Comparing all methods. Risky Business is looking at a project with the following estimated cash flow: Risky Business wants to know the payback period, NPV, IRR, MIRR, and PI of this project. The appropriate discount rate for the project is 9%. If the cutoff period is 6 years for major projects, determine whether the management at Risky Business will accept or reject the project under the five different decision models. What is the payback period for the new project at Risky Business? years (Round to two decimal places.) Data table. (Click on the following icon in order to copy its contents into a spreadsheet.) Initial investment at start of project: $10,900,000 Cash flow at end of year one: $1,853,000 Cash flow at end of years two through six: $2,180,000 each year Cash flow at end of years seven through nine: $2,408,900 each year Cash flow at end of year ten: $1,720,643 Print Done

Comparing all methods. Risky Business is looking at a project with the following estimated cash flow: Risky Business wants to know the payback period, NPV, IRR, MIRR, and PI of this project. The appropriate discount rate for the project is 9%. If the cutoff period is 6 years for major projects, determine whether the management at Risky Business will accept or reject the project under the five different decision models. What is the payback period for the new project at Risky Business? years (Round to two decimal places.) Data table. (Click on the following icon in order to copy its contents into a spreadsheet.) Initial investment at start of project: $10,900,000 Cash flow at end of year one: $1,853,000 Cash flow at end of years two through six: $2,180,000 each year Cash flow at end of years seven through nine: $2,408,900 each year Cash flow at end of year ten: $1,720,643 Print Done

Managerial Accounting

15th Edition

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:Carl Warren, Ph.d. Cma William B. Tayler

Chapter12: Capital Investment Analysis

Section: Chapter Questions

Problem 2PA

Related questions

Question

None

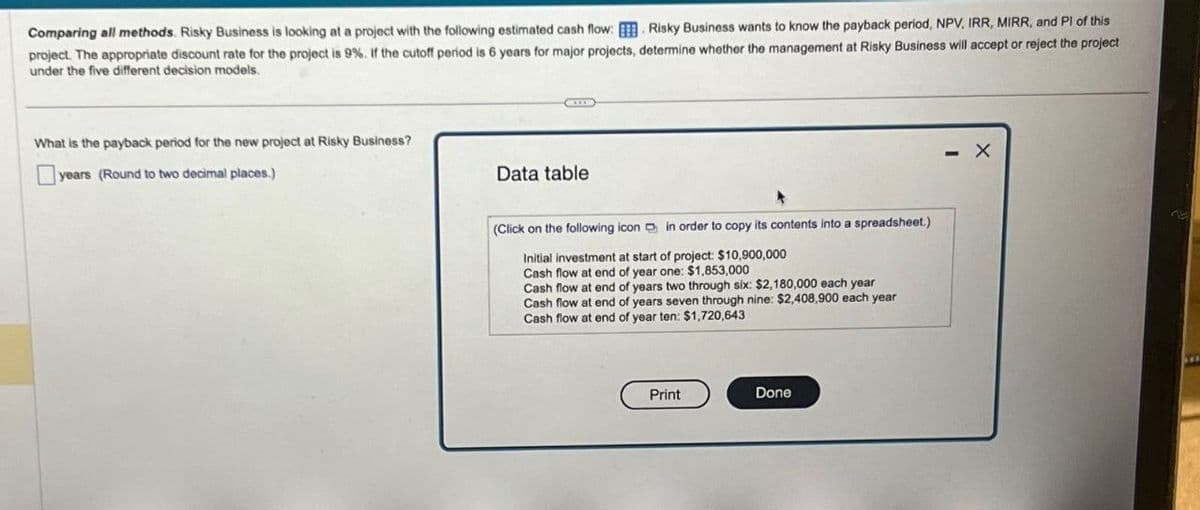

Transcribed Image Text:Comparing all methods. Risky Business is looking at a project with the following estimated cash flow: Risky Business wants to know the payback period, NPV, IRR, MIRR, and PI of this

project. The appropriate discount rate for the project is 9%. If the cutoff period is 6 years for major projects, determine whether the management at Risky Business will accept or reject the project

under the five different decision models.

What is the payback period for the new project at Risky Business?

years (Round to two decimal places.)

Data table.

(Click on the following icon in order to copy its contents into a spreadsheet.)

Initial investment at start of project: $10,900,000

Cash flow at end of year one: $1,853,000

Cash flow at end of years two through six: $2,180,000 each year

Cash flow at end of years seven through nine: $2,408,900 each year

Cash flow at end of year ten: $1,720,643

Print

Done

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 1 images

Recommended textbooks for you

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning