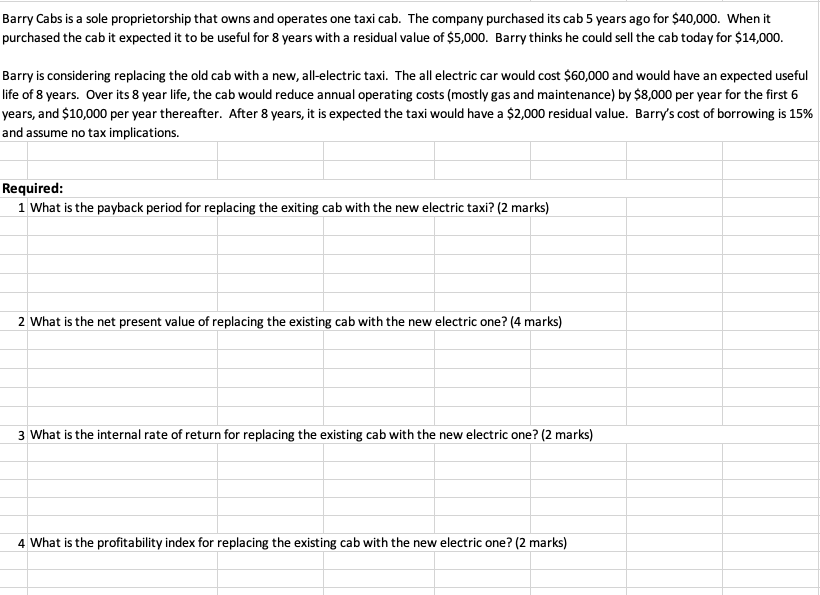

Barry Cabs is a sole proprietorship that owns and operates one taxi cab. The company purchased its cab 5 years ago for $40,000. When it purchased the cab it expected it to be useful for 8 years with a residual value of $5,000. Barry thinks he could sell the cab today for $14,000. Barry is considering replacing the old cab with a new, all-electric taxi. The all electric car would cost $60,000 and would have an expected useful life of 8 years. Over its 8 year life, the cab would reduce annual operating costs (mostly gas and maintenance) by $8,000 per year for the first 6 years, and $10,000 per year thereafter. After 8 years, it is expected the taxi would have a $2,000 residual value. Barry's cost of borrowing is 15% and assume no tax implications.

Barry Cabs is a sole proprietorship that owns and operates one taxi cab. The company purchased its cab 5 years ago for $40,000. When it purchased the cab it expected it to be useful for 8 years with a residual value of $5,000. Barry thinks he could sell the cab today for $14,000. Barry is considering replacing the old cab with a new, all-electric taxi. The all electric car would cost $60,000 and would have an expected useful life of 8 years. Over its 8 year life, the cab would reduce annual operating costs (mostly gas and maintenance) by $8,000 per year for the first 6 years, and $10,000 per year thereafter. After 8 years, it is expected the taxi would have a $2,000 residual value. Barry's cost of borrowing is 15% and assume no tax implications.

Financial Accounting

14th Edition

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Carl Warren, Jim Reeve, Jonathan Duchac

Chapter10: Fixed Assets And Intangible Assets

Section: Chapter Questions

Problem 3CP: Tuttle Construction Co. specializes in building replicas of historic houses. Tim Newman, president...

Related questions

Question

Looking for answers. I have attached images below. Thanks!

Transcribed Image Text:Barry Cabs is a sole proprietorship that owns and operates one taxi cab. The company purchased its cab 5 years ago for $40,000. When it

purchased the cab it expected it to be useful for 8 years with a residual value of $5,000. Barry thinks he could sell the cab today for $14,000.

Barry is considering replacing the old cab with a new, all-electric taxi. The all electric car would cost $60,000 and would have an expected useful

life of 8 years. Over its 8 year life, the cab would reduce annual operating costs (mostly gas and maintenance) by $8,000 per year for the first 6

years, and $10,000 per year thereafter. After 8 years, it is expected the taxi would have a $2,000 residual value. Barry's cost of borrowing is 15%

and assume no tax implications.

Required:

1 What is the payback period for replacing the exiting cab with the new electric taxi? (2 marks)

2 What is the net present value of replacing the existing cab with the new electric one? (4 marks)

3 What is the internal rate of return for replacing the existing cab with the new electric one? (2 marks)

4 What is the profitability index for replacing the existing cab with the new electric one? (2 marks)

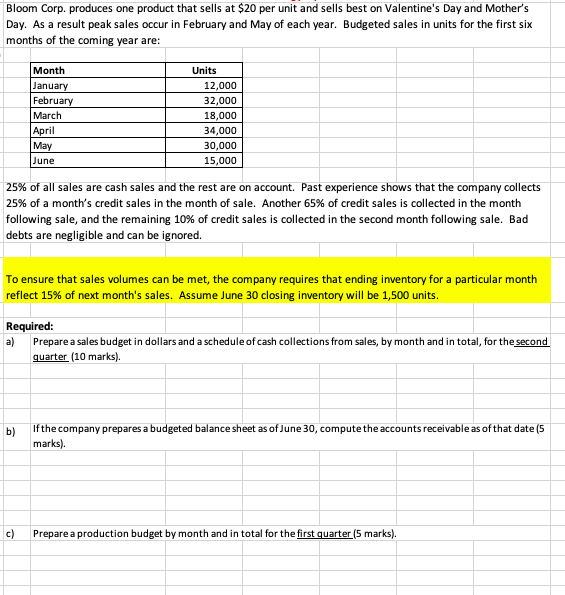

Transcribed Image Text:Bloom Corp. produces one product that sells at $20 per unit and sells best on Valentine's Day and Mother's

Day. As a result peak sales occur in February and May of each year. Budgeted sales in units for the first six

months of the coming year are:

Month

January

Units

12,000

February

March

|Аpril

May

32,000

18,000

34,000

30,000

June

15,000

25% of all sales are cash sales and the rest are on account. Past experience shows that the company collects

25% of a month's credit sales in the month of sale. Another 65% of credit sales is collected in the month

following sale, and the remaining 10% of credit sales is collected in the second month following sale. Bad

debts are negligible and can be ignored.

To ensure that sales volumes can be met, the company requires that ending inventory for a particular month

reflect 15% of next month's sales. Assume June 30 closing inventory will be 1,500 units.

Required:

a)

Prepare a sales budget in dollars and a schedule of cash collections from sales, by month and in total, for the second

quarter (10 marks).

b)

If the company prepares a budgeted balance sheet as of June 30, compute the accounts receivable as of that date (5

marks).

c)

Prepare a production budget by month and in total for the first quarter (5 marks).

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT