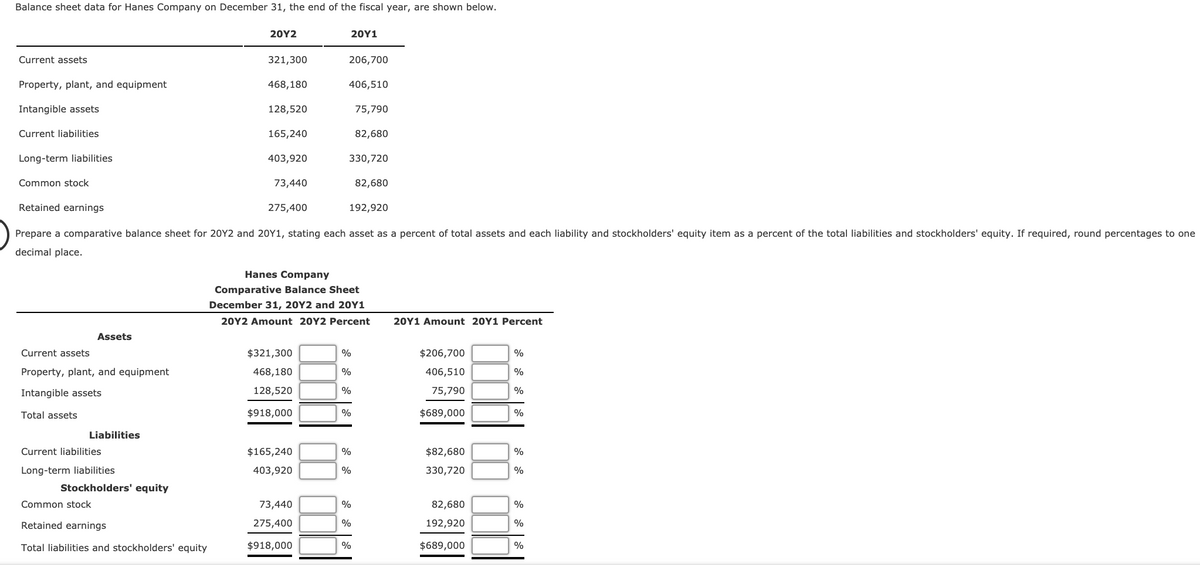

Balance sheet data for Hanes Company on December 31, the end of the fiscal year, are shown below. 20Υ2 20Y1 Current assets 321,300 206,700 Property, plant, and equipment 468,180 406,510 Intangible assets 128,520 75,790 Current liabilities 165,240 82,680 Long-term liabilities 403,920 330,720 Common stock 73,440 82,680 Retained earnings 275,400 192,920 Prepare a comparative balance sheet for 20Y2 and 20Y1, stating each asset as a percent of total assets and each liability and stockholders' equity item as a percent of the total liabilities and stockholders' equity. If required, round percer decimal place. Hanes Company Comparative Balance Sheet December 31, 20Y2 and 20Y1 20Y2 Amount 20Y2 Percent 20Y1 Amount 20Y1 Percent Assets Current assets $321,300 % $206,700 Property, plant, and equipment 468,180 406,510 Intangible assets 128,520 75,790 Total assets $918,000 $689,000 % Liabilities Current liabilities $165,240 % $82,680 Long-term liabilities 403,920 % 330,720 Stockholders' equity Common stock 73,440 % 82,680 Retained earnings 275,400 192,920 Total liabilities and stockholders' equity $918,000 $689,000 %

Balance sheet data for Hanes Company on December 31, the end of the fiscal year, are shown below. 20Υ2 20Y1 Current assets 321,300 206,700 Property, plant, and equipment 468,180 406,510 Intangible assets 128,520 75,790 Current liabilities 165,240 82,680 Long-term liabilities 403,920 330,720 Common stock 73,440 82,680 Retained earnings 275,400 192,920 Prepare a comparative balance sheet for 20Y2 and 20Y1, stating each asset as a percent of total assets and each liability and stockholders' equity item as a percent of the total liabilities and stockholders' equity. If required, round percer decimal place. Hanes Company Comparative Balance Sheet December 31, 20Y2 and 20Y1 20Y2 Amount 20Y2 Percent 20Y1 Amount 20Y1 Percent Assets Current assets $321,300 % $206,700 Property, plant, and equipment 468,180 406,510 Intangible assets 128,520 75,790 Total assets $918,000 $689,000 % Liabilities Current liabilities $165,240 % $82,680 Long-term liabilities 403,920 % 330,720 Stockholders' equity Common stock 73,440 % 82,680 Retained earnings 275,400 192,920 Total liabilities and stockholders' equity $918,000 $689,000 %

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter9: Long-term Liabilities

Section: Chapter Questions

Problem 103.1C: Leverage Cook Corporation issued financial statements at December 31, 2019, that include the...

Related questions

Question

Transcribed Image Text:Balance sheet data for Hanes Company on December 31, the end of the fiscal year, are shown below.

20Υ2

20Υ1

Current assets

321,300

206,700

Property, plant, and equipment

468,180

406,510

Intangible assets

128,520

75,790

Current liabilities

165,240

82,680

Long-term liabilities

403,920

330,720

Common stock

73,440

82,680

Retained earnings

275,400

192,920

Prepare a comparative balance sheet for 20Y2 and 20Y1, stating each asset as a percent of total assets and each liability and stockholders' equity item as a percent of the total liabilities and stockholders' equity. If required, round percentages to one

decimal place.

Hanes Company

Comparative Balance Sheet

December 31, 20Y2 and 20Y1

20Y2 Amount 20Y2 Percent

20Y1 Amount 20Y1 Percent

Assets

Current assets

$321,300

%

$206,700

%

Property, plant, and equipment

468,180

%

406,510

%

Intangible assets

128,520

%

75,790

%

Total assets

$918,000

$689,000

%

Liabilities

Current liabilities

$165,240

$82,680

%

Long-term liabilities

403,920

%

330,720

Stockholders' equity

Common stock

73,440

%

82,680

%

Retained earnings

275,400

192,920

%

Total liabilities and stockholders' equity

$918,000

%

$689,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub