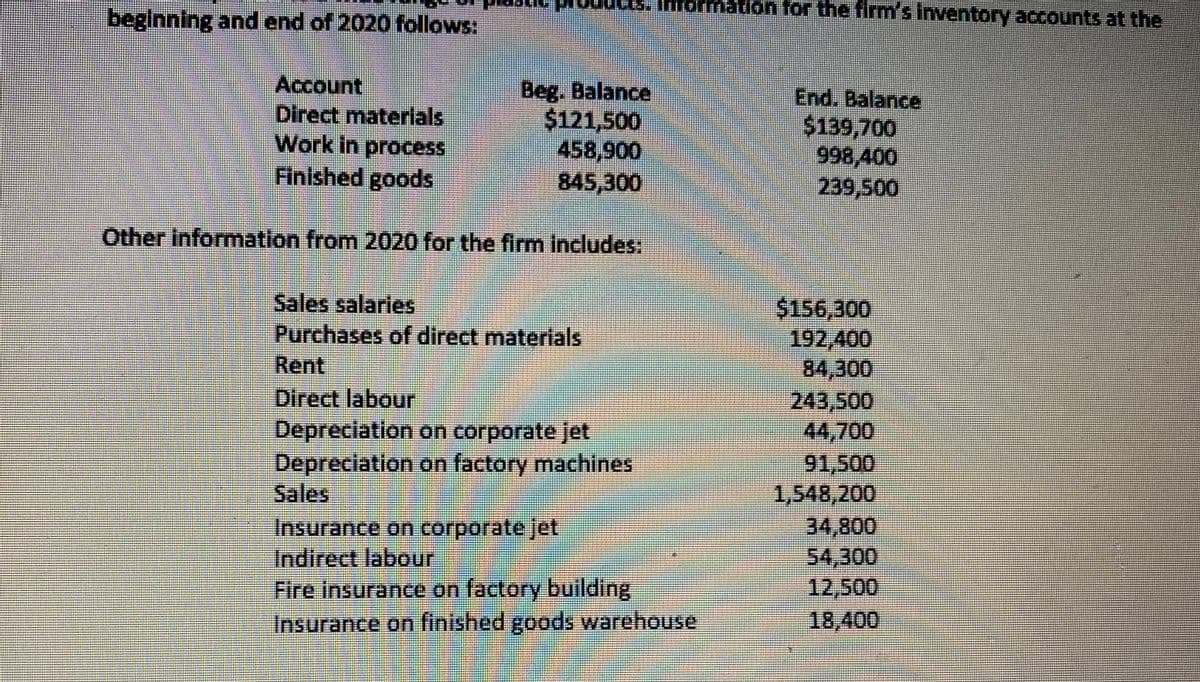

beginning and end of 2020 follows: for the firm's inventory accounts a Account Direct materials Work in process Finished goods Beg. Balance $121,500 458,900 845,300 End. Balance $139,700 998,400 239,500 Other information from 2020 for the firm includes: Sales salaries Purchases of direct materials $156,300 192,400 84,300 243,500 44,700 91,500 1,548,200 Rent Direct labour Depreciation on corporate jet Depreciation on factory machines Sales Insurance on corporate jet Indirect labour 34,800 54,300 Fire insurance on factory building Insurance on finished goods warehouse 12,500 18,400

beginning and end of 2020 follows: for the firm's inventory accounts a Account Direct materials Work in process Finished goods Beg. Balance $121,500 458,900 845,300 End. Balance $139,700 998,400 239,500 Other information from 2020 for the firm includes: Sales salaries Purchases of direct materials $156,300 192,400 84,300 243,500 44,700 91,500 1,548,200 Rent Direct labour Depreciation on corporate jet Depreciation on factory machines Sales Insurance on corporate jet Indirect labour 34,800 54,300 Fire insurance on factory building Insurance on finished goods warehouse 12,500 18,400

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter7: Inventories: Cost Measurement And Flow Assumptions

Section: Chapter Questions

Problem 8P: Comprehensive The following information for 2019 is available for Marino Company: 1. The beginning...

Related questions

Question

Compute the cost of goods manufactured, using a formal schedule of cost of goods manufactured.

Transcribed Image Text:formation for the firm's inventory accounts at the

beginning and end of 2020 follows:

Account

Direct materials

Work in process

Finished goods

Beg. Balance

$121,500

458,900

845,300

End. Balance

$139,700

998,400

239,500

Other information from 2020 for the firm Includes:

Sales salaries

Purchases of direct materials

Rent

Direct labour

Depreciation on corporate jet

Depreciation on factory machines

Sales

$156,300

192,400

84,300

243,500

44,700

91,500

1,548,200

34,800

54,300

12,500

18,400

Insurance on corporate jet

Indirect labour

Fire insurance on factory building

Insurance on linished goods warehouse

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning