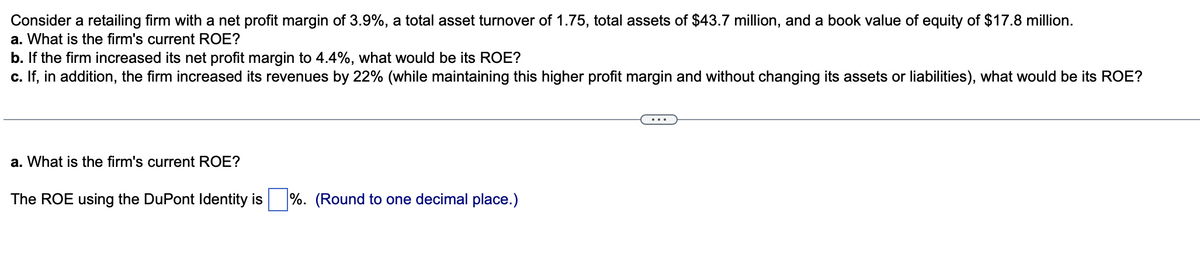

Consider a retailing firm with a net profit margin of 3.9%, a total asset turnover of 1.75, total assets of $43.7 million, and a book value of equity of $17.8 million. a. What is the firm's current ROE? b. If the firm increased its net profit margin to 4.4%, what would be its ROE? c. If, in addition, the firm increased its revenues by 22% (while maintaining this higher profit margin and without changing its assets or liabilities), what would be its ROE? a. What is the firm's current ROE? The ROE using the DuPont Identity is %. (Round to one decimal place.)

Consider a retailing firm with a net profit margin of 3.9%, a total asset turnover of 1.75, total assets of $43.7 million, and a book value of equity of $17.8 million. a. What is the firm's current ROE? b. If the firm increased its net profit margin to 4.4%, what would be its ROE? c. If, in addition, the firm increased its revenues by 22% (while maintaining this higher profit margin and without changing its assets or liabilities), what would be its ROE? a. What is the firm's current ROE? The ROE using the DuPont Identity is %. (Round to one decimal place.)

Chapter2: Developing The Business Idea

Section: Chapter Questions

Problem 9SEP

Related questions

Question

Ee 150.

Transcribed Image Text:Consider a retailing firm with a net profit margin of 3.9%, a total asset turnover of 1.75, total assets of $43.7 million, and a book value of equity of $17.8 million.

a. What is the firm's current ROE?

b. If the firm increased its net profit margin to 4.4%, what would be its ROE?

c. If, in addition, the firm increased its revenues by 22% (while maintaining this higher profit margin and without changing its assets or liabilities), what would be its ROE?

a. What is the firm's current ROE?

The ROE using the DuPont Identity is %. (Round to one decimal place.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning