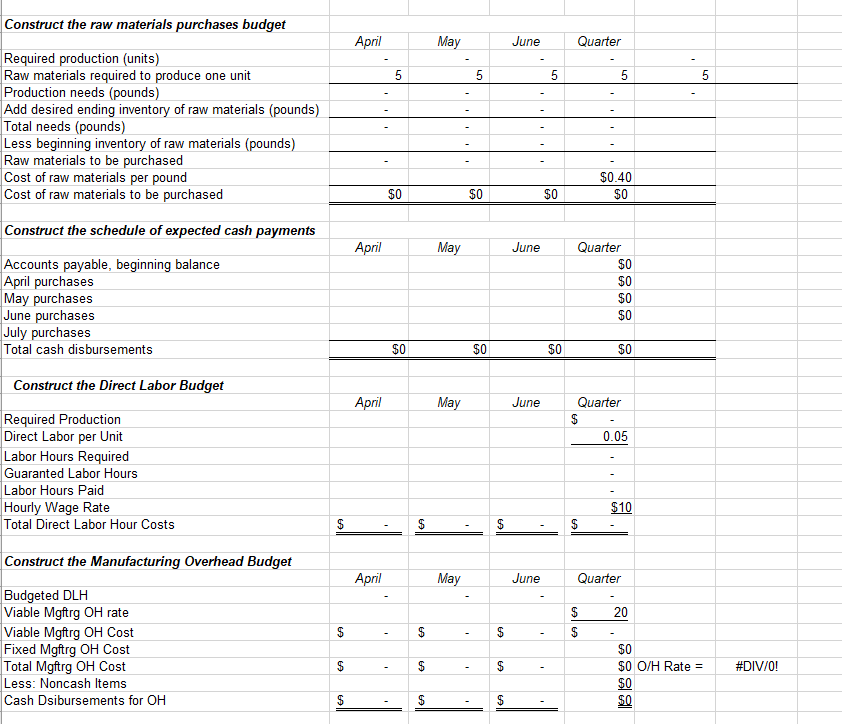

Construct the raw materials purchases budget Аpril May June Quarter Required production (units) Raw materials required to produce one unit Production needs (pounds) |Add desired ending inventory of raw materials (pounds) Total needs (pounds) Less beginning inventory of raw materials (pounds) Raw materials to be purchased Cost of raw materials per pound Cost of raw materials to be purchased 5 5 5 5 5 $0.40 $0 $0 $0 $0 Construct the schedule of expected cash payments April May June Quarter |Accounts payable, beginning balance |April purchases May purchases June purchases |July purchases $0 $0 $0 $0 Total cash disbursements $0 $0 $0 $0 Construct the Direct Labor Budget Аpril May June Quarter Required Production Direct Labor per Unit Labor Hours Required Guaranted Labor Hours Labor Hours Paid Hourly Wage Rate Total Direct Labor Hour Costs 0.05 $10 $ Construct the Manufacturing Overhead Budget Аpril May June Quarter Budgeted DLH Viable Mgftrg OH rate 20 Viable Mgftrg OH Cost Fixed Mgftrg OH Cost Total Mgftrg OH Cost Less: Noncash Items $0 #DIV/ 0! $0 O/H Rate = $0 $0 Cash Dsibursements for OH e tе tе Ending Finished Goods Invesntory Direct Materials Direct Labor #DIV / 0! 0.05 Overhead #DIV/0! Total Cost 4.99 Number of Good in Ending Inventory Ending Finished Goods Inventory Construct Selling & Administrative Budget May Аpril June Quarter Budget Sales Variable S&A Rate $0.50 Variable Expenses Fixed S& A Expenses Total S&A Expenses $0 Less: Non-cash Items Total Cash S&A Expenses Construct Final Cash Budget Аpril May June Quarter Beginning Cash Balances Add: Cash Collections $0 Total Cash Available Less Cash Disbursements Materials $0 Labor $0 Manu OH $0 S&A $0 Equioment Purchases Dividends $0 $0 Total $0 $0 Excess/(Deficiency) Financing: Borrowings Repayments Interest $0 $0 $ Total Financing Ending Cash Balance Prepare Income Statement Sales COGS Gross Margin $0 30 6е tе ее 30 не се е е tа

Construct the raw materials purchases budget Аpril May June Quarter Required production (units) Raw materials required to produce one unit Production needs (pounds) |Add desired ending inventory of raw materials (pounds) Total needs (pounds) Less beginning inventory of raw materials (pounds) Raw materials to be purchased Cost of raw materials per pound Cost of raw materials to be purchased 5 5 5 5 5 $0.40 $0 $0 $0 $0 Construct the schedule of expected cash payments April May June Quarter |Accounts payable, beginning balance |April purchases May purchases June purchases |July purchases $0 $0 $0 $0 Total cash disbursements $0 $0 $0 $0 Construct the Direct Labor Budget Аpril May June Quarter Required Production Direct Labor per Unit Labor Hours Required Guaranted Labor Hours Labor Hours Paid Hourly Wage Rate Total Direct Labor Hour Costs 0.05 $10 $ Construct the Manufacturing Overhead Budget Аpril May June Quarter Budgeted DLH Viable Mgftrg OH rate 20 Viable Mgftrg OH Cost Fixed Mgftrg OH Cost Total Mgftrg OH Cost Less: Noncash Items $0 #DIV/ 0! $0 O/H Rate = $0 $0 Cash Dsibursements for OH e tе tе Ending Finished Goods Invesntory Direct Materials Direct Labor #DIV / 0! 0.05 Overhead #DIV/0! Total Cost 4.99 Number of Good in Ending Inventory Ending Finished Goods Inventory Construct Selling & Administrative Budget May Аpril June Quarter Budget Sales Variable S&A Rate $0.50 Variable Expenses Fixed S& A Expenses Total S&A Expenses $0 Less: Non-cash Items Total Cash S&A Expenses Construct Final Cash Budget Аpril May June Quarter Beginning Cash Balances Add: Cash Collections $0 Total Cash Available Less Cash Disbursements Materials $0 Labor $0 Manu OH $0 S&A $0 Equioment Purchases Dividends $0 $0 Total $0 $0 Excess/(Deficiency) Financing: Borrowings Repayments Interest $0 $0 $ Total Financing Ending Cash Balance Prepare Income Statement Sales COGS Gross Margin $0 30 6е tе ее 30 не се е е tа

Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Don R. Hansen, Maryanne M. Mowen

Chapter8: Budgeting For Planning And Control

Section: Chapter Questions

Problem 3CE: Refer to Cornerstone Exercise 8.2 for the production budgets for practice balls and match balls....

Related questions

Question

Transcribed Image Text:Construct the raw materials purchases budget

Аpril

May

June

Quarter

Required production (units)

Raw materials required to produce one unit

Production needs (pounds)

|Add desired ending inventory of raw materials (pounds)

Total needs (pounds)

Less beginning inventory of raw materials (pounds)

Raw materials to be purchased

Cost of raw materials per pound

Cost of raw materials to be purchased

5

5

5

5

5

$0.40

$0

$0

$0

$0

Construct the schedule of expected cash payments

April

May

June

Quarter

|Accounts payable, beginning balance

|April purchases

May purchases

June purchases

|July purchases

$0

$0

$0

$0

Total cash disbursements

$0

$0

$0

$0

Construct the Direct Labor Budget

Аpril

May

June

Quarter

Required Production

Direct Labor per Unit

Labor Hours Required

Guaranted Labor Hours

Labor Hours Paid

Hourly Wage Rate

Total Direct Labor Hour Costs

0.05

$10

$

Construct the Manufacturing Overhead Budget

Аpril

May

June

Quarter

Budgeted DLH

Viable Mgftrg OH rate

20

Viable Mgftrg OH Cost

Fixed Mgftrg OH Cost

Total Mgftrg OH Cost

Less: Noncash Items

$0

#DIV/ 0!

$0 O/H Rate =

$0

$0

Cash Dsibursements for OH

e

tе

tе

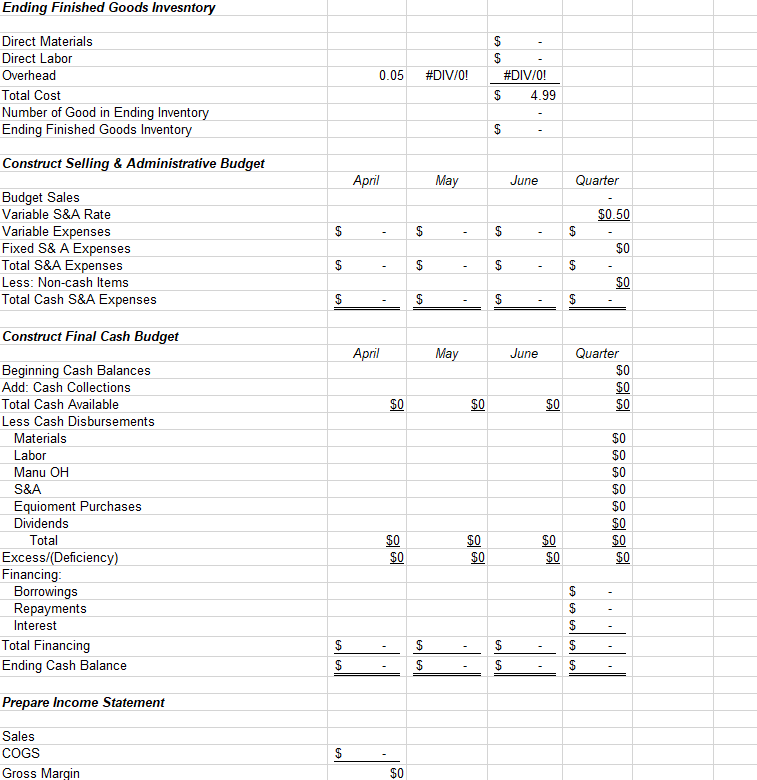

Transcribed Image Text:Ending Finished Goods Invesntory

Direct Materials

Direct Labor

#DIV / 0!

0.05

Overhead

#DIV/0!

Total Cost

4.99

Number of Good in Ending Inventory

Ending Finished Goods Inventory

Construct Selling & Administrative Budget

May

Аpril

June

Quarter

Budget Sales

Variable S&A Rate

$0.50

Variable Expenses

Fixed S& A Expenses

Total S&A Expenses

$0

Less: Non-cash Items

Total Cash S&A Expenses

Construct Final Cash Budget

Аpril

May

June

Quarter

Beginning Cash Balances

Add: Cash Collections

$0

Total Cash Available

Less Cash Disbursements

Materials

$0

Labor

$0

Manu OH

$0

S&A

$0

Equioment Purchases

Dividends

$0

$0

Total

$0

$0

Excess/(Deficiency)

Financing:

Borrowings

Repayments

Interest

$0

$0

$

Total Financing

Ending Cash Balance

Prepare Income Statement

Sales

COGS

Gross Margin

$0

30

6е

tе

ее

30

не

се

е

е

tа

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 5 steps with 4 images

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning