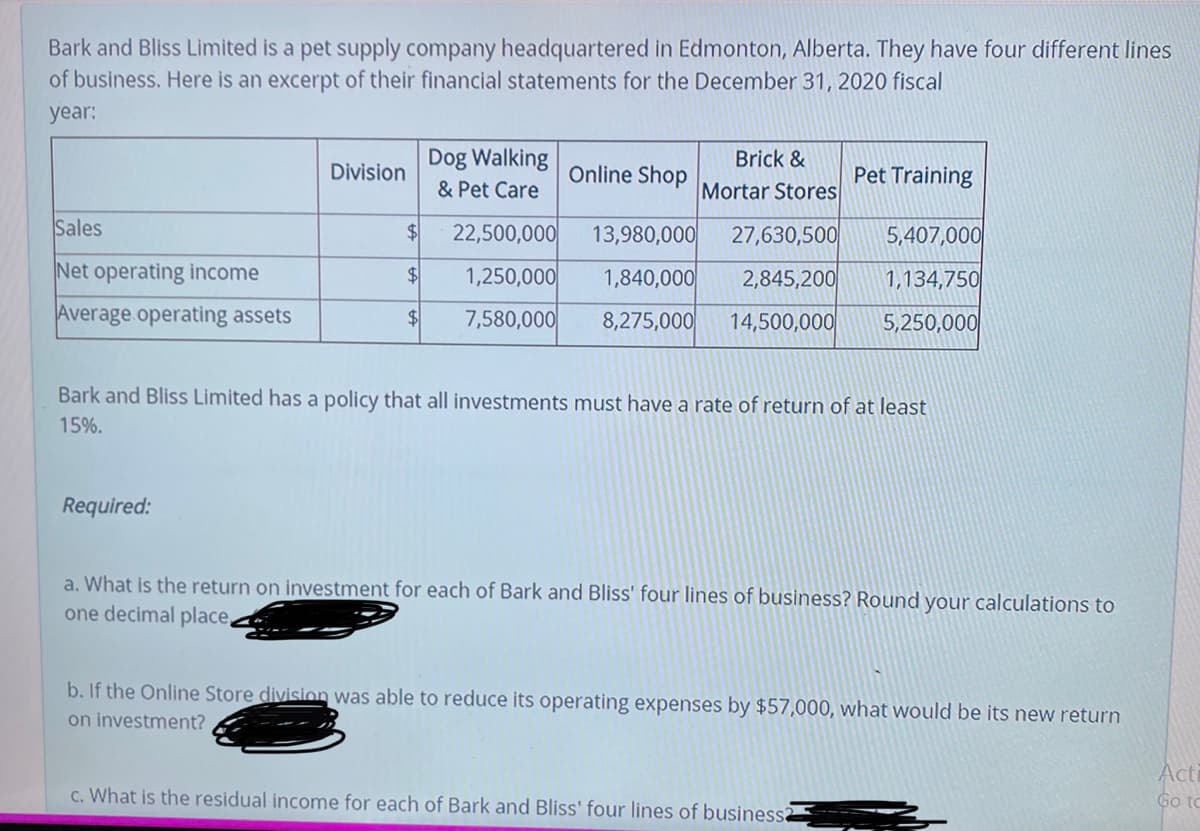

Bark and Bliss Limited is a pet supply company headquartered in Edmonton, Alberta. They have four different lines of business. Here is an excerpt of their financial statements for the December 31, 2020 fiscal year: Dog Walking Brick & Division Online Shop Pet Training & Pet Care Mortar Stores Sales $4 22,500,000 13,980,000 27,630,500 5,407,000 Net operating income $4 1,250,000 1,840,000 2,845,200 1,134,750 Average operating assets $4 7,580,000 8,275,000 14,500,000 5,250,000 Bark and Bliss Limited has a policy that all investments must have a rate of return of at least 15%. Required: a. What is the return on investment for each of Bark and Bliss' four lines of business? Round your calculations to one decimal place, b. If the Online Store division was able to reduce its operating expenses by $57,000, what would be its new return on investment? c. What is the residual income for each of Bark and Bliss' four lines of businessà

Bark and Bliss Limited is a pet supply company headquartered in Edmonton, Alberta. They have four different lines of business. Here is an excerpt of their financial statements for the December 31, 2020 fiscal year: Dog Walking Brick & Division Online Shop Pet Training & Pet Care Mortar Stores Sales $4 22,500,000 13,980,000 27,630,500 5,407,000 Net operating income $4 1,250,000 1,840,000 2,845,200 1,134,750 Average operating assets $4 7,580,000 8,275,000 14,500,000 5,250,000 Bark and Bliss Limited has a policy that all investments must have a rate of return of at least 15%. Required: a. What is the return on investment for each of Bark and Bliss' four lines of business? Round your calculations to one decimal place, b. If the Online Store division was able to reduce its operating expenses by $57,000, what would be its new return on investment? c. What is the residual income for each of Bark and Bliss' four lines of businessà

Chapter2: Building Blocks Of Managerial Accounting

Section: Chapter Questions

Problem 2EA: Park and West, LLC, provides consulting services to retail merchandisers in the Midwest. In 2019,...

Related questions

Question

Transcribed Image Text:Bark and Bliss Limited is a pet supply company headquartered in Edmonton, Alberta. They have four different lines

of business. Here is an excerpt of their financial statements for the December 31, 2020 fiscal

year:

Dog Walking

Brick &

Division

Online Shop

Pet Training

& Pet Care

Mortar Stores

Sales

$1

22,500,000

13,980,000

27,630,500

5,407,000

Net operating income

$4

1,250,000

1,840,000

2,845,200

1,134,750

Average operating assets

$1

7,580,000

8,275,000

14,500,000

5,250,000

Bark and Bliss Limited has a policy that all investments must have a rate of return of at least

15%.

Required:

a. What is the return on investment for each of Bark and Bliss' four lines of business? Round your calculations to

one decimal place,

b. If the Online Store division was able to reduce its operating expenses by $57,000, what would be its new return

on investment?

Acti

c. What is the residual income for each of Bark and Bliss' four lines of businessa

Go to

Transcribed Image Text:Final Exam - Google Chrome

ca/mod/quiz/attempt.php?attempt=D990938&cmid 1259243&page%=3

TRU Moodle

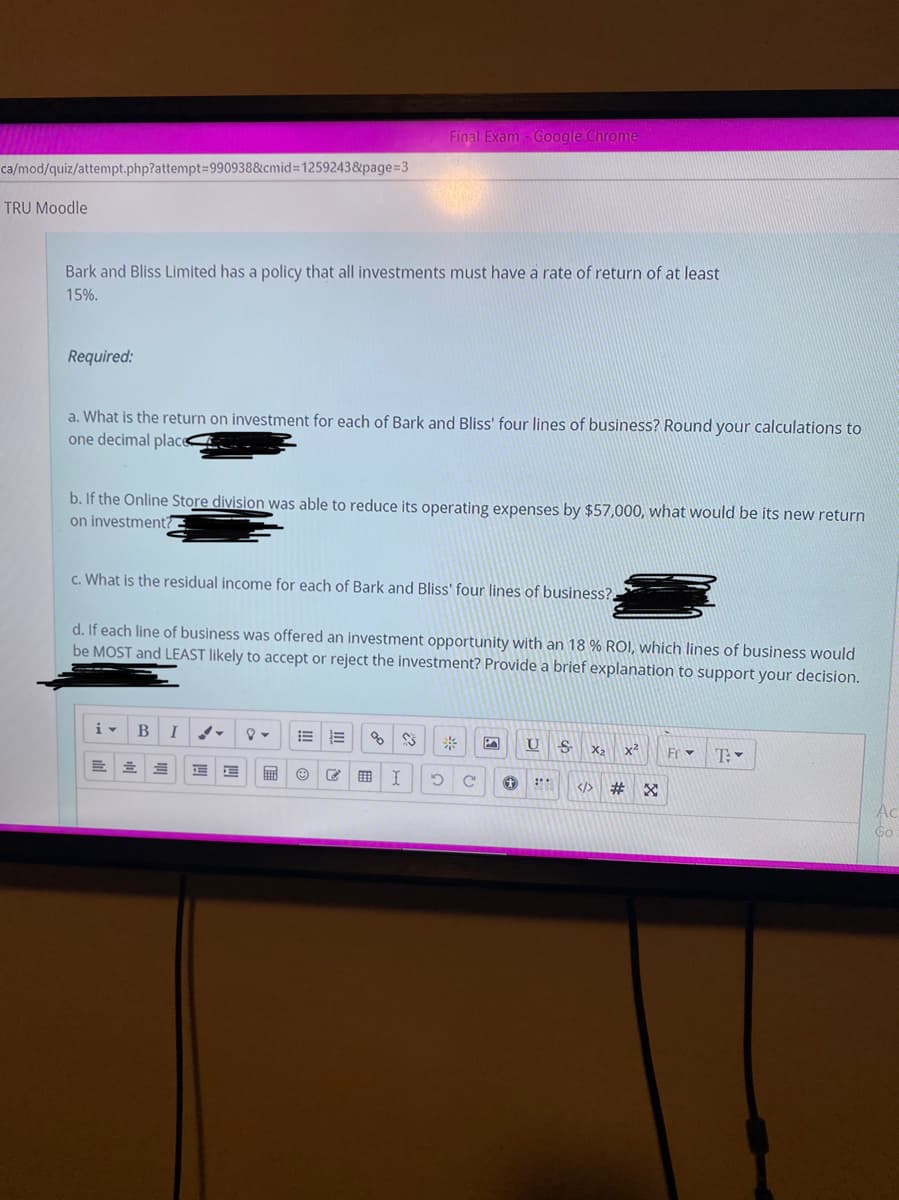

Bark and Bliss Limited has a policy that all investments must have a rate of return of at least

15%.

Required:

a. What is the return on investment for each of Bark and Bliss' four lines of business? Round your calculations to

one decimal plac -

b. If the Online Store division was able to reduce its operating expenses by $57,000, what would be its new return

on investment?

c. What is the residual income for each of Bark and Bliss' four lines of business?.

d. If each line of business was offered an investment opportunity with an 18 % ROI, which lines of business would

be MOST and LEAST likely to accept or reject the investment? Provide a brief explanation to support your decision.

i-

B

!!

X2

x2

Fr

T:

</>

#3

Ac

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning