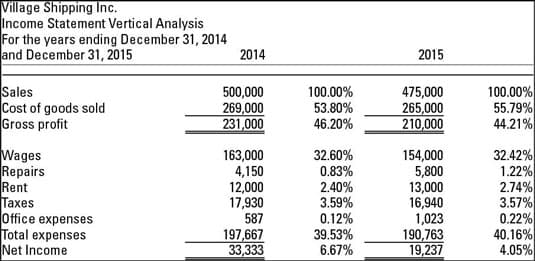

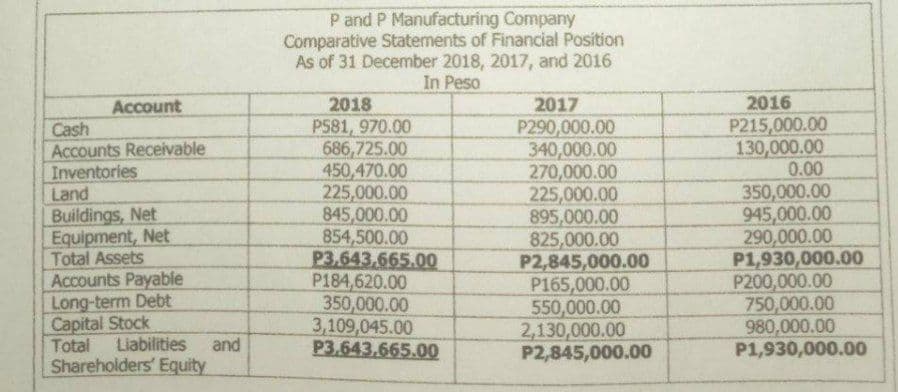

Conduct a vertical analysis (common-size financial statements). Comment on the components of the financial statements by year and its trend for the last three years. (Note: please see second picture as example for vertical analysis. The first picture is the given.)

Conduct a vertical analysis (common-size financial statements). Comment on the components of the financial statements by year and its trend for the last three years. (Note: please see second picture as example for vertical analysis. The first picture is the given.)

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter12: Fainancial Statement Analysis

Section: Chapter Questions

Problem 54CE

Related questions

Question

Conduct a vertical analysis (common-size financial statements). Comment on the components of the financial statements by year and its trend for the last three years.

(Note: please see second picture as example for vertical analysis. The first picture is the given.)

Transcribed Image Text:Village Shipping Inc.

Income Statement Vertical Analysis

For the years ending December 31, 2014

and December 31, 2015

2014

2015

Sales

Cost of goods sold

Gross profit

500,000

269,000

231,000

100.00%

53.80%

46.20%

475,000

265,000

210,000

100.00%

55.79%

44.21%

Wages

Repairs

Rent

Taxes

Office expenses

Total expenses

Net Income

163,000

4,150

12,000

17,930

587

32.60%

0.83%

2.40%

3.59%

0.12%

39.53%

6.67%

154,000

5,800

13,000

16,940

1,023

190,763

19,237

32.42%

1.22%

2.74%

3.57%

0.22%

40.16%

4.05%

197,667

33,333

Transcribed Image Text:P and P Manufacturing Company

Comparative Statements of Financial Position

As of 31 December 2018, 2017, and 2016

In Peso

2018

P581, 970.00

686,725.00

450,470.00

225,000.00

845,000.00

854,500.00

P3.643,665.00

P184,620.00

350,000.00

3,109,045.00

P3.643.665.00

2016

2017

P290,000.00

340,000.00

270,000.00

225,000.00

895,000.00

825,000.00

P2,845,000.00

P165,000.00

550,000.00

2,130,000.00

P2,845,000.00

Account

P215,000.00

130,000.00

0.00

Cash

Accounts Receivable

Inventories

350,000.00

945,000.00

290,000.00

P1,930,000.00

P200,000.00

750,000.00

980,000.00

P1,930,000.00

Land

Buildings, Net

Equipment, Net

Total Assets

Accounts Payable

Long-term Debt

Capital Stock

Liabilities

Total

and

Shareholders' Equity

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning