turnover PPE Turnover Asset Turnover 3. Solvency Debt-to-equity Times interest earned Return on Financial leverage 4. Liquidity Current Ratio Quick Ratio Operating cash flow to current liabilities Working capital

(A)Prepare ratio analyses (for 2019, 2018, and 2017) for both companies.You should include the following ratios in your computations: 1. Profitability ratios Gross Profit margin Profit margin Return on assets Return on equity 2. Productivity Inventory Turnover Accounts Receivable Turnover PPE Turnover Asset Turnover 3. Solvency Debt-to-equity Times interest earned Return on Financial leverage 4. Liquidity Current Ratio Quick Ratio Operating cash flow to current liabilities Working capital

Financial Accounting: The Impact on Decision Makers

10th Edition

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Gary A. Porter, Curtis L. Norton

Chapter7: Receivables And Investments

Section: Chapter Questions

Problem 7.11E

Related questions

Question

(A)Prepare ratio analyses (for 2019, 2018, and 2017) for both companies.You should include the following ratios in your computations:

1. Profitability ratios

Gross Profit margin

Profit margin

Return on assets

Return on equity

2. Productivity

Inventory Turnover

PPE Turnover

Asset Turnover

3. Solvency

Debt-to-equity

Times interest earned

Return on Financial leverage

4.

Current Ratio

Quick Ratio

Operating cash flow to current liabilities

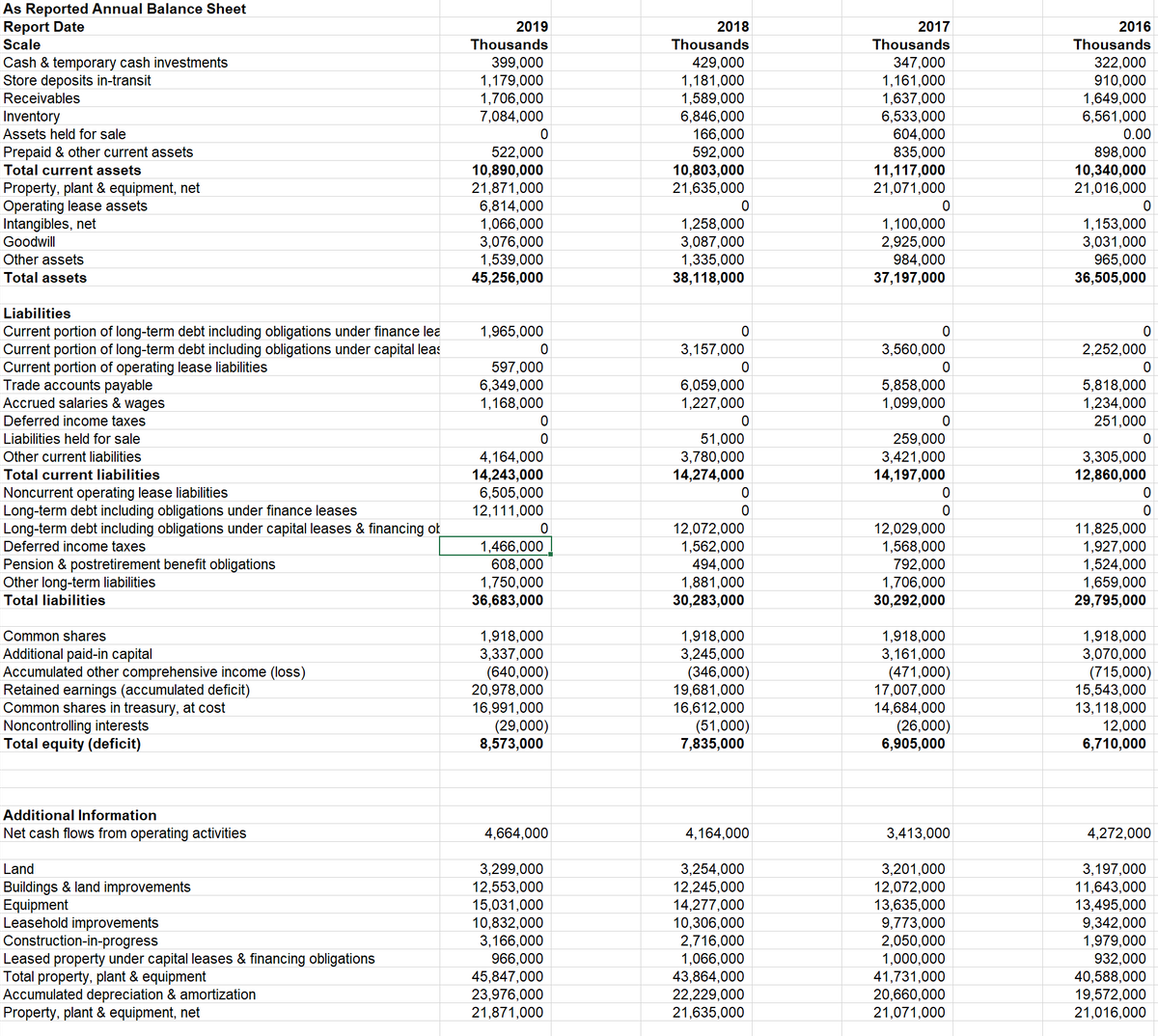

Transcribed Image Text:As Reported Annual Balance Sheet

Report Date

Scale

2019

Thousands

2018

2017

2016

Thousands

Thousands

Thousands

Cash & temporary cash investments

Store deposits in-transit

429,000

1,181,000

1,589,000

6,846,000

166,000

592,000

10,803,000

21,635,000

347,000

1,161,000

1,637,000

6,533,000

604,000

835,000

11,117,000

21,071,000

399,000

1,179,000

1,706,000

7,084,000

322,000

910,000

1,649,000

6,561,000

Receivables

Inventory

Assets held for sale

0.00

Prepaid & other current assets

Total current assets

522,000

10,890,000

21,871,000

6,814,000

1,066,000

3,076,000

1,539,000

45,256,000

898,000

10,340,000

21,016,000

Property, plant & equipment, net

Operating lease assets

Intangibles, net

1,258,000

3,087,000

1,335,000

38,118,000

1,100,000

2,925,000

984,000

37,197,000

1,153,000

3,031,000

965,000

36,505,000

Goodwill

Other assets

Total assets

Liabilities

Current portion of long-term debt including obligations under finance lea

Current portion of long-term debt including obligations under capital leas

Current portion of operating lease liabilities

Trade accounts payable

Accrued salaries & wages

1,965,000

3,157,000

3,560,000

2,252,000

597,000

6,349,000

1,168,000

6,059,000

1,227,000

5,858,000

1,099,000

5,818,000

1,234,000

251,000

Deferred income taxes

Liabilities held for sale

51,000

3,780,000

14,274,000

259,000

3,421,000

14,197,000

3,305,000

12,860,000

Other current liabilities

4,164,000

14,243,000

6,505,000

12,111,000

Total current liabilities

Noncurrent operating lease liabilities

Long-term debt including obligations under finance leases

Long-term debt including obligations under capital leases & financing ok

Deferred income taxes

1,466,000

608,000

1,750,000

36,683,000

12,072,000

1,562,000

494,000

1,881,000

30,283,000

12,029,000

1,568,000

792,000

1,706,000

30,292,000

11,825,000

1,927,000

1,524,000

1,659,000

29,795,000

Pension & postretirement benefit obligations

Other long-term liabilities

Total liabilities

Common shares

Additional paid-in capital

Accumulated other comprehensive income (loss)

Retained earnings (accumulated deficit)

Common shares in treasury, at cost

Noncontrolling interests

Total equity (deficit)

1,918,000

3,245,000

(346,000)

19,681,000

16,612,000

(51,000)

7,835,000

1,918,000

3,161,000

1,918,000

3,337,000

(640,000)

20,978,000

16,991,000

(29,000)

8,573,000

(471,000)

17,007,000

14,684,000

(26,000)

6,905,000

1,918,000

3,070,000

(715,000)

15,543,000

13,118,000

12,000

6,710,000

Additional Information

Net cash flows from operating activities

4,664,000

4,164,000

3,413,000

4,272,000

Land

Buildings & land improvements

Equipment

Leasehold improvements

Construction-in-progress

Leased property under capital leases & financing obligations

Total property, plant & equipment

Accumulated depreciation & amortization

Property, plant & equipment, net

3,299,000

12,553,000

15,031,000

10,832,000

3,166,000

966,000

45,847,000

23,976,000

21,871,000

3,254,000

12,245,000

14,277,000

10,306,000

2,716,000

1,066,000

43,864,000

22,229,000

21,635,000

3,201,000

12,072,000

13,635,000

9,773,000

2,050,000

1,000,000

41,731,000

20,660,000

21,071,000

3,197,000

11,643,000

13,495,000

9,342,000

1,979,000

932,000

40,588,000

19,572,000

21,016,000

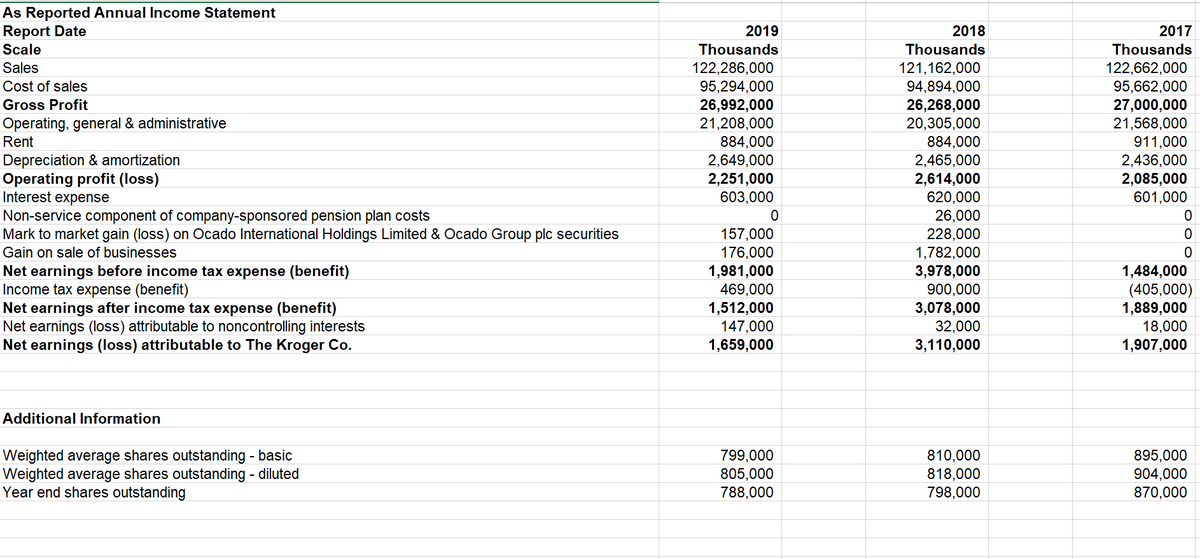

Transcribed Image Text:As Reported Annual Income Statement

Report Date

Scale

2019

2018

2017

Thousands

Thousands

Thousands

Sales

122,286,000

95,294,000

26,992,000

21,208,000

884,000

2,649,000

2,251,000

603,000

121,162,000

94,894,000

26,268,000

20,305,000

884,000

2,465,000

2,614,000

620,000

26,000

228,000

1,782,000

3,978,000

900,000

3,078,000

32,000

3,110,000

122,662,000

95,662,000

27,000,000

21,568,000

Cost of sales

Gross Profit

Operating, general & administrative

Rent

Depreciation & amortization

Operating profit (loss)

Interest expense

911,000

2,436,000

2,085,000

601,000

Non-service component of company-sponsored pension plan costs

Mark to market gain (loss) on Ocado International Holdings Limited & Ocado Group plc securities

157,000

176,000

1,981,000

469,000

1,512,000

147,000

1,659,000

ㅇ

Gain on sale of businesses

Net earnings before income tax expense (benefit)

Income tax expense (benefit)

Net earnings after income tax expense (benefit)

Net earnings (loss) attributable to noncontrolling interests

Net earnings (loss) attributable to The Kroger Co.

1,484,000

(405,000)

1,889,000

18,000

1,907,000

Additional Information

Weighted average shares outstanding - basic

Weighted average shares outstanding - diluted

Year end shares outstanding

799,000

805,000

788,000

810,000

818,000

798,000

895,000

904,000

870,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning