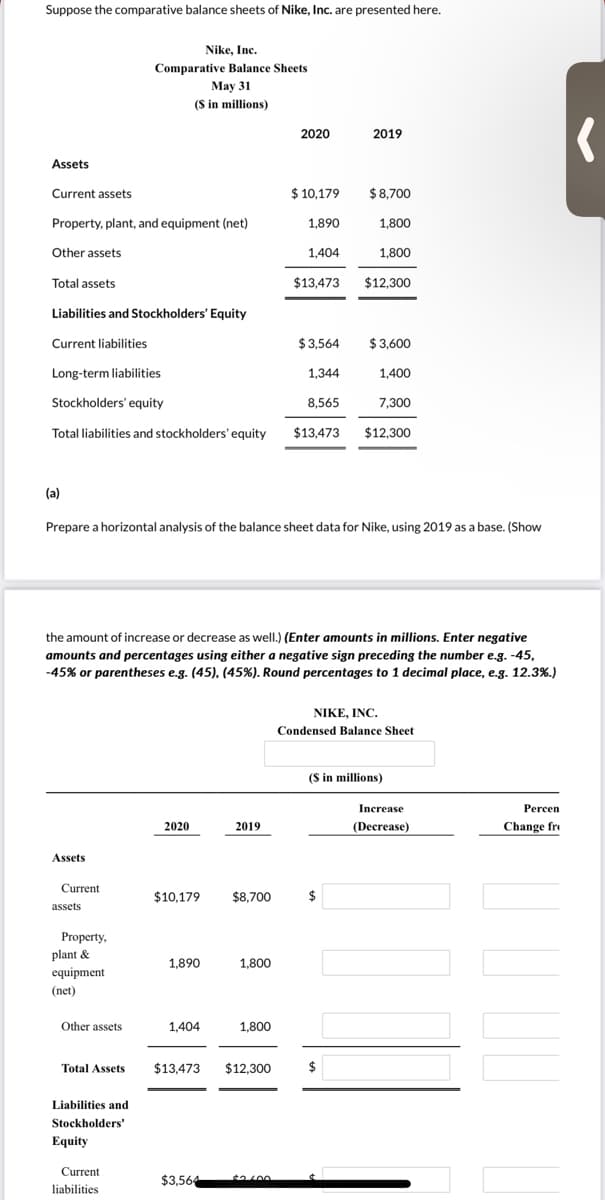

Comparative Balance Sheets May 31 (S in millions) 2020 2019 Assets Current assets $ 10,179 $8,700 Property, plant, and equipment (net) 1,890 1,800 Other assets 1,404 1,800 Total assets $13,473 $12,300 Liabilities and Stockholders' Equity Current liabilities $3,564 $3,600 Long-term liabilities 1,344 1,400 Stockholders' equity 8,565 7,300 Total liabilities and stockholders' equity $13,473 $12,300 (a) Prepare a horizontal analysis of the balance sheet data for Nike, using 2019 as a base. (Show the amount of increase or decrease as well.) (Enter amounts in millions. Enter negative amounts and percentages using either a negative sign preceding the number e.g. -45, -45% or parentheses e.g. (45), (45%). Round percentages to 1 decimal place, e.g. 12.3%.) NIKE, INC. Condensed Balance Sheet (S in millions) Increase Percen 2020 2019 (Decrease) Change fr Assets Current $10,179 $8,700 2$ assets Property, plant & 1,890 1,800 equipment (net) Other assets 1,404 1,800 Total Assets $13,473 $12,300 Liabilities and Stockholders' Equity Current $3,566 liahilitie as

Comparative Balance Sheets May 31 (S in millions) 2020 2019 Assets Current assets $ 10,179 $8,700 Property, plant, and equipment (net) 1,890 1,800 Other assets 1,404 1,800 Total assets $13,473 $12,300 Liabilities and Stockholders' Equity Current liabilities $3,564 $3,600 Long-term liabilities 1,344 1,400 Stockholders' equity 8,565 7,300 Total liabilities and stockholders' equity $13,473 $12,300 (a) Prepare a horizontal analysis of the balance sheet data for Nike, using 2019 as a base. (Show the amount of increase or decrease as well.) (Enter amounts in millions. Enter negative amounts and percentages using either a negative sign preceding the number e.g. -45, -45% or parentheses e.g. (45), (45%). Round percentages to 1 decimal place, e.g. 12.3%.) NIKE, INC. Condensed Balance Sheet (S in millions) Increase Percen 2020 2019 (Decrease) Change fr Assets Current $10,179 $8,700 2$ assets Property, plant & 1,890 1,800 equipment (net) Other assets 1,404 1,800 Total Assets $13,473 $12,300 Liabilities and Stockholders' Equity Current $3,566 liahilitie as

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter9: Long-term Liabilities

Section: Chapter Questions

Problem 103.2C

Related questions

Question

Transcribed Image Text:Suppose the comparative balance sheets of Nike, Inc. are presented here.

Nike, Inc.

Comparative Balance Sheets

May 31

(S in millions)

2020

2019

Assets

Current assets

$ 10,179

$8,700

Property, plant, and equipment (net)

1,890

1,800

Other assets

1,404

1,800

Total assets

$13,473

$12,300

Liabilities and Stockholders' Equity

Current liabilities

$3,564

$3,600

Long-term liabilities

1,344

1,400

Stockholders' equity

8,565

7,300

Total liabilities and stockholders' equity

$13,473

$12,300

(a)

Prepare a horizontal analysis of the balance sheet data for Nike, using 2019 as a base. (Show

the amount of increase or decrease as well.) (Enter amounts in millions. Enter negative

amounts and percentages using either a negative sign preceding the number e.g. -45,

-45% or parentheses e.g. (45), (45%). Round percentages to 1 decimal place, e.g. 12.3%.)

NIKE, INC.

Condensed Balance Sheet

(S in millions)

Increase

Percen

2020

2019

(Decrease)

Change fre

Assets

Current

$10,179

$8.700

$

assets

Property,

plant &

1,890

1,800

equipment

(net)

Other assets

1,404

1,800

Total Assets

$13,473

$12,300

$

Liabilities and

Stockholders'

Equity

Current

$3,564

liabilities

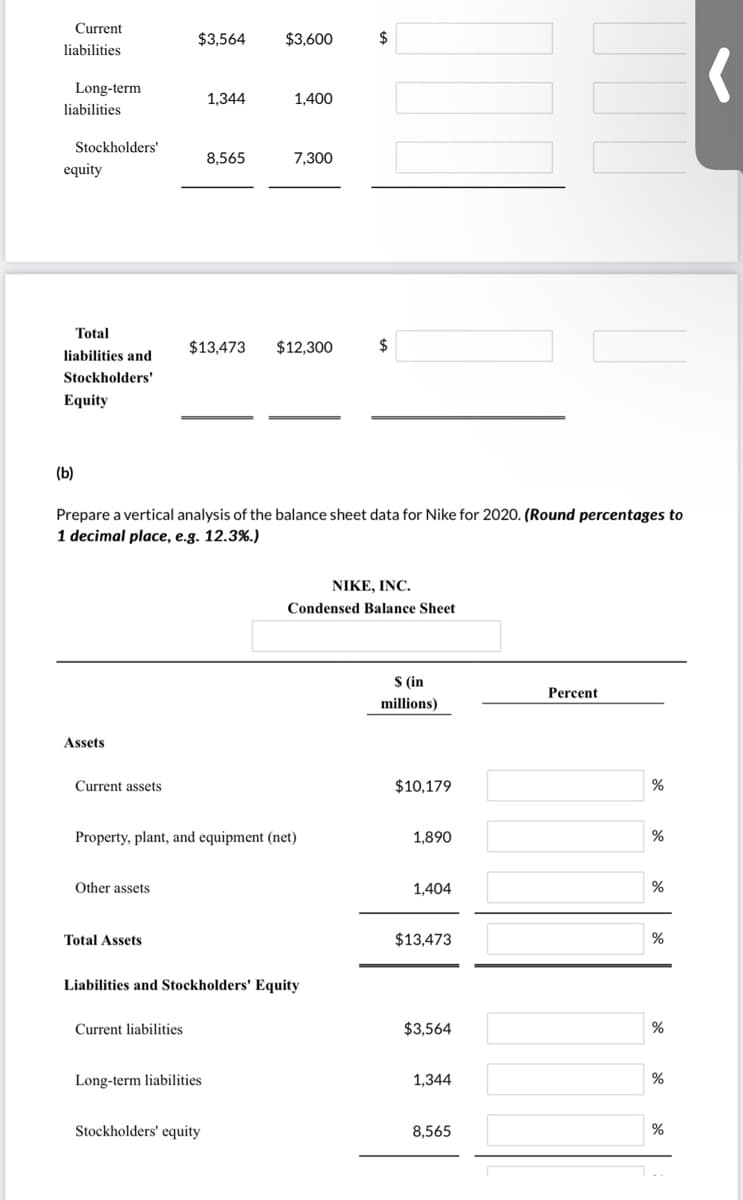

Transcribed Image Text:Current

$3,564

$3,600

$

liabilities

Long-term

1,344

1,400

liabilities

Stockholders'

8,565

7,300

equity

Total

$13,473

$12,300

$

liabilities and

Stockholders'

Equity

(b)

Prepare a vertical analysis of the balance sheet data for Nike for 2020. (Round percentages to

1 decimal place, e.g. 12.3%.)

NIKE, INC.

Condensed Balance Sheet

$ (in

Percent

millions)

Assets

Current assets

$10,179

Property, plant, and equipment (net)

1,890

%

Other assets

1,404

%

Total Assets

$13,473

%

Liabilities and Stockholders' Equity

Current liabilities

$3,564

%

Long-term liabilities

1,344

%

Stockholders' equity

8,565

%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,