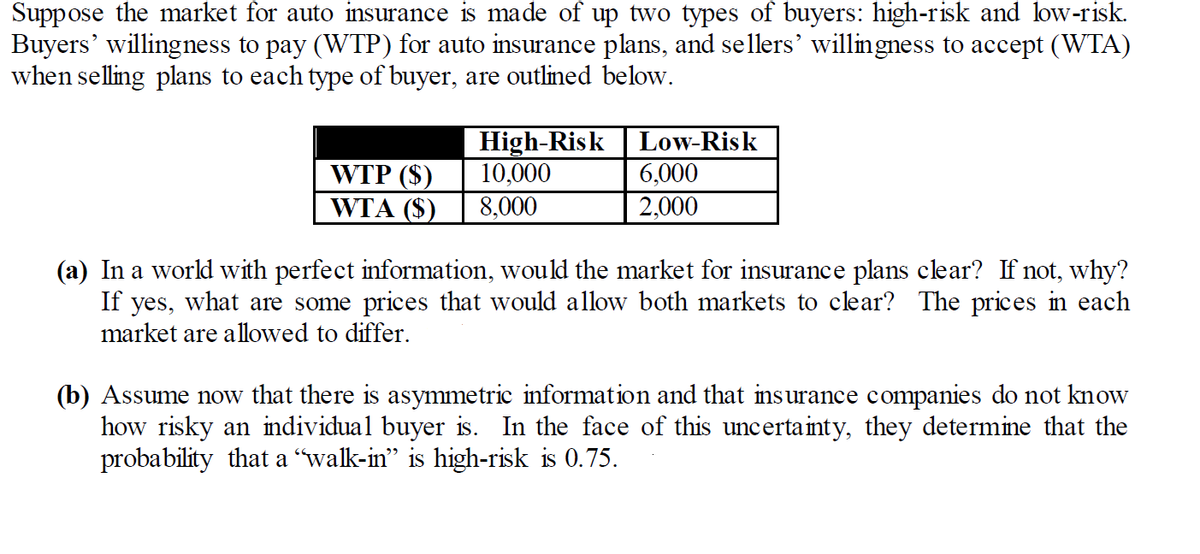

Buyers' willingness to pay (WTP) for auto insurance plans, and sellers’ willingness to accept (WTA) when selling plans to each type of buyer, are outlined below. High-Risk 10,000 Low-Risk WTP ($) WTA ($) 6,000 8,000 2,000 (a) In a world with perfect information, would the market for insurance plans clear? If not, why? If yes, what are some prices that would allow both markets to clear? The prices in each market are allowed to differ. (b) Assume now that there is asymmetric information and that insurance companies do not know how risky an individual buver is In the face of this uncertainty they determine that the

Buyers' willingness to pay (WTP) for auto insurance plans, and sellers’ willingness to accept (WTA) when selling plans to each type of buyer, are outlined below. High-Risk 10,000 Low-Risk WTP ($) WTA ($) 6,000 8,000 2,000 (a) In a world with perfect information, would the market for insurance plans clear? If not, why? If yes, what are some prices that would allow both markets to clear? The prices in each market are allowed to differ. (b) Assume now that there is asymmetric information and that insurance companies do not know how risky an individual buver is In the face of this uncertainty they determine that the

Managerial Economics: A Problem Solving Approach

5th Edition

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Chapter17: Making Decisions With Uncertainty

Section: Chapter Questions

Problem 17.6IP

Related questions

Question

Transcribed Image Text:Suppose the market for auto insurance is made of up two types of buyers: high-risk and low-risk.

Buyers' willingness to pay (WTP) for auto insurance plans, and selers’ willingness to accept (WTA)

when selling plans to each type of buyer, are outlined below.

High-Risk Low-Risk

10,000

WTP ($)

WTA ($)

6,000

8,000

2,000

(a) In a world with perfect information, would the market for insurance plans clear? If not, why?

If yes, what are some prices that would allow both markets to clear? The prices in each

market are allowed to differ.

(b) Assume now that there is asymmetric information and that insurance companies do not know

how risky an individual buyer is. In the face of this uncertainty, they determine that the

probability that a "walk-in" is high-risk is 0.75.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Economics: A Problem Solving Approach

Economics

ISBN:

9781337106665

Author:

Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:

Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:

9781337106665

Author:

Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:

Cengage Learning