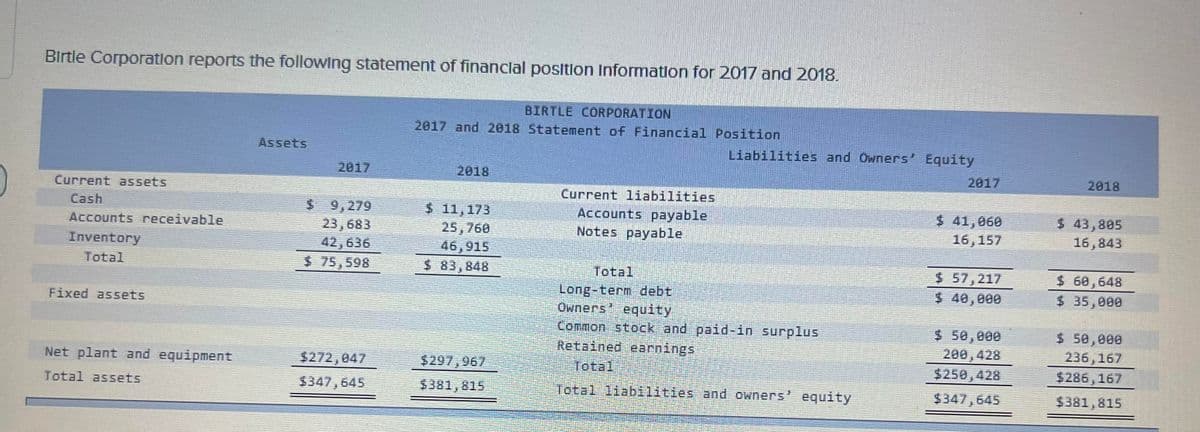

Birtle Corporation reports the following statement of financial position Information for 2017 and 2018. Current assets Cash Accounts receivable Inventory Total Fixed assets Net plant and equipment Total assets Assets 2017 $ 9,279 23,683 42,636 $ 75,598 $272,047 $347,645 BIRTLE CORPORATION 2017 and 2018 Statement of Financial Position 2018 $ 11,173 25,760 46,915 $ 83,848 $297,967 $381,815 Current liabilities Accounts payable Notes payable Liabilities and Owners' Equity Total Long-term debt Owners' equity Common stock and paid-in surplus Retained earnings Total Total liabilities and owners' equity 2017 $ 41,060 16,157 $ 57,217 $ 40,000 $ 50,000 200,428 $250,428 $347,645 2018 $ 43,805 16,843 $ 60,648 $ 35,000 $ 50,000 236,167 $286,167 $381,815

Birtle Corporation reports the following statement of financial position Information for 2017 and 2018. Current assets Cash Accounts receivable Inventory Total Fixed assets Net plant and equipment Total assets Assets 2017 $ 9,279 23,683 42,636 $ 75,598 $272,047 $347,645 BIRTLE CORPORATION 2017 and 2018 Statement of Financial Position 2018 $ 11,173 25,760 46,915 $ 83,848 $297,967 $381,815 Current liabilities Accounts payable Notes payable Liabilities and Owners' Equity Total Long-term debt Owners' equity Common stock and paid-in surplus Retained earnings Total Total liabilities and owners' equity 2017 $ 41,060 16,157 $ 57,217 $ 40,000 $ 50,000 200,428 $250,428 $347,645 2018 $ 43,805 16,843 $ 60,648 $ 35,000 $ 50,000 236,167 $286,167 $381,815

Survey of Accounting (Accounting I)

8th Edition

ISBN:9781305961883

Author:Carl Warren

Publisher:Carl Warren

Chapter9: Metric-analysis Of Financial Statements

Section: Chapter Questions

Problem 9.23E: Unusual income statement items Assume that the amount of each of the following items is material to...

Related questions

Question

Transcribed Image Text:Birtle Corporation reports the following statement of financial position Information for 2017 and 2018.

Current assets

Cash

Accounts receivable

Inventory

Total

Fixed assets

Net plant and equipment

Total assets

Assets

2017

$ 9,279

23,683

42,636

$ 75,598

$272,847

$347,645

BIRTLE CORPORATION

2017 and 2018 Statement of Financial Position

2018

$ 11,173

25,760

46,915

$ 83,848

$297,967

$381,815

Current liabilities

Accounts payable

Notes payable

Liabilities and Owners' Equity

Total

Long-term debt

Owners' equity

Common stock and paid-in surplus

Retained earnings

Total

Total liabilities and owners' equity

2017

$ 41,060

16, 157

$ 57,217

$ 40,000

$ 50,000

200,428

$250,428

$347,645

2018

$ 43,805

16,843

$

60,648

$ 35,000

$ 50,000

236,167

$286,167

$381,815

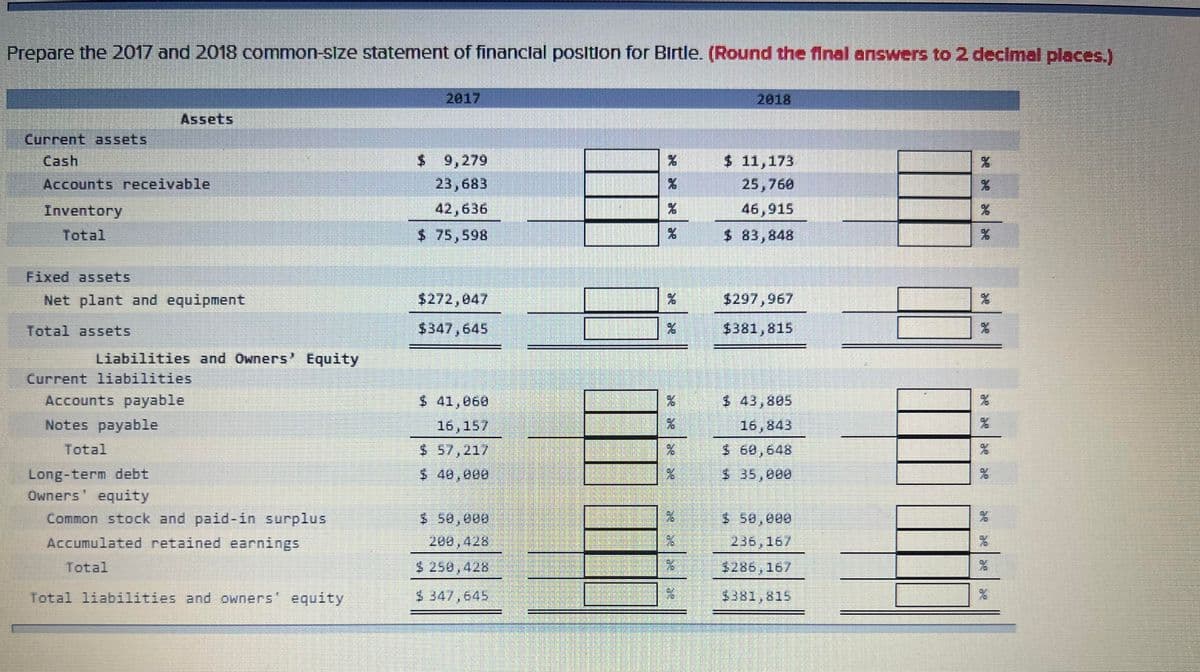

Transcribed Image Text:Prepare the 2017 and 2018 common-size statement of financial position for Birtle. (Round the final answers to 2 decimal places.)

Current assets

Assets

Accounts receivable

Inventory

Total

Fixed assets

Net plant and equipment

Total assets

Liabilities and Owners' Equity

Current liabilities

Accounts payable

Notes payable

Total

Long-term debt

Owners' equity

Common stock and paid-in surplus

Accumulated retained earnings

Total

Total liabilities and owners' equity

2017

$ 9,279

23,683

42,636

$ 75,598

$272,047

$347,645

§ 41,060

16,157

$ 57,217

$ 40,000

$50,000

200,428

$ 258,428

%

%

%

%

%

%

%

%

%

%4

2018

$ 11,173

25,760

46,915

$ 83,848

$297,967

$381,815

$ 43,805

16,843

$ 68,648

$ 35,000

236,167

+286,167

$381,815

%

%

%

%

%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Recommended textbooks for you

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning