Calculate the number of days' sales in Rudolph's receivables at December 31, 2002. • Calculate Rudolph's times interest earned at December 31, 2002. - Calculate Rudolph's ratio of liabilities to stockholders' equity for 2002.

Calculate the number of days' sales in Rudolph's receivables at December 31, 2002. • Calculate Rudolph's times interest earned at December 31, 2002. - Calculate Rudolph's ratio of liabilities to stockholders' equity for 2002.

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter11: The Statement Of Cash Flows

Section: Chapter Questions

Problem 27BE

Related questions

Question

Use balance sheet and income statement in the first photo to answer questions CIRCLED IN RED in the second photo

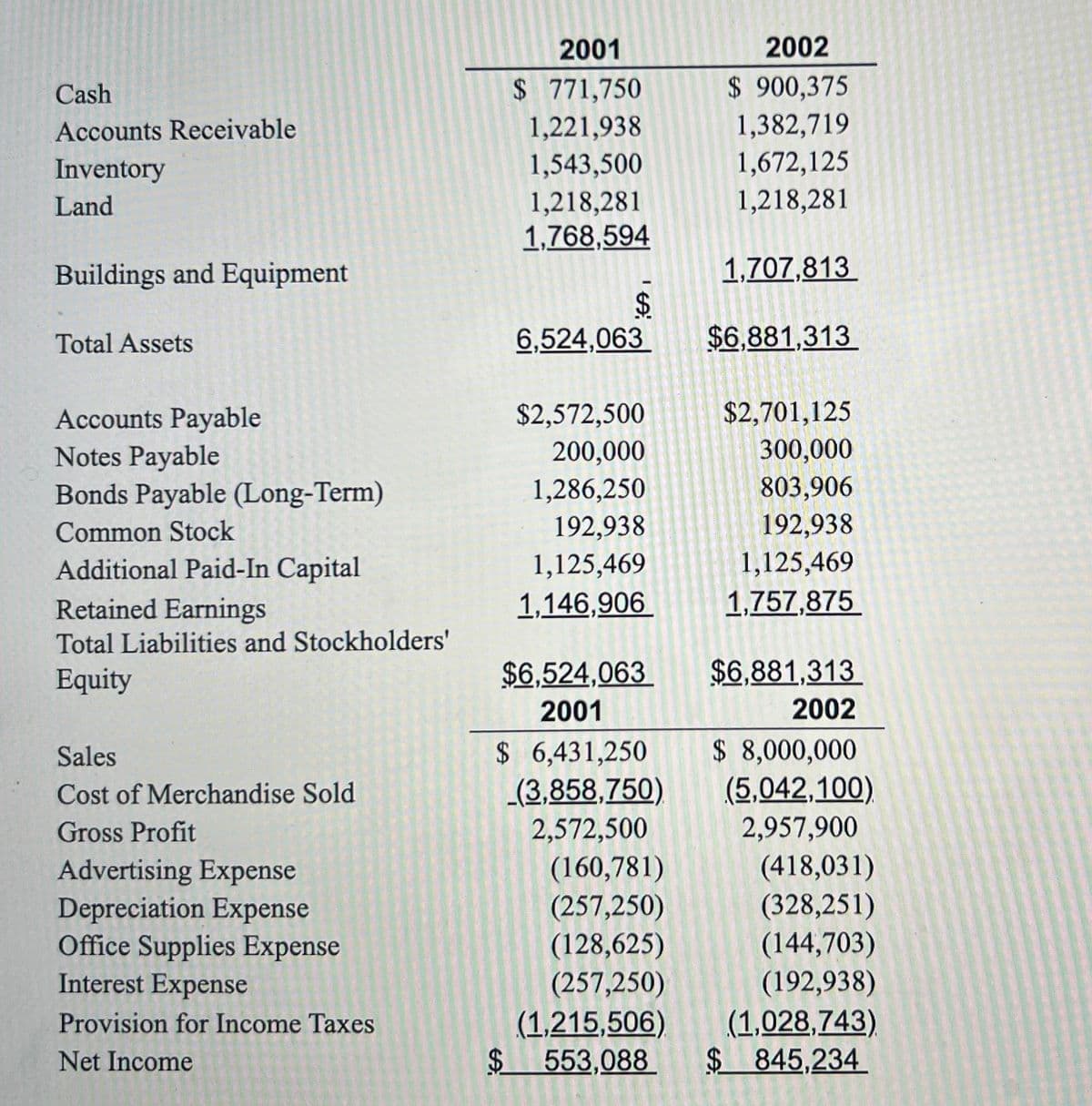

Transcribed Image Text:Cash

Accounts Receivable

Inventory

Land

Buildings and Equipment

Total Assets

Accounts Payable

Notes Payable

Bonds Payable (Long-Term)

Common Stock

Additional Paid-In Capital

Retained Earnings

Total Liabilities and Stockholders'

Equity

Sales

Cost of Merchandise Sold

Gross Profit

Advertising Expense

Depreciation Expense

Office Supplies Expense

Interest Expense

Provision for Income Taxes

Net Income

2001

$ 771,750

1,221,938

1,543,500

1,218,281

1,768,594

$

6,524,063

$2,572,500

200,000

1,286,250

192,938

1,125,469

1,146,906

$6,524,063

2001

$ 6,431,250

(3,858,750)

2,572,500

(160,781)

(257,250)

(128,625)

(257,250)

(1,215,506)

$ 553,088

2002

$ 900,375

1,382,719

1,672,125

1,218,281

1,707,813

$6,881,313

$2,701,125

300,000

803,906

192,938

1,125,469

1,757,875

$6,881,313

2002

$ 8,000,000

(5,042,100)

2,957,900

(418,031)

(328,251)

(144,703)

(192,938)

(1,028,743)

$ 845,234

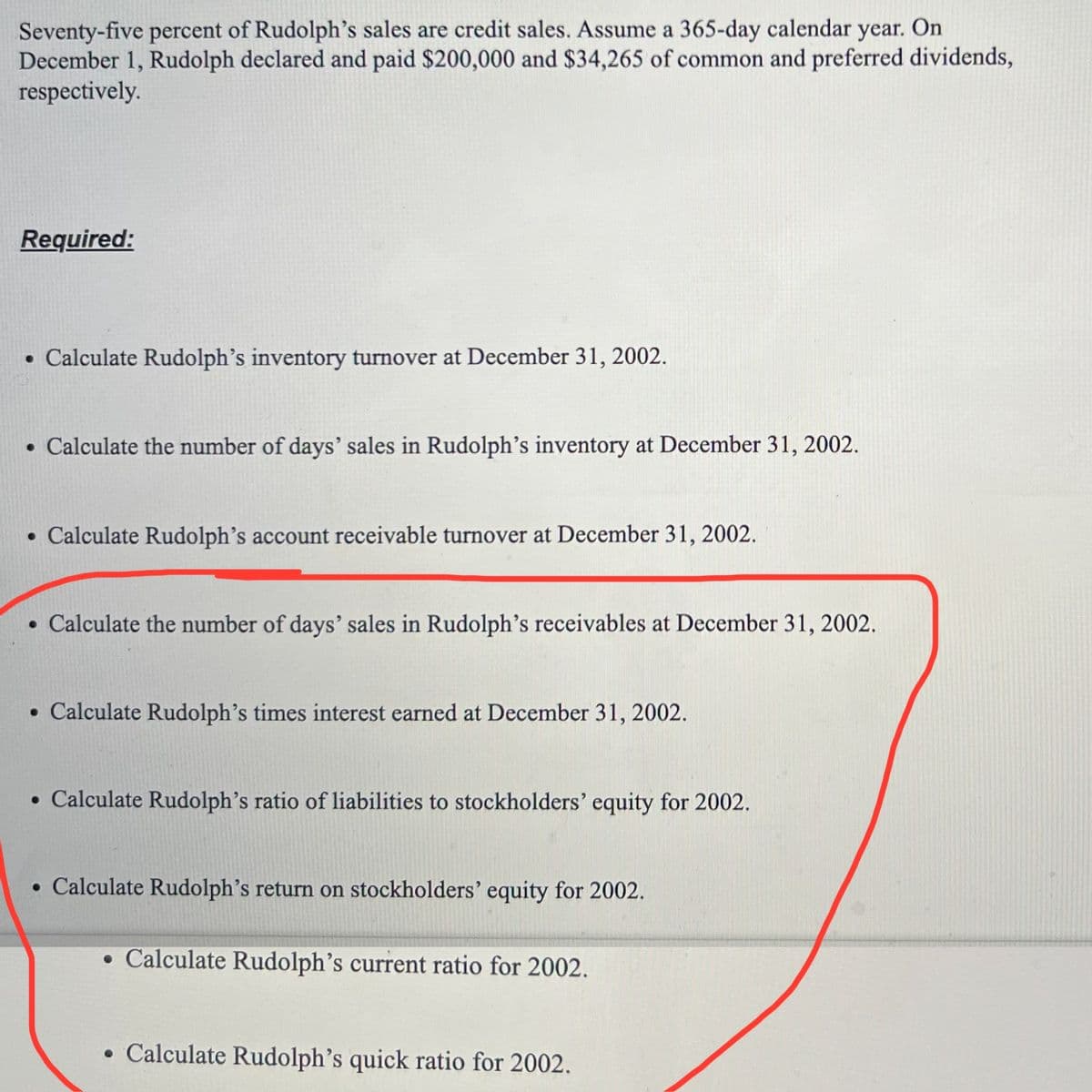

Transcribed Image Text:Seventy-five percent of Rudolph's sales are credit sales. Assume a 365-day calendar year. On

December 1, Rudolph declared and paid $200,000 and $34,265 of common and preferred dividends,

respectively.

Required:

• Calculate Rudolph's inventory turnover at December 31, 2002.

• Calculate the number of days' sales in Rudolph's inventory at December 31, 2002.

• Calculate Rudolph's account receivable turnover at December 31, 2002.

• Calculate the number of days' sales in Rudolph's receivables at December 31, 2002.

• Calculate Rudolph's times interest earned at December 31, 2002.

• Calculate Rudolph's ratio of liabilities to stockholders' equity for 2002.

• Calculate Rudolph's return on stockholders' equity for 2002.

• Calculate Rudolph's current ratio for 2002.

• Calculate Rudolph's quick ratio for 2002.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning