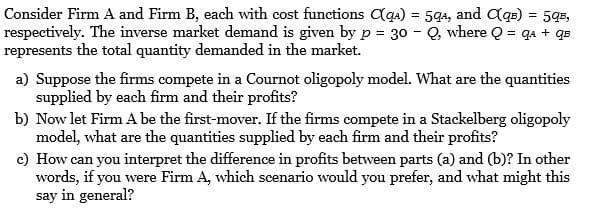

Consider Firm A and Firm B, each with cost functions C(qA) = 5qA, and C(qB) = 5qB, The inverse market demand is given by p = 30 − Q, where Q = qA + qB represents the total quantity demanded in the market. a) Suppose the firms compete in a Cournot oligopoly model. What are the quantities supplied by each firm and their profits? b) Now let Firm A be the first-mover. If the firms compete in a Stackelberg oligopoly model, what are the quantities supplied by each firm and their profits? c) How can you interpret the difference in profits between parts (a) and (b)? In other words, if you were Firm A, which scenario would you prefer, and what might this say in general?

Consider Firm A and Firm B, each with cost functions C(qA) = 5qA, and C(qB) = 5qB, The inverse market demand is given by p = 30 − Q, where Q = qA + qB represents the total quantity demanded in the market. a) Suppose the firms compete in a Cournot oligopoly model. What are the quantities supplied by each firm and their profits? b) Now let Firm A be the first-mover. If the firms compete in a Stackelberg oligopoly model, what are the quantities supplied by each firm and their profits? c) How can you interpret the difference in profits between parts (a) and (b)? In other words, if you were Firm A, which scenario would you prefer, and what might this say in general?

Managerial Economics: Applications, Strategies and Tactics (MindTap Course List)

14th Edition

ISBN:9781305506381

Author:James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Chapter12: Price And Output Determination: Oligopoly

Section: Chapter Questions

Problem 2E

Related questions

Question

Consider Firm A and Firm B, each with cost functions C(qA) = 5qA, and C(qB) = 5qB, The inverse market demand is given by p = 30 − Q, where Q = qA + qB represents the total quantity demanded in the market.

a) Suppose the firms compete in a Cournot oligopoly model. What are the quantities supplied by each firm and their profits?

b) Now let Firm A be the first-mover. If the firms compete in a Stackelberg oligopoly model, what are the quantities supplied by each firm and their profits?

c) How can you interpret the difference in profits between parts (a) and (b)? In other words, if you were Firm A, which scenario would you prefer, and what might this say in general?

Transcribed Image Text:Consider Firm A and Firm B, each with cost functions Cqa) = 59a, and Cqe) = 5q5,

respectively. The inverse market demand is given by p = 30 - Q, where Q = qa + qs

represents the total quantity demanded in the market.

a) Suppose the firms compete in a Cournot oligopoly model. What are the quantities

supplied by each firm and their profits?

b) Now let Firm A be the first-mover. If the firms compete in a Stackelberg oligopoly

model, what are the quantities supplied by each firm and their profits?

c) How can you interpret the difference in profits between parts (a) and (b)? In other

words, if you were Firm A, which scenario would you prefer, and what might this

say in general?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Economics: Applications, Strategies an…

Economics

ISBN:

9781305506381

Author:

James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:

Cengage Learning

Managerial Economics: Applications, Strategies an…

Economics

ISBN:

9781305506381

Author:

James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:

Cengage Learning

Exploring Economics

Economics

ISBN:

9781544336329

Author:

Robert L. Sexton

Publisher:

SAGE Publications, Inc