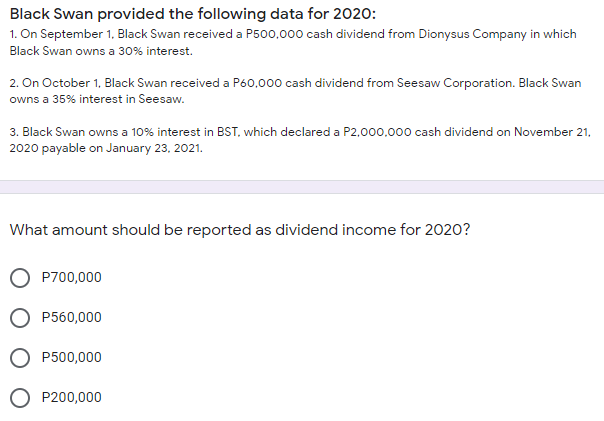

Black Swan provided the following data for 2020: 1. On September 1, Black Swan received a P500,000 cash dividend from Dionysus Company in which Black Swan owns a 30% interest. 2. On October 1, Black Swan received a P60,000 cash dividend from Seesaw Corporation. Black Swan owns a 35% interest in Seesaw. 3. Black Swan owns a 10% interest in BST, which declared a P2.000.000 cash dividend on November 21. 2020 payable on January 23, 2021. What amount should be reported as dividend income for 2020? P700,000 P560,000 P500,000 P200,000

Black Swan provided the following data for 2020: 1. On September 1, Black Swan received a P500,000 cash dividend from Dionysus Company in which Black Swan owns a 30% interest. 2. On October 1, Black Swan received a P60,000 cash dividend from Seesaw Corporation. Black Swan owns a 35% interest in Seesaw. 3. Black Swan owns a 10% interest in BST, which declared a P2.000.000 cash dividend on November 21. 2020 payable on January 23, 2021. What amount should be reported as dividend income for 2020? P700,000 P560,000 P500,000 P200,000

Chapter11: The Corporate Income Tax

Section: Chapter Questions

Problem 5P: Fisafolia Corporation has gross income from operations of $210,000 and operating expenses of...

Related questions

Question

Transcribed Image Text:Black Swan provided the following data for 2020:

1. On September 1, Black Swan received a P500,000 cash dividend from Dionysus Company in which

Black Swan owns a 30% interest.

2. On October 1, Black Swan received a P60,000 cash dividend from Seesaw Corporation. Black Swan

owns a 35% interest in Seesaw.

3. Black Swan owns a 10% interest in BST, which declared a P2.000.000 cash dividend on November 21.

2020 payable on January 23, 2021.

What amount should be reported as dividend income for 2020?

P700,000

P560,000

P500,000

P200,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning