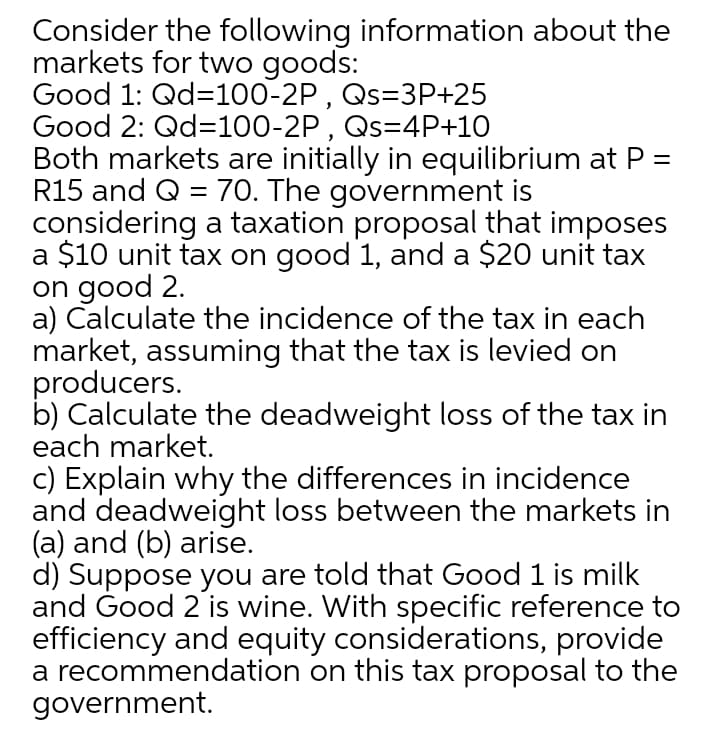

Consider the following information about the markets for two goods: Good 1: Qd=100-2P , Qs=3P+25 Good 2: Qd=100-2P , Qs=4P+10 Both markets are initially in equilibrium at P = R15 and Q = 70. The government is considering a taxation proposal that imposes a $10 unit tax on good 1, and a $20 unit tax on good 2. a) Calculate the incidence of the tax in each market, assuming that the tax is levied on producers. b) Calculate the deadweight loss of the tax in each market. c) Explain why the differences in incidence and deadweight loss between the markets in (a) and (b) arise.

Consider the following information about the markets for two goods: Good 1: Qd=100-2P , Qs=3P+25 Good 2: Qd=100-2P , Qs=4P+10 Both markets are initially in equilibrium at P = R15 and Q = 70. The government is considering a taxation proposal that imposes a $10 unit tax on good 1, and a $20 unit tax on good 2. a) Calculate the incidence of the tax in each market, assuming that the tax is levied on producers. b) Calculate the deadweight loss of the tax in each market. c) Explain why the differences in incidence and deadweight loss between the markets in (a) and (b) arise.

Principles of Microeconomics (MindTap Course List)

8th Edition

ISBN:9781305971493

Author:N. Gregory Mankiw

Publisher:N. Gregory Mankiw

Chapter8: Application: The Cost Of Taxation

Section: Chapter Questions

Problem 10PA

Related questions

Question

Transcribed Image Text:Consider the following information about the

markets for two goods:

Good 1: Qd=100-2P , Qs=3P+25

Good 2: Qd=100-2P , Qs=4P+10

Both markets are initially in equilibrium at P =

R15 and Q = 70. The government is

considering a taxation proposal that imposes

a $10 unit tax on good 1, and a $20 unit tax

on good 2.

a) Calculate the incidence of the tax in each

market, assuming that the tax is levied on

producers.

b) Calculate the deadweight loss of the tax in

each market.

c) Explain why the differences in incidence

and deadweight loss between the markets in

(a) and (b) arise.

d) Suppose you are told that Good 1 is milk

and Good 2 is wine. With specific reference to

efficiency and equity considerations, provide

a recommendation on this tax proposal to the

government.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps

Recommended textbooks for you

Principles of Microeconomics (MindTap Course List)

Economics

ISBN:

9781305971493

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Macroeconomics (MindTap Course List)

Economics

ISBN:

9781285165912

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Essentials of Economics (MindTap Course List)

Economics

ISBN:

9781337091992

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Microeconomics (MindTap Course List)

Economics

ISBN:

9781305971493

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Macroeconomics (MindTap Course List)

Economics

ISBN:

9781285165912

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Essentials of Economics (MindTap Course List)

Economics

ISBN:

9781337091992

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Macroeconomics (MindTap Course List)

Economics

ISBN:

9781305971509

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Microeconomics

Economics

ISBN:

9781305156050

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Economics, 7th Edition (MindTap Cou…

Economics

ISBN:

9781285165875

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning