Consider the following situation in the Canadian banking system: •The Bank of Canada purchases $5 million worth of government securities from an investment dealer with a cheque drawn on the Bank of Canada. •The dealer deposits this cheque at Bank XYZ, a commercial bank. •The target reserve ratio for all commercial banks is 20%. •All commercial banks operate with no excess reserves. Suppose the public decides to hold 5% of their deposits in cash – that is, there is now a cash drain of 5%. As a result of the new deposit, the money supply would eventually (a) increase by $16.67 million (b) increase by $20 million

Consider the following situation in the Canadian banking system: •The Bank of Canada purchases $5 million worth of government securities from an investment dealer with a cheque drawn on the Bank of Canada. •The dealer deposits this cheque at Bank XYZ, a commercial bank. •The target reserve ratio for all commercial banks is 20%. •All commercial banks operate with no excess reserves. Suppose the public decides to hold 5% of their deposits in cash – that is, there is now a cash drain of 5%. As a result of the new deposit, the money supply would eventually (a) increase by $16.67 million (b) increase by $20 million

Economics: Private and Public Choice (MindTap Course List)

16th Edition

ISBN:9781305506725

Author:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Chapter13: Money And The Banking System

Section: Chapter Questions

Problem 8CQ

Related questions

Question

refer to the photo

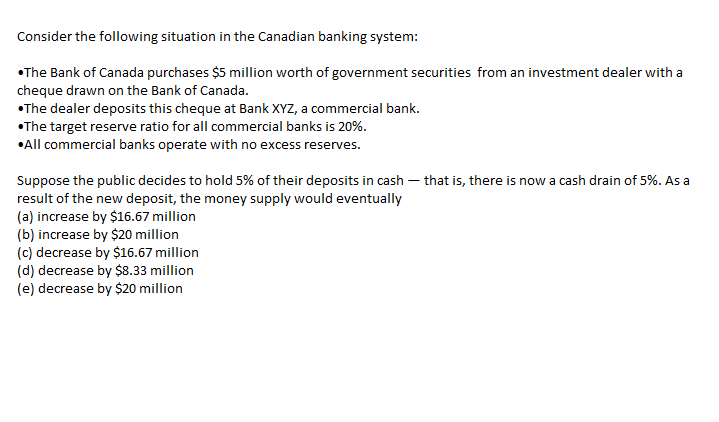

Transcribed Image Text:Consider the following situation in the Canadian banking system:

•The Bank of Canada purchases $5 million worth of government securities from an investment dealer with a

cheque drawn on the Bank of Canada.

•The dealer deposits this cheque at Bank XYZ, a commercial bank.

•The target reserve ratio for all commercial banks is 20%.

•All commercial banks operate with no excess reserves.

Suppose the public decides to hold 5% of their deposits in cash – that is, there is now a cash drain of 5%. As a

result of the new deposit, the money supply would eventually

(a) increase by $16.67 million

(b) increase by $20 million

(c) decrease by $16.67 million

(d) decrease by $8.33 million

(e) decrease by $20 million

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Economics: Private and Public Choice (MindTap Cou…

Economics

ISBN:

9781305506725

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning

Macroeconomics: Private and Public Choice (MindTa…

Economics

ISBN:

9781305506756

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning

Exploring Economics

Economics

ISBN:

9781544336329

Author:

Robert L. Sexton

Publisher:

SAGE Publications, Inc

Economics: Private and Public Choice (MindTap Cou…

Economics

ISBN:

9781305506725

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning

Macroeconomics: Private and Public Choice (MindTa…

Economics

ISBN:

9781305506756

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning

Exploring Economics

Economics

ISBN:

9781544336329

Author:

Robert L. Sexton

Publisher:

SAGE Publications, Inc

Economics (MindTap Course List)

Economics

ISBN:

9781337617383

Author:

Roger A. Arnold

Publisher:

Cengage Learning