FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:WileyPLUS

Pyment Opp

Class Specifications Sorted

https://edugen.wileyplus.com/edugen/student/mainfr.uni

BACK

PRINTER VERSION

NE

FULL SCREEN

CALCULATOR

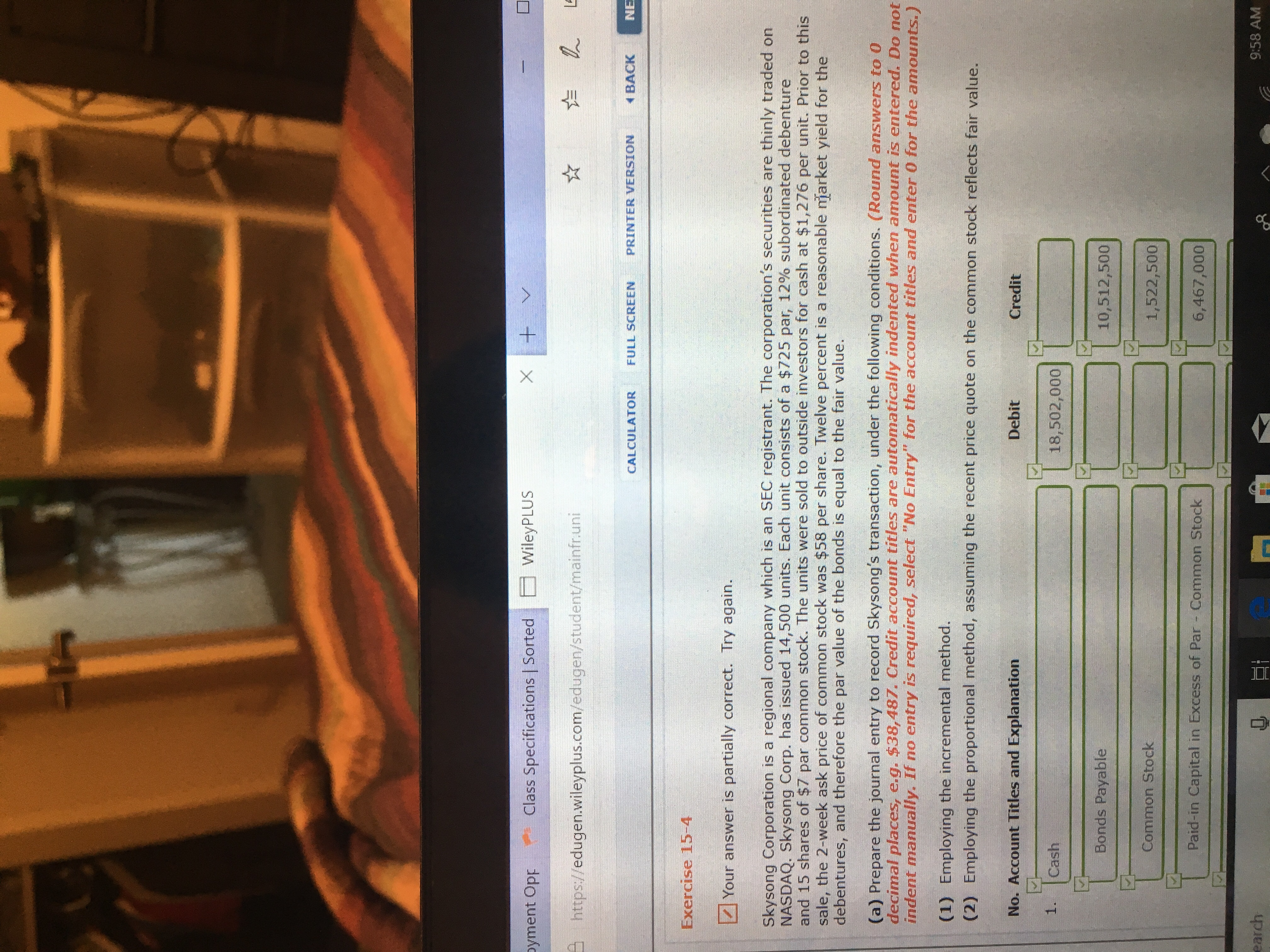

Exercise 15-4

Your answer is partially correct. Try again.

Skysong Corporation is a regional company which is an SEC registrant. The corporation's securities are thinly traded on

NASDAQ. Skysong Corp. has issued 14,500 units. Each unit consists of a $725 par, 12% subordinated debenture

and 15 shares of $7 par common stock. The units were sold to outside investors for cash at $1,276 per unit. Prior to this

sale, the 2-week ask price of common stock was $58 per share. Twelve percent is a reasonable mjarket yield for the

debentures, and therefore the par value of the bonds is equal to the fair value.

(a) Prepare the journal entry to record Skysong's transaction, under the following conditions. (Round answers to 0

decimal places, e.g. $38,487. Credit account titles are automatically indented when amount is entered. Do not

indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.)

(1) Employing the incremental method.

(2) Employing the proportional method, assuming the recent price quote on the common stock reflects fair value.

No. Account Titles and Explanation

Debit

Credit

1.

Cash

18,502,000

Bonds Payable

10,512,500

Common Stock

1,522,500

Paid-in Capital in Excess of Par - Common Stock

6,467,000

earch

9:58 AM

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Similar questions

- Space used (includes formatting): 0/15000 Part D Eliza has only one investment: $15,000 in stock shares of IFruit Computing. The stock's annual returns for the last 10 years have averaged around 8%. Evaluate the risk level of Eliza's investment. Is there anything she can do to make her investment less risky? Explain your answer. BIUX² X₂ 15px Space used (includes formatting): 0/15000 C AVV 14 Apr 15 5:45 2arrow_forwardhelp please answer in text form with proper workings and explanation for each and every part and steps with concept and introduction no AI no copy paste remember answer must be in proper format with all workingarrow_forward• X Enterprises has an investment in 25,000 shares of Y Electronics that X accounts for as a security available for sale. Y shares are publicly traded on the New York Stock Exchange, and the Wall Street Journal quotes a price for those shares of $10/share, but X believes the market has not appreciated the full value of the Y shares and that a more accurate price is $12/share. X should carry the Y investment on its balance sheet at: O $300,000. $250,000. O either $250,000 or $300,000, as either are defensible valuations. O $275,000, the midpoint of X's range of reasonably likely valuations of Y.arrow_forward

- S430908 A A Aa-ES2¶ x² AA EE. Paragraph out References ant Ei H View WORKSHOP 8 EXAMPLES - Word Practice Question 1 Guff plc, an all-equity firm, has the following earnings per share and dividend history (paid annually). Year This year last year Tell me what you want to do... AaBbCcDc AaBb CcDc AaBbC AaBbccc AaB Aa Bbccc AaBbcсD AaBb CCD AaBb CcD; AaBbCcD AaBb CcD AaBb CCD AABBCCDC AABBCCDC AaBb CcD Normal No Spac.... Heading 1 Heading 2 Title Subtitle Intense E... Strong Quote Intense Q... Subtle Ref... Intense Re... Book Title Subtle Em... Emphasis Styles Dividend per share 8p 7.5p Earnings per share 21p 18p 7p 16p 2 years ago 6.5p 3 years ago 13p 4 years ago 14p 6p This year's dividend has just been paid and the next is due in one-year. Guff has an opportunity to invest in a new product, Stuff, during the next two years. The directors are considering cutting the dividend to 4p for each of the next two years to fund the project. However, the dividend in three years can be raised to…arrow_forwardRakesh Dot's upload image pleasearrow_forwardhelp please answer in text form with proper workings and explanation for each and every part and steps with concept and introduction no AI no copy paste remember answer must be in proper format with all workingarrow_forward

- Please Give Step by Step Answer I Give thumb uparrow_forwardHi I need an answer key to the questions below in the images thank youarrow_forwardJournal entry worksheet < 1 Record the fair value adjustment assuming the fair value of the IBM common shares was $1,610,000. Note: Enter debits before credits. Transaction 1 Record entry General Journal Clear entry Debit Credit View general journalarrow_forward

- Required Information Exercise 12-17 (Algo) Equity investments; fair value through net income [LO12-5] [The following information applies to the questions displayed below.] The accounting records of Jamaican Importers, Incorporated, at January 1, 2024, included the following: Assets: Investment in IBM common shares Less: Fair value adjustment No changes occurred during 2024 in the investment portfolio. $ 1,745, 000 (185, 000) $ 1,560,000 Exercise 12-17 (Algo) Part 3 3. Prepare appropriate adjusting entry(s) at December 31, 2024, assuming the fair value of the IBM common shares was $1,755,000. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. View transaction listarrow_forwardQ3 Which of the following statements is CORRECT? a. Capital market instruments include both long-term debt and common stocks. b. An example of a primary market transaction would be your uncle transferring 100 shares of Wal-Mart stock to you as a birthday gift. c. The NYSE does not exist as a physical location; rather, it represents a loose collection of dealers who trade stocks electronically. d. If your uncle in New York sold 100 shares of Microsoft through his broker to an investor in Los Angeles, this would be a primary market transaction. e. While the two frequently perform similar functions, investment banks generally specialize in lending money, whereas commercial banks generally help companies raise large blocks of capital from investors.arrow_forwardNot a previously submitted question. Thank youarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education