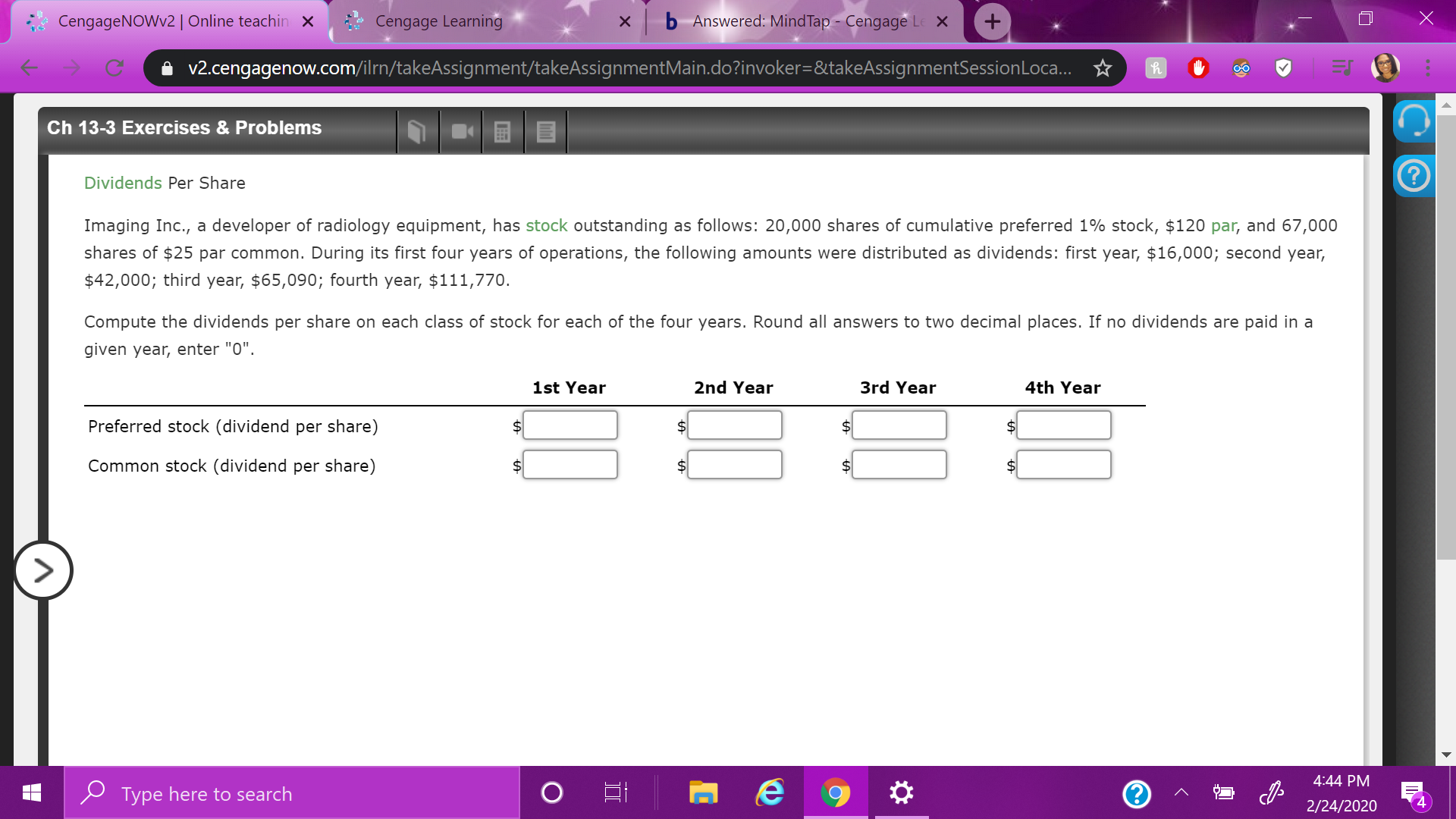

CengageNOWv2| Online teachin × Cengage Learning x b Answered: MindTap - Cengage Le X i v2.cengagenow.com/ilrn/takeAssignment/takeAssignmentMain.do?invoker=&takeAssignmentSessionLoca. ☆ Ch 13-3 Exercises & Problems Dividends Per Share Imaging Inc., a developer of radiology equipment, has stock outstanding as follows: 20,000 shares of cumulative preferred 1% stock, $120 par, and 67,000 shares of $25 par common. During its first four years of operations, the following amounts were distributed as dividends: first year, $16,000; second year, $42,000; third year, $65,090; fourth year, $111,770. Compute the dividends per share on each class of stock for each of the four years. Round all answers to two decimal places. If no dividends are paid in a given year, enter "0". 1st Year 2nd Year 3rd Year 4th Year Preferred stock (dividend per share) 2$ 2$ Common stock (dividend per share) $4 2$ 4:44 PM P Type here to search 2/24/2020

CengageNOWv2| Online teachin × Cengage Learning x b Answered: MindTap - Cengage Le X i v2.cengagenow.com/ilrn/takeAssignment/takeAssignmentMain.do?invoker=&takeAssignmentSessionLoca. ☆ Ch 13-3 Exercises & Problems Dividends Per Share Imaging Inc., a developer of radiology equipment, has stock outstanding as follows: 20,000 shares of cumulative preferred 1% stock, $120 par, and 67,000 shares of $25 par common. During its first four years of operations, the following amounts were distributed as dividends: first year, $16,000; second year, $42,000; third year, $65,090; fourth year, $111,770. Compute the dividends per share on each class of stock for each of the four years. Round all answers to two decimal places. If no dividends are paid in a given year, enter "0". 1st Year 2nd Year 3rd Year 4th Year Preferred stock (dividend per share) 2$ 2$ Common stock (dividend per share) $4 2$ 4:44 PM P Type here to search 2/24/2020

Fundamentals Of Financial Management, Concise Edition (mindtap Course List)

10th Edition

ISBN:9781337902571

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Eugene F. Brigham, Joel F. Houston

Chapter10: The Cost Of Capital

Section: Chapter Questions

Problem 1TCL: CALCULATING 3MS COST OF CAPITAL Use online resources to work on this chapters questions. Please note...

Related questions

Question

What steps do I need to follow in order to find the preferred and common stock?

Transcribed Image Text:CengageNOWv2| Online teachin ×

Cengage Learning

x b Answered: MindTap - Cengage Le X

i v2.cengagenow.com/ilrn/takeAssignment/takeAssignmentMain.do?invoker=&takeAssignmentSessionLoca. ☆

Ch 13-3 Exercises & Problems

Dividends Per Share

Imaging Inc., a developer of radiology equipment, has stock outstanding as follows: 20,000 shares of cumulative preferred 1% stock, $120 par, and 67,000

shares of $25 par common. During its first four years of operations, the following amounts were distributed as dividends: first year, $16,000; second year,

$42,000; third year, $65,090; fourth year, $111,770.

Compute the dividends per share on each class of stock for each of the four years. Round all answers to two decimal places. If no dividends are paid in a

given year, enter "0".

1st Year

2nd Year

3rd Year

4th Year

Preferred stock (dividend per share)

2$

2$

Common stock (dividend per share)

$4

2$

4:44 PM

P Type here to search

2/24/2020

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning