Chatham Automotive purchased new electric forklifts to move steel automobile parts two years ago. They cost $75,000 each, including the charging stand. In practice, it was found that they did not hold a charge as long as claimed by the manufacturer, so operating costs are very high. As a result, their current salvage value is about $10,000. Chatham is considering replacing them with propane models. New propane forklifts cost $58,000 each. After one year, they have a salvage value of $40,000, and thereafter decline in value at a declining-balance depreciation rate of 20 percent, as does the electric model from this time on. The MARR is 7 percent. Operating costs for the electric model will be $20,000 this year, rising by 12 percent per year. Operating costs for the propane model will initially be $11,000 over the first year, rising by 12 percent per year. Should Chatham Automotive replace the forklifts now? E Click the icon to view the table compound interest factors for discrete compounding periods when i = 7%. Chatham Automotive V replace the forklifts now since the minimum total EAC for the electric forklifts is s which is V than S, the minimum total EAC for the propane forklifts (Round to the nearest dollar as needed.)

Chatham Automotive purchased new electric forklifts to move steel automobile parts two years ago. They cost $75,000 each, including the charging stand. In practice, it was found that they did not hold a charge as long as claimed by the manufacturer, so operating costs are very high. As a result, their current salvage value is about $10,000. Chatham is considering replacing them with propane models. New propane forklifts cost $58,000 each. After one year, they have a salvage value of $40,000, and thereafter decline in value at a declining-balance depreciation rate of 20 percent, as does the electric model from this time on. The MARR is 7 percent. Operating costs for the electric model will be $20,000 this year, rising by 12 percent per year. Operating costs for the propane model will initially be $11,000 over the first year, rising by 12 percent per year. Should Chatham Automotive replace the forklifts now? E Click the icon to view the table compound interest factors for discrete compounding periods when i = 7%. Chatham Automotive V replace the forklifts now since the minimum total EAC for the electric forklifts is s which is V than S, the minimum total EAC for the propane forklifts (Round to the nearest dollar as needed.)

Managerial Economics: Applications, Strategies and Tactics (MindTap Course List)

14th Edition

ISBN:9781305506381

Author:James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Chapter17: Long-term Investment Analysis

Section: Chapter Questions

Problem 4E

Related questions

Question

1.

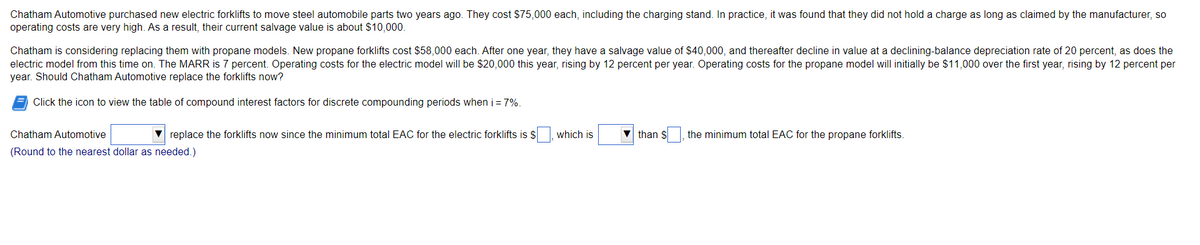

Transcribed Image Text:Chatham Automotive purchased new electric forklifts to move steel automobile parts two years ago. They cost $75,000 each, including the charging stand. In practice, it was found that they did not hold a charge as long as claimed by the manufacturer, so

operating costs are very high. As a result, their current salvage value is about $10,000.

Chatham is considering replacing them with propane models. New propane forklifts cost $58,000 each. After one year, they have a salvage value of $40,000, and thereafter decline in value at a declining-balance depreciation rate of 20 percent, as does the

electric model from this time on. The MARR is 7 percent. Operating costs for the electric model will be $20,000 this year, rising by 12 percent per year. Operating costs for the propane model will initially be $11,000 over the first year, rising by 12 percent per

year. Should Chatham Automotive replace the forklifts now?

Click the icon to view the table of compound interest factors for discrete compounding periods when i = 7%.

Chatham Automotive

V replace the forklifts now since the minimum total EAC for the electric forklifts is $

which is

than $

the minimum total EAC for the propane forklifts.

(Round to the nearest dollar as needed.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Economics: Applications, Strategies an…

Economics

ISBN:

9781305506381

Author:

James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:

Cengage Learning

Economics: Private and Public Choice (MindTap Cou…

Economics

ISBN:

9781305506725

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning

Microeconomics: Private and Public Choice (MindTa…

Economics

ISBN:

9781305506893

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning

Managerial Economics: Applications, Strategies an…

Economics

ISBN:

9781305506381

Author:

James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:

Cengage Learning

Economics: Private and Public Choice (MindTap Cou…

Economics

ISBN:

9781305506725

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning

Microeconomics: Private and Public Choice (MindTa…

Economics

ISBN:

9781305506893

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning