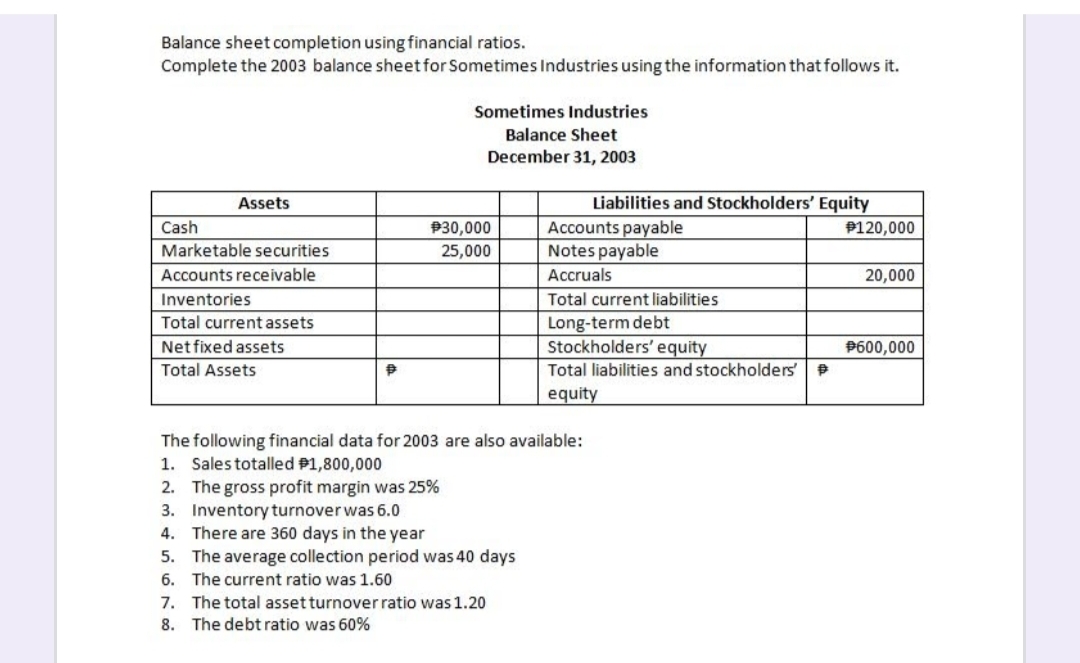

Balance sheet completion using financial ratios. Complete the 2003 balance sheet for Sometimes Industries using the information that follows it. Sometimes Industries Balance Sheet December 31, 2003 Liabilities and Stockholders' Equity Accounts payable Notes payable Assets Cash P30,000 P120,000 Marketable securities 25,000 Accounts receivable Accruals 20,000 Inventories Total current liabilities Total current assets Long-term debt Stockholders' equity Total liabilities and stockholders'P equity Net fixed assets P600,000 Total Assets The following financial data for 2003 are also available: 1. Sales totalled P1,800,000 2. The gross profit margin was 25% 3. Inventory turnover was 6.0 4. There are 360 days in the year 5. The average collection period was 40 days 6. The current ratio was 1.60 7. The total asset turnover ratio was 1.20 8. The debt ratio was 60%

Balance sheet completion using financial ratios. Complete the 2003 balance sheet for Sometimes Industries using the information that follows it. Sometimes Industries Balance Sheet December 31, 2003 Liabilities and Stockholders' Equity Accounts payable Notes payable Assets Cash P30,000 P120,000 Marketable securities 25,000 Accounts receivable Accruals 20,000 Inventories Total current liabilities Total current assets Long-term debt Stockholders' equity Total liabilities and stockholders'P equity Net fixed assets P600,000 Total Assets The following financial data for 2003 are also available: 1. Sales totalled P1,800,000 2. The gross profit margin was 25% 3. Inventory turnover was 6.0 4. There are 360 days in the year 5. The average collection period was 40 days 6. The current ratio was 1.60 7. The total asset turnover ratio was 1.20 8. The debt ratio was 60%

Managerial Accounting

15th Edition

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:Carl Warren, Ph.d. Cma William B. Tayler

Chapter16: Financial Statement Analysis

Section: Chapter Questions

Problem 4PB

Related questions

Question

Transcribed Image Text:Balance sheet completion using financial ratios.

Complete the 2003 balance sheet for Sometimes Industries using the information that follows it.

Sometimes Industries

Balance Sheet

December 31, 2003

Liabilities and Stockholders' Equity

Accounts payable

Notes payable

Assets

Cash

P30,000

P120,000

Marketable securities

25,000

Accounts receivable

Accruals

20,000

Inventories

Total current liabilities

Long-term debt

Stockholders' equity

Total current assets

Net fixed assets

P600,000

Total Assets

Total liabilities and stockholders'

equity

The following financial data for 2003 are also available:

1. Sales totalled P1,800,000

2. The gross profit margin was 25%

3. Inventory turnover was 6.0

4. There are 360 days in the year

5. The average collection period was 40 days

6. The current ratio was 1.60

7. The total asset turnover ratio was 1.20

8. The debt ratio was 60%

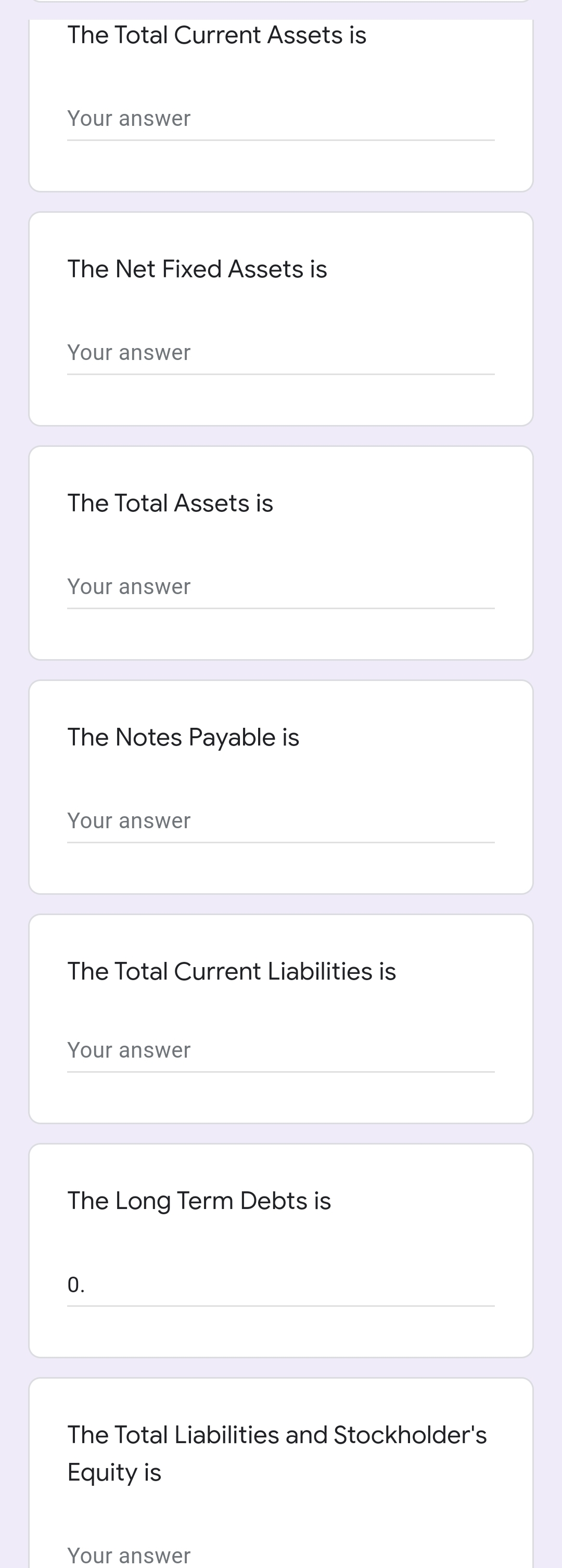

Transcribed Image Text:The Total Current Assets is

Your answer

The Net Fixed Assets is

Your answer

The Total Assets is

Your answer

The Notes Payable is

Your answer

The Total Current Liabilities is

Your answer

The Long Term Debts is

0.

The Total Liabilities and Stockholder's

Equity is

Your answer

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning