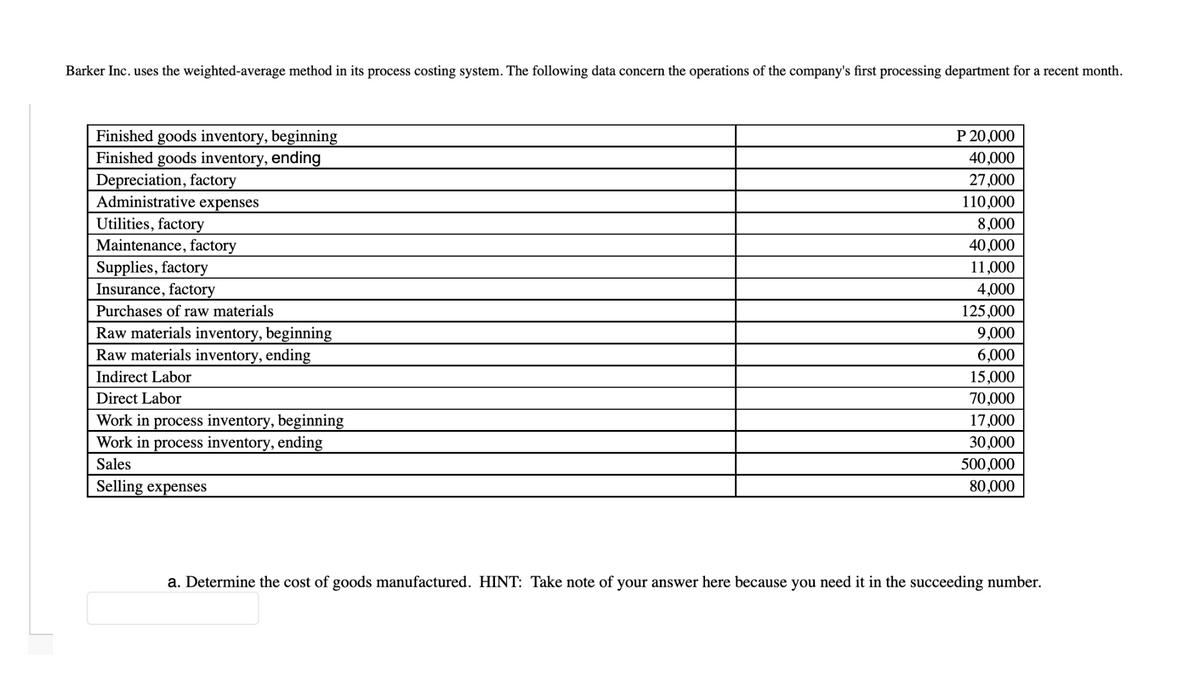

Barker Inc. uses the weighted-average method in its process costing system. The following data concern the operations of the company's first processing department for a recent month. Finished goods inventory, beginning Finished goods inventory, ending Depreciation, factory Administrative expenses P 20,000 40,000 27,000 110,000 Utilities, factory Maintenance, factory 8,000 40,000 Supplies, factory Insurance, factory 11,000 4,000 Purchases of raw materials 125,000 Raw materials inventory, beginning Raw materials inventory, ending Indirect Labor 9,000 6,000 15,000 Direct Labor 70,000 Work in process inventory, beginning Work in process inventory, ending 17,000 30,000 Sales 500,000 Selling expenses 80,000 a. Determine the cost of goods manufactured. HINT: Take note of your answer here because you need it in the succeeding number.

Barker Inc. uses the weighted-average method in its process costing system. The following data concern the operations of the company's first processing department for a recent month. Finished goods inventory, beginning Finished goods inventory, ending Depreciation, factory Administrative expenses P 20,000 40,000 27,000 110,000 Utilities, factory Maintenance, factory 8,000 40,000 Supplies, factory Insurance, factory 11,000 4,000 Purchases of raw materials 125,000 Raw materials inventory, beginning Raw materials inventory, ending Indirect Labor 9,000 6,000 15,000 Direct Labor 70,000 Work in process inventory, beginning Work in process inventory, ending 17,000 30,000 Sales 500,000 Selling expenses 80,000 a. Determine the cost of goods manufactured. HINT: Take note of your answer here because you need it in the succeeding number.

Principles of Cost Accounting

17th Edition

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Edward J. Vanderbeck, Maria R. Mitchell

Chapter5: Process Cost Accounting—general Procedures

Section: Chapter Questions

Problem 8P: Premier Products Inc. has three departments and uses the process cost system of accounting. A...

Related questions

Question

Transcribed Image Text:Barker Inc. uses the weighted-average method in its process costing system. The following data concern the operations of the company's first processing department for a recent month.

Finished goods inventory, beginning

Finished goods inventory, ending

Depreciation, factory

Administrative expenses

P 20,000

40,000

27,000

110,000

8,000

Utilities, factory

Maintenance, factory

Supplies, factory

Insurance, factory

40,000

11,000

4,000

Purchases of raw materials

125,000

Raw materials inventory, beginning

Raw materials inventory, ending

9,000

6,000

Indirect Labor

15,000

70,000

Direct Labor

Work in process inventory, beginning

Work in process inventory, ending

17,000

30,000

Sales

500,000

Selling expenses

80,000

a. Determine the cost of goods manufactured. HINT: Take note of your answer here because you need it in the succeeding number.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,