Class Specificatio WileyPLUS X Bb Ch 16 WP - 2019 myStanState Port + https://edugen.wileyplus.com/edugen/student/mainfr.uni ment CALCULATOR NEXT FULL SCREEN PRINTER VERSION BACK Exercise 16-11 On January 1, 2018, Sandhill Inc. granted stock options to officers and key employees for the purchase of 21,000 shares of the company's $10 par common stock at $24 per share. The options were exercisable within a 5-year period beginning January 1, 2020, by grantees still in the employ of the company, and expiring December 31, 2024. The service period for this award is 2 years. Assume that the fair value option-pricing model determines total compensation expense to be $361,400. On April 1, 2019, 2,100 options were terminated when the employees resigned from the company. The market price of the common stock was $35 per share on this date. On March 31, 2020, 12,600 options were exercised when the market price of the common stock was $41 per share. Prepare journal entries to record issuance of the stock options, termination of the stock options, exercise of the stock options, and charges to compensation expense, for the years ended December 31, 2018, 2019, and 2020. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.) Account Titles and Explanation Debit Credit Date Jan. 1, 2018 No Entry 0 No Entry Dec. 31, 2018 Compensation Expense Paid-in Capital-Stock Options Paid-in Capital-Expired Stock Options April 1, 2019 V 11:30 PM e to search 9/30/2019 Print K4 Inse Screen F12 F9 F11 F10 F8 F7 F6 F5 F3 F4 & ( $ # 7 0 6 4 3 P Y U R E L K J H G F D +II T

Class Specificatio WileyPLUS X Bb Ch 16 WP - 2019 myStanState Port + https://edugen.wileyplus.com/edugen/student/mainfr.uni ment CALCULATOR NEXT FULL SCREEN PRINTER VERSION BACK Exercise 16-11 On January 1, 2018, Sandhill Inc. granted stock options to officers and key employees for the purchase of 21,000 shares of the company's $10 par common stock at $24 per share. The options were exercisable within a 5-year period beginning January 1, 2020, by grantees still in the employ of the company, and expiring December 31, 2024. The service period for this award is 2 years. Assume that the fair value option-pricing model determines total compensation expense to be $361,400. On April 1, 2019, 2,100 options were terminated when the employees resigned from the company. The market price of the common stock was $35 per share on this date. On March 31, 2020, 12,600 options were exercised when the market price of the common stock was $41 per share. Prepare journal entries to record issuance of the stock options, termination of the stock options, exercise of the stock options, and charges to compensation expense, for the years ended December 31, 2018, 2019, and 2020. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.) Account Titles and Explanation Debit Credit Date Jan. 1, 2018 No Entry 0 No Entry Dec. 31, 2018 Compensation Expense Paid-in Capital-Stock Options Paid-in Capital-Expired Stock Options April 1, 2019 V 11:30 PM e to search 9/30/2019 Print K4 Inse Screen F12 F9 F11 F10 F8 F7 F6 F5 F3 F4 & ( $ # 7 0 6 4 3 P Y U R E L K J H G F D +II T

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

ChapterA2: Investments

Section: Chapter Questions

Problem 18E: Trading Securities Pear Investments began operations in 2020 and invests in securities classified as...

Related questions

Question

Transcribed Image Text:Class Specificatio

WileyPLUS

X

Bb Ch 16 WP - 2019

myStanState Port

+

https://edugen.wileyplus.com/edugen/student/mainfr.uni

ment

CALCULATOR

NEXT

FULL SCREEN

PRINTER VERSION

BACK

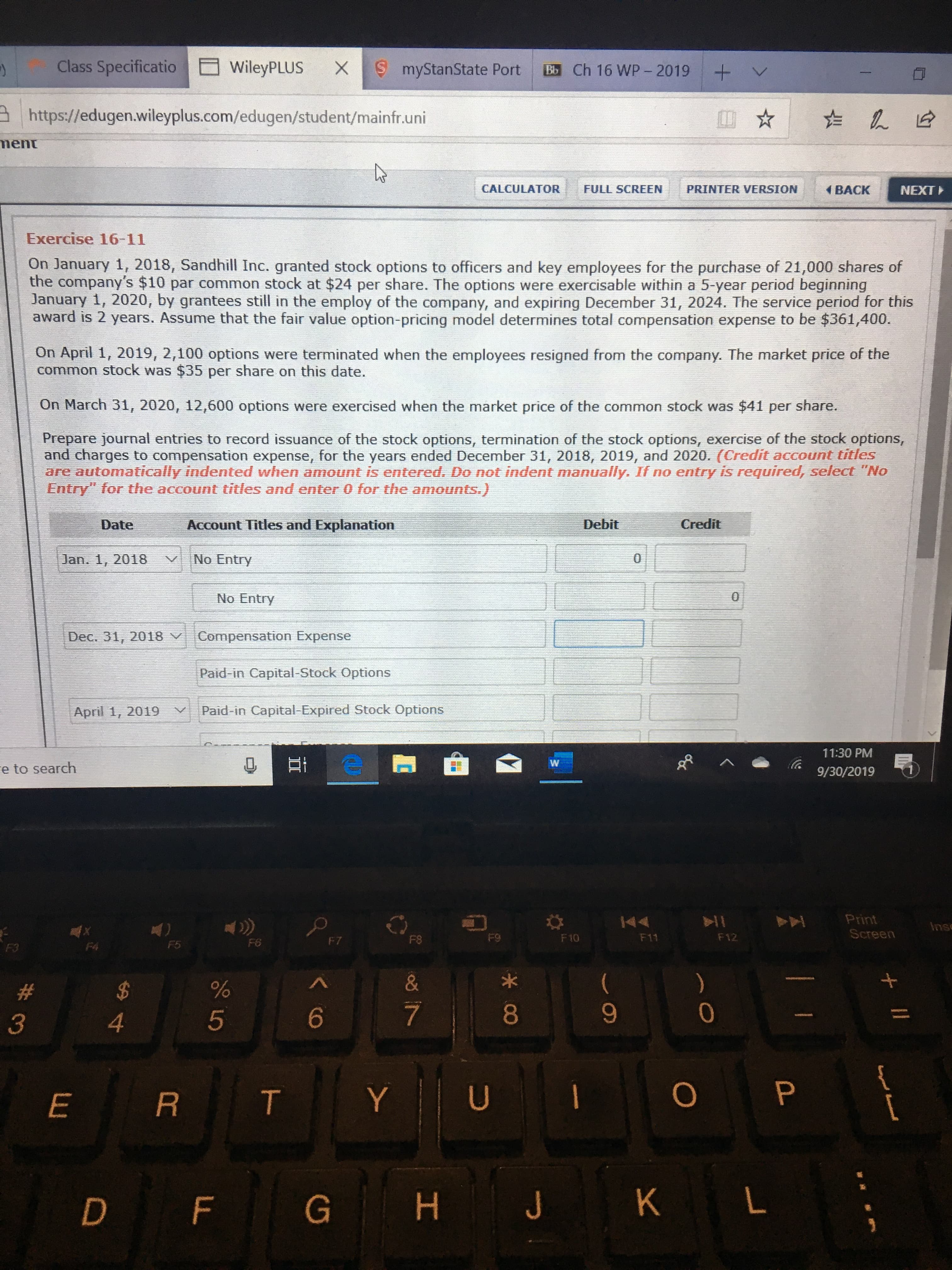

Exercise 16-11

On January 1, 2018, Sandhill Inc. granted stock options to officers and key employees for the purchase of 21,000 shares of

the company's $10 par common stock at $24 per share. The options were exercisable within a 5-year period beginning

January 1, 2020, by grantees still in the employ of the company, and expiring December 31, 2024. The service period for this

award is 2 years. Assume that the fair value option-pricing model determines total compensation expense to be $361,400.

On April 1, 2019, 2,100 options were terminated when the employees resigned from the company. The market price of the

common stock was $35 per share on this date.

On March 31, 2020, 12,600 options were exercised when the market price of the common stock was $41 per share.

Prepare journal entries to record issuance of the stock options, termination of the stock options, exercise of the stock options,

and charges to compensation expense, for the years ended December 31, 2018, 2019, and 2020. (Credit account titles

are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No

Entry" for the account titles and enter 0 for the amounts.)

Account Titles and Explanation

Debit

Credit

Date

Jan. 1, 2018

No Entry

0

No Entry

Dec. 31, 2018

Compensation Expense

Paid-in Capital-Stock Options

Paid-in Capital-Expired Stock Options

April 1, 2019

V

11:30 PM

e to search

9/30/2019

Print

K4

Inse

Screen

F12

F9

F11

F10

F8

F7

F6

F5

F3

F4

&

(

$

#

7

0

6

4

3

P

Y U

R

E

L

K

J

H

G

F

D

+II

T

Expert Solution

Trending now

This is a popular solution!

Step by step

Solved in 9 steps with 7 images

Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning