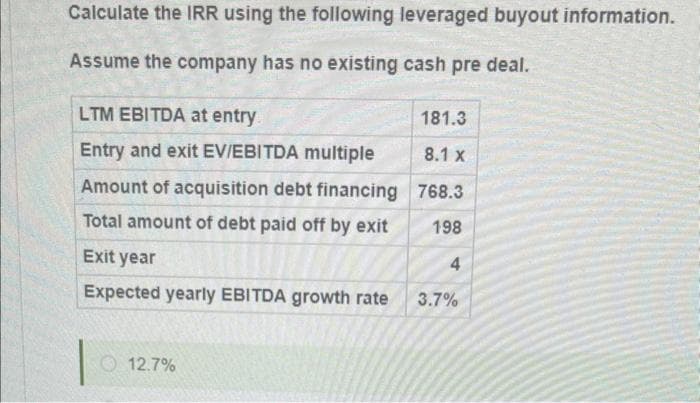

Assume the company has no existing cash pre deal. LTM EBITDA at entry Entry and exit EV/EBITDA multiple Amount of acquisition debt financing Total amount of debt paid off by exit Exit year Expected yearly EBITDA growth rate 181.3 8.1 X 768.3 198 4 3.7%

Q: Nowlin Pipe & Steel has projected sales of 19,600 pipes this year, an ordering cost of $5 per order,…

A: a. Economic Order Quantity = (2S0 / C)1/2 where, C = carrying cost per unit S = total demand in…

Q: compute the discounted payback statistic for Project X and recommend whether the firm should accept…

A: Discounted payback period shows that how long it will take to recoup an investment using present…

Q: Set out and explain how the p/e ratio provides a shorthand guide to the market’s assessment of a…

A: The P/E ratio is very important in the valuation of the firm and it show how is the firm going to do…

Q: Krawczek Company will enter into a lease agreement with Heavy Equipment Co. where Krawczek will make…

A: Introduction Operating leases require lease expenses to be recognized on a straight-line basis over…

Q: What is the compound amount after you invest P22,350 for 5 years and 6 months at 5% compounded…

A: To calculate the compound amount we will use the below formula Compound amount = P*(1+r)n Where P…

Q: How do money markets and capital markets differ? Identify the types of securities traded in money…

A: The Money market is a feature of the economy that offers short term investment option. A…

Q: The yield spread between two bond issues reflect more than just credit risk. What other factors…

A: Bond refers to the securities in which an investor lends money to the government in exchange for…

Q: The engineering team at Manuel's Manufacturing, Inc., is planning to purchase an enterprise resource…

A: Solution:- Present worth means the net present value. It means the net present value of benefits…

Q: Green Thumb Landscaping wants to build a $145,000 greenhouse in 2 years. The company sets up a…

A: We will use the concept of time value of money here. As per the concept of time value of money the…

Q: Explain why the price of a put option is higher when the strike price is higher.

A: The put option is a type of option which will be offering with the right of selling a particular…

Q: A loan of $381,000 at 2.72% compounded quarterly was to be settled with month-end payments of…

A: Total amount, A = P(1+(R/100*4))4*3.629

Q: Suppose in 1978 there is a surprise recession expected to last until 1979 and in response the Bank…

A: Recession is referred as the business cycle, which has the contraction at the time of decline in an…

Q: What would you expect to pay for a 5486 sqm prime industrial property, fully leased at $175/sqm…

A: Gross Income = Building area * gross rate. Outgoings = Building area* outgoings rate. Net Income =…

Q: Suppose your firm has a market value of equity is $500 million and a market value of debt is $475…

A: Given: Market value of equity = $500 Million Market value of debt = $475 Million

Q: What is the amount of net working capital?

A: Information Provided: Shareholders equity = $218,700 Total liabilities = $141,000 Long Term assets…

Q: The following data represents the prices (in R) of 50 items purchased by a shopper. Price (R)…

A: Mean, median, and mode A data set's mean (average) is calculated by adding all of the numbers in the…

Q: Identify the main ethical arguments that

A: Insider trading is considered as unethical in corporate world and there are huge punishment for…

Q: UESTION FOUR Dell is among the world leaders for manufacturing PC, mobile, tablets, and other…

A: Some of Public limited company want to go back to private company due to some of advantages over…

Q: You're evaluating various investment opportunities and you have the following information about five…

A: The Sharpe ratio is used to measure the return of a portfolio that has been adjusted for risk. An…

Q: heavy equipment for a certain project and the details are as follows: ITEM: MACHINE A: MACHINE B:…

A: Annual Costs= Annual operating cost +Annual labor cost +0.10(Annual labor cost) + 0.04(First cost)

Q: Pretend that you are saving up for a down payment on a car or house. Pretend that we get an…

A: Future value of a present amount Future value is always more than the present amount, deposited in…

Q: Chî Mining Corporative is set to open a gold mine in Mansa. According to the evaluations made this…

A: IRR It is a capital budgeting tool to decide on whether the capital project should be accepted or…

Q: In 6 years Dawn wants her current savings of $3700 to grow to $7300? What per annum rate, compounded…

A: Current saving (P0) = $3700 Future value after 6 years (FV) = $7300 Annual rate (r) = ? Period (p) =…

Q: Consider a put option on a stock that currently sells for £100, but may rise to £120 or fall to £80…

A: Since you have posted a question with multiple sub-parts, we will solve the first three subparts for…

Q: 7.5 UNKNOWN PERIODIC PAYMENTS Often, in a given problem, the present or future value, the interest…

A: Future value of annuity includes the amount being deposited but also accumulated amount of the…

Q: Lennon invests $8500 in two different accounts. The first account paid 13%, the second account paid…

A: We need to Create Two equations here to solve this We will assume that Amount invested in First…

Q: Suppose we have a bond issue currently outstanding that has 25 years left to maturity. The coupon…

A: A bond is a debt instrument that pays coupons and face value as the repayments for the debt that the…

Q: A project with a life of 6 years is expected to provide annual sales of $380,000 and costs of…

A: Given: Particulars Base case Sales $380,000.00 Cost $269,000.00 Tax rate =21%

Q: An asset has values S(0) = 10 and S(1, 1) = 9 with up factor u = 1.1 and the return over one…

A: The no arbitrage rule is as follows:0< d< 1+r or R < u or 0 < π < 1 we are given S(1,…

Q: Juliana has contributed $2.108.00 every six months for the last 9 years into an RRSP fund The…

A: The concept of the time value of money states that due to the interest-earning capacity of money,…

Q: Edison wants to have Php900,000 in 4 years. He makes semi-annual deposits in a savings account…

A: Here, Desired Amount (FV) is Php 900,000 Time Period (n) is 4 years Interest Rate (r) is 8%…

Q: Sara purchased a three-bedroom, two-storey house for $209 000 with a 10% down payment. The mortgage…

A: The down payment refers to the money paid by the customer in the early stage of purchasing the…

Q: H4. Which statement is true? a. Duration is good for estimating the impact of large interest rate…

A: Price of bond depends on the interest rate prevailing in the market and coupon payment and period of…

Q: Assuming an interest rate of 5%, which three cash flows have the best Net Present Value? (Remember…

A: PVF (5%,1year) = 0.9524 PVF (5%,2year) = 0.9070 PVF (5%,3year) = 0.8638 PVF (5%,4year) = 0.8227 PVF…

Q: 8. Determine the amount that would have to be invested to provide 200 dollars interest at the end of…

A: Simple interest is the quick and the straightforward way to calculate the interest on the loan.…

Q: Analyze the capital gains and the growth in share price for the five year period

A: Trend analysis is the change in the share price annually over a period. It helps to determine…

Q: XYZ Company has bonds outstanding with 7 years left before maturity. The bonds are currently selling…

A: The effective interest rate that a corporation pays on its obligations, such as bonds and loans, is…

Q: Problem 2. On January 1, 1995, an investor opened a savings account at Bank A with a deposit of…

A: The simple interest is the interest earned on the same amount for each successive period. Compound…

Q: Which of the following(s) would be ways to reject the CAPM? a showing that there exist a stock…

A: CAPM is calculated with the formula below:Return on stock = Risk free rate + Beta (Market return -…

Q: A Uniform series estimating the economic worth F(Future value) when A is given is calculated using:…

A: The worth of a series of recurrent payments at a specific future date, assuming a specific rate of…

Q: Compare the monthly payment and total payment for the following pair of $180,000 loan options.…

A: An annuity is a stream of fixed cash flows that occur at regular intervals.The periodic payments on…

Q: Searching the value of the factor (P/F,5%, 10) in the table of factors: O a the factor value is…

A: The factor value can be found in P/F table at the intersection of time period or n = and interest…

Q: onthly. After this period, the accumulated money was left in the account for another 5.5 yea e same…

A: Future value of deposit includes the amount being deposited and amount of compounding interest…

Q: Tshepo needs R5 000 urgently. He goes to the bank and borrows the money at an interest rate of 28%…

A: Compound interest is the interest earn on interest. The rate at which compound interest accrues…

Q: For the question below use the following figures which illustrate the production possibilities…

A: First let us calculate advantage of Farmer over the rancher.Farmer can produce 4 pounds of potato…

Q: Using information about the following company, calculate the share premium / (discount) a private…

A: Leveraged Buyout: A leveraged buyout occurs when a company acquires another by taking on a…

Q: Project A requires an original investment of $66,800. The project will yield cash flows of $19,800…

A: Net Present Value: The difference between the value of cash today and the worth of cash at a future…

Q: You just purchased a parcel of land for $40,000. To earn a 9% annual rate of return on your…

A: Future value of a present amount The future value (FV) for a present value (PV) that earns annual…

Q: Fill the correct inputs on the T184 finance application to determine what initial investment would…

A: Given: Future value = $28,000 Interest rate = 2.14% Years = 3

Q: $510 monthly for 60 months. What are the total amount financed and the total finance charge that…

A: Information Provided: Car cost = $42,500 Down payment = $16,000 Monthly payments = $510 Number of…

The answer is 12.7% but i need an explanation.

Step by step

Solved in 5 steps

- JJJCorporation is to be sold off by its shareholders. It currently has market values of debt and of equity at $20,000,000 and $25,000,000 respectively. The effective cost of debt is 12% while the cost of equity is 18%. Several analysts determined three potential acquirers who may be able to synergize with JJJ. The following returns from JJJ depending on the acquirer are as follows:" Acquirer Expected Firm Return G 20% H 24% I 18% Based on the above and assuming that liabilities will be retained by the entity, what is the highest selling price that the shareholders can get from the sale of JJJ?A Company wants to seek additional source of external financing. The current book value structure of the company is as follows: GHS13% Debentures (GHS 100 per debenture)800,00014% Preference Shares (GHS 100 per share)200,000Equity Shares (GHS 10 per share)1,000,000The following external financing opportunities are: (i)A debenture with 10-year maturity, 4% flotation cost and current market price of GHS 100.(ii)A redeemable preference share with 10-year maturity, 5% floatation cost and current market price of GHS 100. (iii)Equity shares – GHS 2 per share flotation costs and current market price of GHS 22.Dividend expected on equity share at the end year is GHS 2 per share, anticipated growth rate in dividends is 7%. Company pays all its earnings in the form dividends. Corporate tax rate is 50%. Required – Calculate the WACCPenn Corp. is analyzing the possible acquisition of Teller Company. Both believes the acquisition will increase its total aftertax annual cash flow by $1,272,653.1 indefinitely. The current market value of Teller is $23,042,111 and that of Penn is $62,440,594. The appropriate discount rate for the incremental cash flow is 14.22%. Penn is trying to decide whether it should offer 33% of its stock or $36,097,009 in cash to Teller's shareholders. What is the NPV of the stock offer? HINT: Subtract the equity cost (as computed in the previous problem) from the value of the combined firm.

- You have the following initial information on Financeur Co. on which to base your calculations and discussion for question 2): • Current long-term and target debt-equity ratio (D:E) = 1:3 • Corporate tax rate (TC) = 30% • Expected Inflation = 1.55% • Equity beta (E) = 1.6325 • Debt beta (D) = 0.203 • Expected market premium (rM – rF) = 6.00% • Risk-free rate (rF) =2.05% 2) Assume now a firm that is an existing customer of Financeur Co. is considering a buyout of Financeur Co. to allow them to integrate production activities. The potential acquiring firm’s management has approached an investment bank for advice. The bank believes that the firm can gear Financeur Co. to a higher level, given that its existing management has been highly conservative in its use of debt. It also notes that the customer’s firm has the same cost of debt as that of Financeur Co. Thus, it has suggested use of a target debtequity ratio of 2:3 when undertaking valuation calculations. a) What would the required…Penn Corp. is analyzing the possible acquisition of Teller Company. Both believes the acquisition will increase its total aftertax annual cash flow by $1,176,015.93 indefinitely. The current market value of Teller is $23,453,722 and that of Penn is $63,348,212. The appropriate discount rate for the incremental cash flow is 13.63%. Penn is trying to decide whether it should offer 36% of its stock or $35,478,193 in cash to Teller's shareholders. What is the equity cost of the acquisition? HINT: Compute the value of the combined firm by adding the current value of the target with the present value of the differential cash flow of the combined firm. To determine the equity cost of the acquisition, add the current value of the acquirer and then multiply by the proposed percentage of the stock that has been offered for the firm.Company A has a market capitalization of $2410539999 and 22833777 shares outstanding. It plans to distribute $35977773 through an open market repurchase. Assuming perfect capital markets: What will the price per share of the firm be right after the repurchase?

- You have the following initial information on Financeur Co. on which to base your calculationsand discussion for questions 2):• Current long-term and target debt-equity ratio (D:E) = 1:3• Corporate tax rate (TC) = 30%• Expected Inflation = 1.55%• Equity beta (E) = 1.6325• Debt beta (D) = 0.203• Expected market premium (rM – rF) = 6.00%• Risk-free rate (rF) =2.05%2) Assume now a firm that is an existing customer of Financeur Co. is considering a buyoutof Financeur Co. to allow them to integrate production activities. The potential acquiringfirm’s management has approached an investment bank for advice. The bank believesthat the firm can gear Financeur Co. to a higher level, given that its existing managementhas been highly conservative in its use of debt. It also notes that the customer’s firm hasthe same cost of debt as that of Financeur Co. Thus, it has suggested use of a target debtequity ratio of 2:3 when undertaking valuation calculations.a) What would the required rate of return…The DestitutusVentis Company (DV Co) has the following items on its balance sheet (question mark means that the quantity is unknown): Type of asset/liability Market value Risk (beta) Cash holdings £20m 0 Fixed investments £180m ? Short term debt £10m 0 Long term debt £70m 0.05 Equity £120m 1.1 The risk-free rate is 3%, and the average return on the market index is 7%. The number of shares outstanding for DV Co is 100m. The corporate and investor tax rates are zero. Modigliani-Miller irrelevance of dividend policy and capital structure holds. What is the weighted average cost of capital (WACC) for DV Co? The company plans to pay a dividend per share of £0.10, which is funded by increasing the company’s long-term debt correspondingly. The new debt has the same beta as the old long-term debt. What is the value per share of the DV Co’s stock on ex-dividend day if the dividend payment goes ahead? What is the beta of the equity on…When an acquirer assesses a potential target, the price the acquirer is willing to pay should be based on the value of: The target firm’s total corporate value (debt and equity) The target firm’s equity The target firm’s debt Consider the following scenario: Ziffy Corp. is considering an acquisition of Keedsler Motors Co., and estimates that acquiring Keedsler will result in incremental after-tax net cash flows in years 1–3 of $14.00 million, $21.00 million, and $25.20 million, respectively. After the first three years, the incremental cash flows contributed by the Keedsler acquisition are expected to grow at a constant rate of 6% per year. Ziffy’s current beta is 1.60, but its post-merger beta is expected to be 2.08. The risk-free rate is 5%, and the market risk premium is 7.10%. Based on this information, complete the following table by selecting the appropriate values (Note: Do not round intermediate calculations, but round your answers to two decimal places): Value…

- Penn Corporation is analyzing the possible acquisition of Teller Company. Both firms have no debt. Penn believes the acquisition will increase its total aftertax annual cash flows by $1.45 million indefinitely. The current market value of Teller is $31.5 million, and that of Penn is $53 million. The appropriate discount rate for the incremental cash flows is 10 percent. Penn is trying to decide whether it should offer 40 percent of its stock or $44.5 million in cash to Teller’s shareholders. a. What is the cost of each alternative? (Enter your answers in dollars, not millions of dollars, e.g, 1,234,567.) b. What is the NPV of each alternative? (Enter your answers in dollars, not millions of dollars, e.g, 1,234,567.)Hastings Corporation is interested in acquiring Vandell Corporation. Hastings Corporation estimates that if it acquires Vandell Corporation, synergies will cause Vandell’s free cash flows to be $2.3 million, $2.9 million, $3.4 million, and $3.79 million at Years 1 through 4, respectively, after which the free cash flows will grow at a constant 5% rate. Hastings plans to assume Vandell’s $10.29 million in debt (which has a 7.4% interest rate) and raise additional debt financing at the time of the acquisition. Hastings estimates that interest payments will be $1.6 million each year for Years 1, 2, and 3. After Year 3, a target capital structure of 30% debt will be maintained. Interest at Year 4 will be $1.431 million, after which the interest and the tax shield will grow at 5%. Vandell currently has 1.5 million shares outstanding and a target capital structure consisting of 30% debt; its current beta is 1.10 (i.e., based on its target capital structure). Vandell and Hastings each have a…RTE Telecom Inc., which is considering the acquisition of Lucky Coro, estimates that acquiring Lucky will result in an incremental value for the firm. The analysts involved in the deal have collected the following information from the projected financial statements of the target company: Data Collected (in millions of dollars) Year 1 Year 2 Year 3 EBIT $120 $14.4 $18.0 Interest expense 505560 Debt 29.7 35.1 37.8 Total net operating capital 109.2 111.3 1134) Lucky Corp is a pubicly traded company, and its market- determined pre-merger beta is 1.20 You also have the following information about the company and the projected statements: Lucky currently has a $12.00 million market value of equity and S 7:80 million in debt. The risk-free rate is 3.5%, there is a 5.60% market risk premium, and the Capital Asset Pricing Model produces a pre merger required rate of return on equity rs of 10.22% Lucky's cost of debt is 5.50% al a laxtale of 35% The projections assume that the company will have…