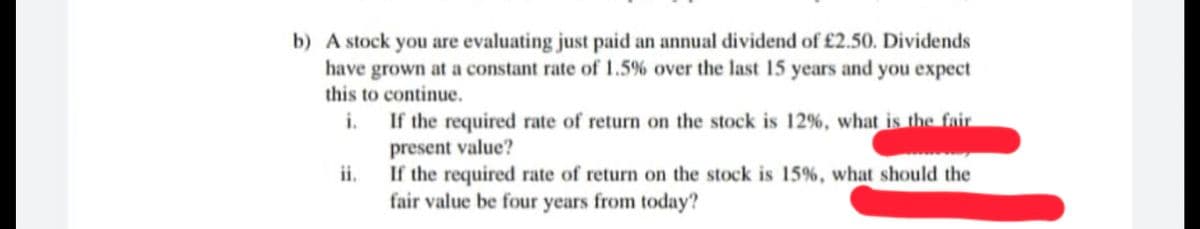

b) A stock you are evaluating just paid an annual dividend of £2.50. Dividends have grown at a constant rate of 1.5% over the last 15 years and you expect this to continue. i. If the required rate of return on the stock is 12%, what is the fair present value? ii. If the required rate of return on the stock is 15%, what should the fair value be four years from today?

Q: A country has a GDP of $250 billion dollars. The consumption in that country is $30 billion. There…

A: Note: You have uploaded two questions simultaneously. Hence, we shall solve the first question for…

Q: 1) Suppose gold (G) and silver (S) are substitutes for each other because both serve as hedges…

A: As given Demand for gold and silver is PG= 975 - QG + 0.5PS PS = 600 -QS + 0.5PG As also given that…

Q: Break-Even Point The break-even point for a company is where costs equal revenues. Therefore the…

A: In short run, each and every firm focus to recover variable cost and ready to bear fixed cost .

Q: 2- Find Profit for the project, which its cash flow is shown below 95 x 10 700,000 U دفعات شهرية 0 0…

A: The total cash and cash equivalents received and expended by a company are referred to as its cash…

Q: cation systems are being con n China. Doing nothing is e data below and state yc ng this problem…

A: *Answer:

Q: iv) Natural disasters increase the post-disaster Gross Domestic Product (GDP) but are bad to long…

A: GDP refers to the final value of goods and services that produced in a nation in a particular period…

Q: Describe an innovation in technology, business, or culture that had a major economic impact in your…

A: Innovation and change have become the key components for the success and failure of any business.…

Q: In the market for euros, a Multiple Choice cause no change in equilibrium price. increase…

A: Exchnage rate is the rate at which the nations currency are exchanged . And it is determined by the…

Q: a firm earns $375 billion in profits for the year and they retain $218 billion, what is the percent…

A: As given Profit = $375 billion Retain = $218 billion Dividend payout ratio = Dividendsincome…

Q: QUESTION 10 Governor Kathy Hochul does not like rabbits. She has decided to institute a $50 tax on…

A: Given: Supply: P=9+0.4Q Demand: P=75-0.4Q

Q: Discuss the fuel tax increase impact on the economic growth of S.A

A: Increase in fuel tax will decrease the domestic demand in South Africa which decrease the domestic…

Q: Commercial banks hold governments bonds of £71, reserves of £61, and currency of E48. The public…

A: Answer to the question is as follows:

Q: Modified True or False: State whether each statement is true or false. If the statement is false,…

A: Fixed cost refers to the cost which does not change with change in the output level.

Q: Consider a market demand function P=100-0.01Q. There are only two firms in the market and each…

A: When there is no first-mover, both firms act as Cournot duopoly and when there is a first mover,…

Q: There are two stores at a mall, the mall can be protected by security guards, q measures the hours…

A:

Q: Hübert brings $40 to a football game to spend on hot dogs and beer. The following diagram shows his…

A: Budget constraint: - it is a graphical representation of different bundles of goods that a consumer…

Q: Which point corresponds to level of consumption and investment in the economy after malinvestment…

A: Optimal choice - It is the best combination of goods which will lead to the best satisfaction of the…

Q: The figum to the right shows he matet for g The mtt ofa, Now eeose produers decide t o, hoder Hitely…

A: Here, the given graph shows the market demand curve and market supply curve with the initial price…

Q: 2. Suppose the total cost function of a firm that produces hotdogs is C= 150q - 4q + 2q where q is…

A:

Q: In which of the following markets do you expect efficient outcomes? Explain your position. Your…

A: In a market, if the Marginal Cost and Marginal benefits are same this situation is reffered as…

Q: The interest rate increases from 10% to 12% and GDP falls from 110 to 100 and money supply is…

A:

Q: Recently, gas prices have soared across the capital region. When the average gas price rose from…

A: Given information: When the average gas price rose from $3.60 a gallon to $4.40 a gallon, there is a…

Q: Who prepares and passes the federal budget?

A: The United States federal budget involves the spending and incomes of the U.S. national government.…

Q: What could be the major learnings that could developed by taking a introductory microeconomics…

A: The Microeconomics is an economics that deals to satisfy an individual producer, an individual…

Q: Your friend Stan owns a coffee shop in a monopolistically competitive industry. One day, Stan tells…

A: Every firm in the market works with the goal of profit maximization.

Q: Use the graph below to answer this question: Based on this graph, suppose the equilibrium price and…

A: We will answer the first question since the exact one was not specified. Please submit a new…

Q: There's quite a diverse set of countries in East Asia that have varying levels of development.…

A: Nature of countries whether Lower , higher or middle income countries are measured by the gross…

Q: Alex purchases 100 stocks in a company that pay dividends of $10 every year for the next 5 years.…

A: Alex purchases 100 stocks in a company that pay dividends of $10 every year for the next 5 years.…

Q: Modified True or False: State whether each statement is true or false. If the statement is false,…

A: The correct answer is given in the second step.

Q: (Q#7a) Each time the FED purchased a large tranche (amount) of treasury and mortgage bonds, what…

A: Answer - Money Market:- money market is a market where money and other loanable funds are…

Q: John is planning to retire in 15 years. Money can be deposited at 8% compounded quarterly. What…

A: Semiannually Withdrawal = 25,940 Interest rate = 8% compound quarterly

Q: Drive-in cinema became very popular in the late 1950s and early 1960s, particularly after screening…

A: Opportunity costs address the potential advantages that an individual, financial backer, or business…

Q: 1. In an OLG model with money: Each gen picks 12 banans when young, 4 bananas when old. Central…

A: * ANSWER :- (1) From the given information the answer is provided below as ,

Q: 3. given by q = LeK. Michelle hires labor and rents capital in perfectly competitive markets where w…

A: Production function : q = L1/6K1/6 w = 1 , r = 64 The major difference between a short run and long…

Q: Using aggregate demand and aggregate supply analysis, show the effects of the llowing (Assume…

A: Note: You have uploaded a question with multiple sub parts. Hence, we shall solve the first three…

Q: Commercial banks hold governments bonds of £71, reserves of £61, and currency of E48. The public…

A: Money Multiplier is the reciprocal of required reserves ratio on the other its also be determined by…

Q: 1. The market price for tomatoes is $2/pound. Lynn is too small to influence the price of tomatoes.…

A: The labor market, sometimes known as the job market, is concerned with the supply and demand for…

Q: 7. You are given with some economic data of Economy B in 2021. Answer this question using the…

A: Nominal GDP growth rate refers to growth rate of GDP of a country in current price terms whereas…

Q: Per capita GDP is used to measure a country's standard of living. What other economic factors impact…

A: The GDP is known as gross domestic product which is the sum of all the final goods and services…

Q: Meow Chow sells cat food in a perfectly competitive market and has the following cost curves:…

A: Perfectly competitive market: - it is a market condition where there are many buyers and many…

Q: Question 8 Match the explanation of poverty and inequality with its example. Endowments V [Choose ]…

A: Economies of scale means production at large quantities which lead to decline in per unit cost of…

Q: Firms A and B compete à la Cournot and sell at a price P = 12 - (qa + q8). If none of them invest in…

A:

Q: What are the benefit and disadvantages of A working capital loan ?

A:

Q: pu are asked to help the company "X" omputing the Loan repayment table. ODraw up the repayment table…

A: *Answer: Loan is an amount of money borrowed from a lender and is expected to repay at a future…

Q: differences between the mainstream/New Keynesian and the Post-Keynesian theory of medium run…

A: New Keynesian Theory According to the New Keynesian Theory, prices and wages are closely related and…

Q: A) Ana decides every day how many hours to work and how much beef to consume. She spends all income…

A: Given information U=2t^0.5+Y W=1 t=24-h Y= consumption of beef Price of beef=4

Q: The government imposes a restriction on firms such that no more than Q, units of output can be…

A: Answer: (1). Consumer surplus is the area between the equilibrium price and the demand curve.…

Q: Question #2: This question contains two parts and they are independent to each other. Part 1:…

A: Equation: %∆Wine = – 0.7×(%∆Price of Wine) + 3.8×(%∆Income) + 1.0×(%∆Price of Beer)

Q: A negative cash balance requires an increase in payments and decrease in cash receipts. True or…

A: In economics, cash refers to the most liquid form of money that can be used anywhere to make any…

Q: Potential economic value of mobile internet

A: The various sectors are developing and are contributing to economic growth and development. And the…

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

- Carnes Cosmetics Co.'s stock price is $60, and it recently paid a $1.25 dividend. This dividend is expected to grow by 27% for the next 3 years, then grow forever at a constant rate, g; and rs = 14%. At what constant rate is the stock expected to grow after Year 3? Do not round intermediate calculations. Round your answer to two decimal places.A stock now trades for 11 TL per share and distributes 0.16 TL in dividends annually. What is the stock worth to an investor if she anticipates selling it for 14 TL in a year and demands a 10% return on equity investments? a. 12,89%b. 12,73%c. 12,87%d. 10%A stock currently sells for 11 TL per share and pays 0.16 TL per year in dividends. What is an investor's valuation of this stock if she expects it to be selling for 14 TL in one year and requires a 10 % return on equity investments? a. 12,89% b. 12,73% c. 12,87% d. 10%

- Consider company ABC. Today it is 1st of January 2023 and ABC has just paid a dividend of £3 million. The expected earnings of ABC for the next 30 years are forecast to grow at a rate of 15% per annum. From 1st of January 2053 and onwards the earnings of ABC are expected to grow at a rate of 5%. The required rate of return of ABC is 12% per annum. The current dividend policy of ABC is such that they pay out 50% of its earnings as dividends (assume that they pay their dividends on 1st of January every year). a) Suppose that the dividend payout ratio is expected to stay constant in the future. What is the value of ABC stock? Show and explain your calculations and any assumptions you make. b) Just after the dividend payment on 1st of January 2043, ABC is planning to reduce their dividends and only pay out 40% of its earnings. What is the value of ABC under the new dividend policy? c) Provide a recommendation to the management of ABC as to whether they should increase/cut back on…You have been asked by the chief financial officer of your company to estimate what thecompany’s share price will be at the end of four years from today. Your company has recentlypaid a dividend of $1.00 which is expected to grow at 5% p.a. over the foreseeable future. Ifthe company’s required rate of return on equity is 10% your price estimate at the end of year 4will be closest to: A. $20.00.B. $21.00.C. $24.30.D. $25.50.A share of stock of A-Star Inc. is now selling for $23.50. A financial analyst summarizes the uncertainty about the rate of return on the stock by specifying three possible scenarios: Business Condition Scenario, s Probability, p(s) End of Year Price Annual Dividend High growth 1 0.35 $35 $ 4.40 Normal growth 2 0.30 27 4.00 No growth 3 0.35 15 4.00 What are the holding-period returns for a one-year investment in the stock of A-Star Inc. for each of the three scenarios? Calculate the expected HPR and standard deviation of the HPR.

- An entrepreneur recently learned about a new hotel business that requires an initial investment of $12M and annual cash flow of $2M in perpetuity. The appropriate discount rate is 20%. Now, consider a pretty similar scenario: an Initial investment $12M. Now, in good state, $6M annual cash flows. In a bad state, -$2M annual cash flows. Furthermore, assume that the entrepreneur wants to own at most, 1 hotel (no option to expand). - But things change when we consider the abandonment option. At date 1, the entrepreneur will know which forecast has come true. If the world is in the good state, he will keep the project alive. If bad state, he will abandon the hotel after period 1. - Now, what is the NPV of the project? - What is the value of the option to abandon?The Duo Growth Company just paid a dividend of $1.00 per share. The dividend is expected to grow at a rate of 26% per year for the next three years and then to level off to 5% per year forever. You think the appropriate market capitalization rate is 21% per year. Required: a. What is your estimate of the intrinsic value of a share of the stock? Note: Use intermediate calculations rounded to 4 decimal places. Round your answer to 2 decimal places. b. If the market price of a share is equal to this intrinsic value, what is the expected dividend yield? Note: Use intermediate values rounded to 2 decimal places. Round your answer to 2 decimal places. c. What do you expect its price to be one year from now? Note: Use intermediate values rounded to 4 decimal places. Round your answer to 2 decimal places. d-1. What is the implied capital gain? Note: Use intermediate values rounded to 2 decimal places. Round your answer to 4 decimal places. d-2. Is the implied capital gain…You are financial analyst for the XYZ company. The director has asked you to analyze two proposed capital investments, Project A and Project B. Each project has a cost of RM 10, 000, and the cost of capital for each project is 12 percent. The project s’ cash flows are as follows: Year Expected Net Cash Flows Project A Project B 0 (10,000) (10,000) 1 6500 3500 2 3000 3500 3 3000 3500 4 1000 3500 Calculate each project’s NPV. Which project or projects should be accepted?

- Compute the price of a share of stock that pays a $5 peryear dividend and that you expect to be able to sell inone year for $40, assuming you require a 5% returnThe sole proprietor of the FM2 Financial Services, Bondo, receives allaccounting profits earned by her firm and a K28,000-a-year salary she pays herself. Itis noteworthy that she also has a standing salary offer of K35,000 a year if she agreesto work for Bank of Zambia. If she had invested her capital outside her own company,she estimates that would have made a return of K22,000 a year. Further, informationhas reached you that last year, Bondo’s accounting profit was K50,000. Calculate hereconomic profit?You've estimated the following expected returns for a stock, depending on the strength of the economy: State (s) Probability Expected return Recession 0.3 -0.03 Normal 0.5 0.08 Expansion 0.2 0.13 What is the expected return for the stock? What is the standard deviation of returns for the stock?