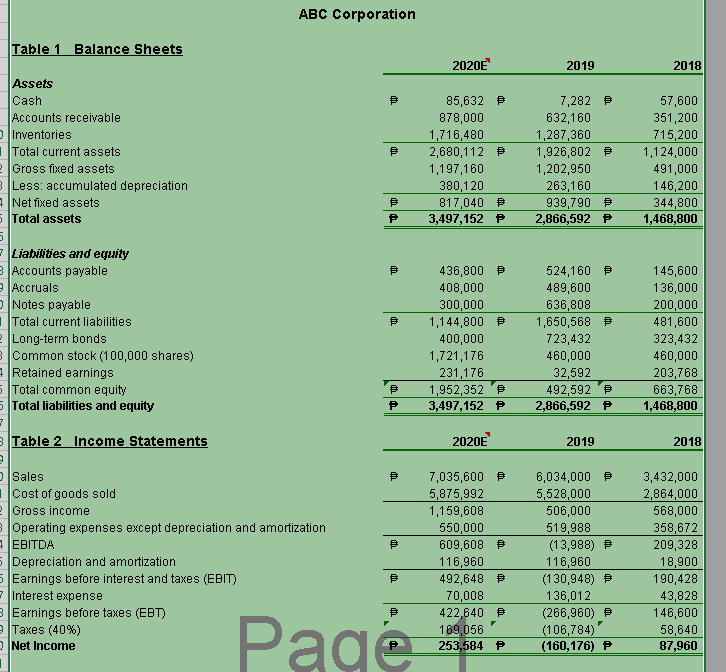

Given are the statements of financial position, income statements, and other pertinent data for ABC Corporation (see previous page). The amounts are historical data for 2018 and 2019 and expected (E) amounts for 2020. Requirements: 1. Compute the given ratios for 2020E. Fill in the yellow blanks on the picture.

Given are the statements of financial position, income statements, and other pertinent data for ABC Corporation (see previous page). The amounts are historical data for 2018 and 2019 and expected (E) amounts for 2020. Requirements: 1. Compute the given ratios for 2020E. Fill in the yellow blanks on the picture.

Chapter1: Financial Statements And Business Decisions

Section: Chapter Questions

Problem 1Q

Related questions

Question

100%

| Given are the The amounts are historical data for 2018 and 2019 and expected (E) amounts for 2020. |

||||

| Requirements: | ||||

| 1. Compute the given ratios for 2020E. Fill in the yellow blanks on the picture. | ||||

Transcribed Image Text:ABC Corporation

Table 1 Balance Sheets

2020E

2019

2018

Assets

85,632 P

878,000

Cash

7,282 P

57,600

Accounts receivable

632,160

351,200

DInventories

|Total current assets

2Gross fixed assets

B Less: accumulated depreciation

4Net fixed assets

5 Total assets

1,716,480

1,287,360

1,926,802 P

1,202,950

263,160

939,790 P

2,866,592 P

715,200

2,680,112 P

1,124,000

1,197,160

491,000

380,120

817,040 P

3,497,152 P

146,200

344,800

1,468,800

P

- Liabilities and equity

B Accounts payable

e Accruals

DNotes payable

|Total current liabilities

e Long-term bonds

3 Common stock (100,000 shares)

a Retained earnings

5 Total common equity

5 Total liabilities and equity

436,800 P

524,160 P

145,600

408,000

489,600

136,000

300,000

1,144,800 P

400,000

636,808

200,000

481,600

1,650,568 P

723,432

323,432

1,721,176

460,000

460,000

231,176

32,592

203,768

1,952,352 P

492,592

2,866,592 P

663,768

1,468,800

3,497,152 P

3 Table 2 Income Statements

2020E

2019

2018

DSales

7,035,600 P

5,875,992

1,159,608

6,034,000 P

5,528,000

506,000

3,432,000

2,864,000

568,000

Cost of goods sold

e Gross income

3 Operating expenses except depreciation and amortization

A EBITDA

5 Depreciation and amortization

5Earnings before interest and taxes (EBIT)

- Interest expense

3 Earnings before taxes (EBT)

e Taxes (40%)

358,672

209,328

550,000

519,988

(13,988) P

116,960

(130,948) P

136,012

(266,960) P

(106,784)

(160,176) P

609,608 P

116,960

18,900

190,428

492,648 P

70,008

422,640 P

43,828

146,600

Pagé

189,056

253,584 P

58,640

87,960

DNet Incone

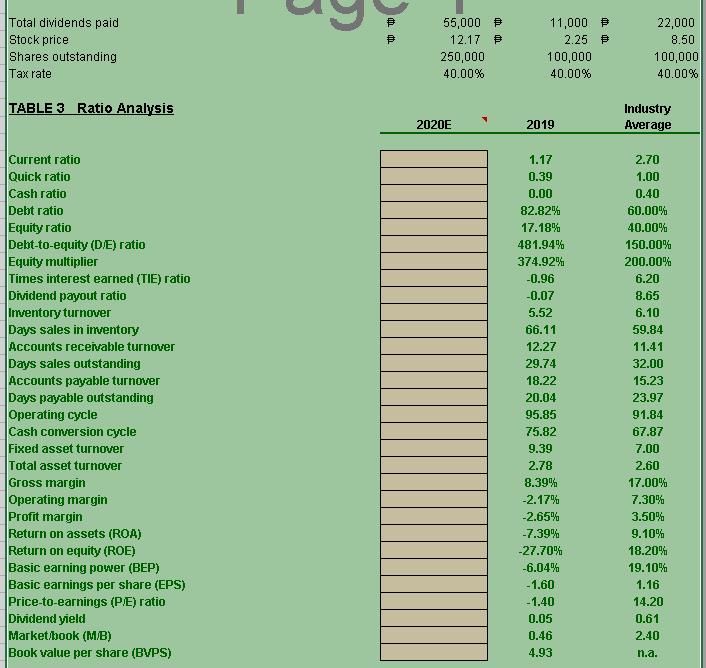

Transcribed Image Text:Total dividends paid

Stock price

Shares outstanding

55,000 P

11,000 P

22,000

12.17

2.25 P

8.50

250,000

100,000

100,000

|Таx rate

40.00%

40.00%

40.00%

TABLE 3 Ratio Analysis

Industry

2020E

2019

Average

Current ratio

Quick ratio

1.17

2.70

0.39

1.00

Cash ratio

0.00

0.40

Debt ratio

82.82%

60.00%

Equity ratio

17.18%

40.00%

Debt-to-equity (DE) ratio

481.94%

150.00%

Equity multiplier

Times interest earned (TIE) ratio

Dividend payout ratio

374.92%

200.00%

-0.96

6.20

-0.07

8.65

Inventory turnover

Days sales in imventory

5.52

6.10

66.11

59.84

Accounts receivable turnover

12.27

11.41

Days sales outstanding

29.74

32.00

Accounts payable turnover

18.22

15.23

Days payable outstanding

20.04

23.97

Operating cycle

Cash conversion cycle

95.85

91.84

75.82

67.87

Fixed asset turnover

9.39

7.00

Total asset turnover

2.78

2.60

Gross margin

8.39%

17.00%

Operating margin

Profit margin

Return on assets (ROA)

Return on equity (ROE)

Basic earning power (BEP)

Basic earnings per share (EPS)

Price-to-earnings (PE) ratio

Dividend yield

Market/book (MB)

Book value per share (BVPS)

-2.17%

7.30%

-2.65%

3.50%

-7.39%

9.10%

-27.70%

18.20%

-6.04%

19.10%

-1.60

1.16

-1.40

14.20

0.05

0.61

0.46

2.40

4.93

n.a.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis…

Accounting

ISBN:

9780134475585

Author:

Srikant M. Datar, Madhav V. Rajan

Publisher:

PEARSON

Intermediate Accounting

Accounting

ISBN:

9781259722660

Author:

J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:

McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:

9781259726705

Author:

John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:

McGraw-Hill Education