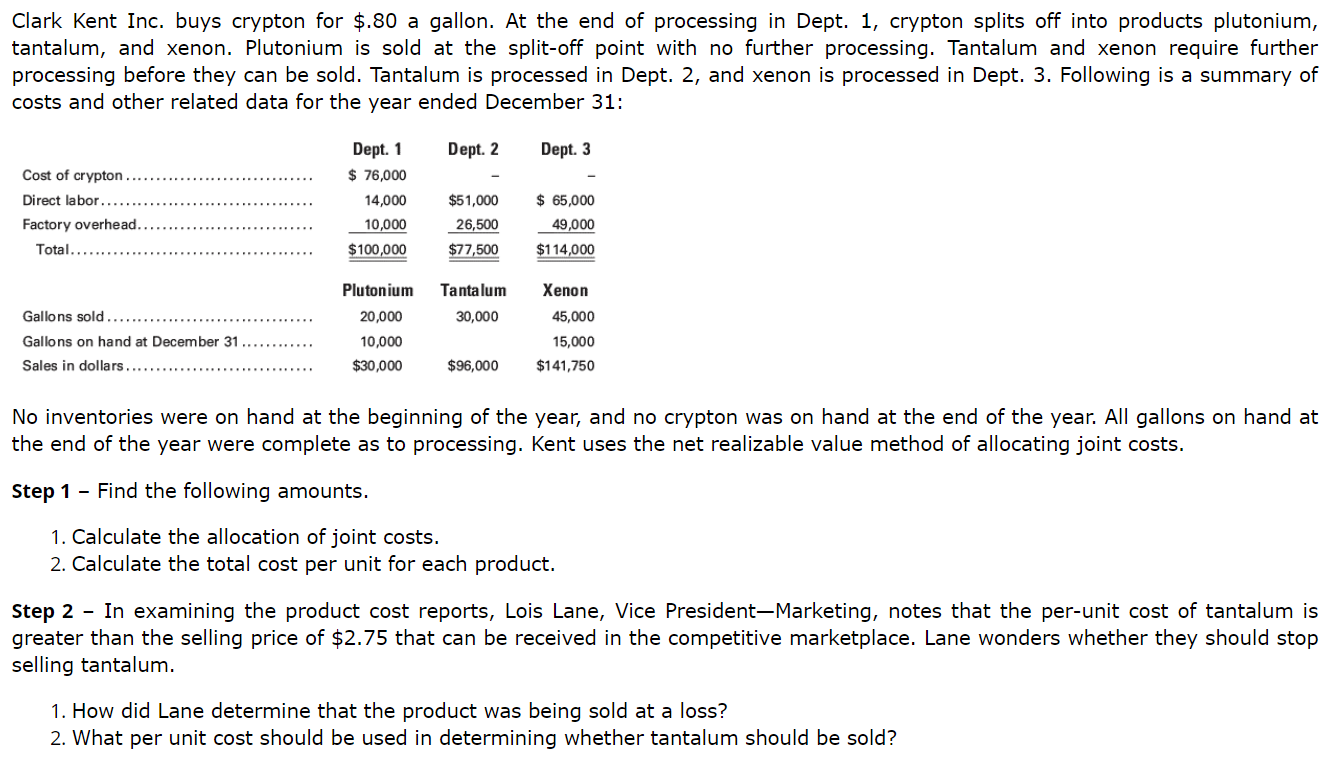

Clark Kent Inc. buys crypton for $.80 a gallon. At the end of processing in Dept. 1, crypton splits off into products plutonium, tantalum, and xenon. Plutonium is sold at the split-off point with no further processing. Tantalum and xenon require further processing before they can be sold. Tantalum is processed in Dept. 2, and xenon is processed in Dept. 3. Following is a summary of costs and other related data for the year ended December 31: Dept. 1 Dept. 2 14,000 $51,000 $65,000 ...10,000 26,500 49,000 Factory overhead.... Plutonium Tantalum Xenon 45,000 15,000 $96,000$141,750 20,000 10,000 $30,000 30,000 No inventories were on hand at the beginning of the year, and no crypton was on hand at the end of the year. All gallons on hand at the end of the year were complete as to processing. Kent uses the net realizable value method of allocating joint costs. Step 1 - Find the following amounts. 1. Calculate the allocation of joint costs. 2. Calculate the total cost per unit for each product. Step 2 - In examining the product cost reports, Lois Lane, Vice President-Marketing, notes that the per-unit cost of tantalum is greater than the selling price of $2.75 that can be received in the competitive marketplace. Lane wonders whether they should stop selling tantalum 1. How did Lane determine that the product was being sold at a loss? 2. What per unit cost should be used in determining whether tantalum should be sold?

Clark Kent Inc. buys crypton for $.80 a gallon. At the end of processing in Dept. 1, crypton splits off into products plutonium, tantalum, and xenon. Plutonium is sold at the split-off point with no further processing. Tantalum and xenon require further processing before they can be sold. Tantalum is processed in Dept. 2, and xenon is processed in Dept. 3. Following is a summary of costs and other related data for the year ended December 31: Dept. 1 Dept. 2 14,000 $51,000 $65,000 ...10,000 26,500 49,000 Factory overhead.... Plutonium Tantalum Xenon 45,000 15,000 $96,000$141,750 20,000 10,000 $30,000 30,000 No inventories were on hand at the beginning of the year, and no crypton was on hand at the end of the year. All gallons on hand at the end of the year were complete as to processing. Kent uses the net realizable value method of allocating joint costs. Step 1 - Find the following amounts. 1. Calculate the allocation of joint costs. 2. Calculate the total cost per unit for each product. Step 2 - In examining the product cost reports, Lois Lane, Vice President-Marketing, notes that the per-unit cost of tantalum is greater than the selling price of $2.75 that can be received in the competitive marketplace. Lane wonders whether they should stop selling tantalum 1. How did Lane determine that the product was being sold at a loss? 2. What per unit cost should be used in determining whether tantalum should be sold?

Principles of Cost Accounting

17th Edition

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Edward J. Vanderbeck, Maria R. Mitchell

Chapter6: Process Cost Accounting—additional Procedures; Accounting For Joint Products And By-products

Section: Chapter Questions

Problem 1MC: Clark Kent Inc. buys crypton for $.80 a gallon. At the end of processing in Dept. 1, crypton splits...

Related questions

Question

Transcribed Image Text:Clark Kent Inc. buys crypton for $.80 a gallon. At the end of processing in Dept. 1, crypton splits off into products plutonium,

tantalum, and xenon. Plutonium is sold at the split-off point with no further processing. Tantalum and xenon require further

processing before they can be sold. Tantalum is processed in Dept. 2, and xenon is processed in Dept. 3. Following is a summary of

costs and other related data for the year ended December 31:

Dept. 1

Dept. 2

14,000

$51,000 $65,000

...10,000 26,500 49,000

Factory overhead....

Plutonium Tantalum Xenon

45,000

15,000

$96,000$141,750

20,000

10,000

$30,000

30,000

No inventories were on hand at the beginning of the year, and no crypton was on hand at the end of the year. All gallons on hand at

the end of the year were complete as to processing. Kent uses the net realizable value method of allocating joint costs.

Step 1 - Find the following amounts.

1. Calculate the allocation of joint costs.

2. Calculate the total cost per unit for each product.

Step 2 - In examining the product cost reports, Lois Lane, Vice President-Marketing, notes that the per-unit cost of tantalum is

greater than the selling price of $2.75 that can be received in the competitive marketplace. Lane wonders whether they should stop

selling tantalum

1. How did Lane determine that the product was being sold at a loss?

2. What per unit cost should be used in determining whether tantalum should be sold?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 3 images

Recommended textbooks for you

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning