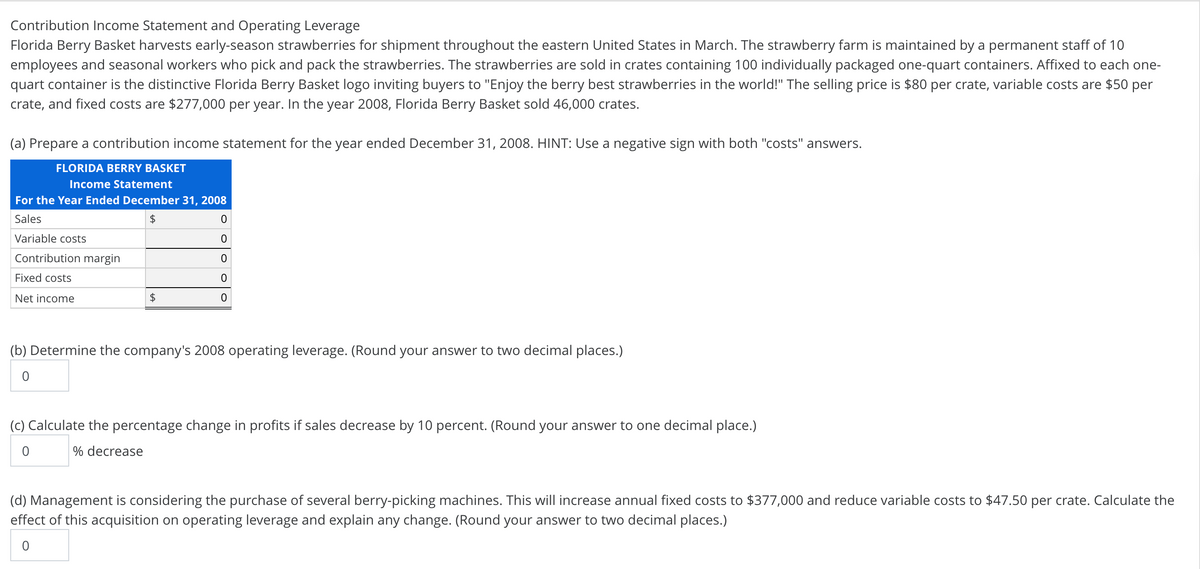

Contribution Income Statement and Operating Leverage Florida Berry Basket harvests early-season strawberries for shipment throughout the eastern United States in March. The strawberry farm is maintained by a permanent staff of 10 employees and seasonal workers who pick and pack the strawberries. The strawberries are sold in crates containing 100 individually packaged one-quart containers. Affixed to each one- quart container is the distinctive Florida Berry Basket logo inviting buyers to "Enjoy the berry best strawberries in the world!" The selling price is $80 per crate, variable costs are $50 per crate, and fixed costs are $277,000 per year. In the year 2008, Florida Berry Basket sold 46,000 crates. (a) Prepare a contribution income statement for the year ended December 31, 2008. HINT: Use a negative sign with both "costs" answers. FLORIDA BERRY BASKET Income Statement For the Year Ended December 31, 2008 Sales Variable costs Contribution margin Fixed costs Net income $4 (b) Determine the company's 2008 operating leverage. (Round your answer to two decimal places.) (c) Calculate the percentage change in profits if sales decrease by 10 percent. (Round your answer to one decimal place.) % decrease (d) Management is considering the purchase of several berry-picking machines. This will increase annual fixed costs to $377,000 and reduce variable costs to $47.50 per crate. Calculate the effect of this acquisition on operating leverage and explain any change. (Round your answer to two decimal places.)

Contribution Income Statement and Operating Leverage Florida Berry Basket harvests early-season strawberries for shipment throughout the eastern United States in March. The strawberry farm is maintained by a permanent staff of 10 employees and seasonal workers who pick and pack the strawberries. The strawberries are sold in crates containing 100 individually packaged one-quart containers. Affixed to each one- quart container is the distinctive Florida Berry Basket logo inviting buyers to "Enjoy the berry best strawberries in the world!" The selling price is $80 per crate, variable costs are $50 per crate, and fixed costs are $277,000 per year. In the year 2008, Florida Berry Basket sold 46,000 crates. (a) Prepare a contribution income statement for the year ended December 31, 2008. HINT: Use a negative sign with both "costs" answers. FLORIDA BERRY BASKET Income Statement For the Year Ended December 31, 2008 Sales Variable costs Contribution margin Fixed costs Net income $4 (b) Determine the company's 2008 operating leverage. (Round your answer to two decimal places.) (c) Calculate the percentage change in profits if sales decrease by 10 percent. (Round your answer to one decimal place.) % decrease (d) Management is considering the purchase of several berry-picking machines. This will increase annual fixed costs to $377,000 and reduce variable costs to $47.50 per crate. Calculate the effect of this acquisition on operating leverage and explain any change. (Round your answer to two decimal places.)

Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Chapter7: Cost-volume-profit Analysis

Section: Chapter Questions

Problem 59P: Cost-Volume-Profit, Margin of Safety Victoria Company produces a single product. Last years income...

Related questions

Concept explainers

Variance Analysis

In layman's terms, variance analysis is an analysis of a difference between planned and actual behavior. Variance analysis is mainly used by the companies to maintain a control over a business. After analyzing differences, companies find the reasons for the variance so that the necessary steps should be taken to correct that variance.

Standard Costing

The standard cost system is the expected cost per unit product manufactured and it helps in estimating the deviations and controlling them as well as fixing the selling price of the product. For example, it helps to plan the cost for the coming year on the various expenses.

Topic Video

Question

Transcribed Image Text:Contribution Income Statement and Operating Leverage

Florida Berry Basket harvests early-season strawberries for shipment throughout the eastern United States in March. The strawberry farm is maintained by a permanent staff of 10

employees and seasonal workers who pick and pack the strawberries. The strawberries are sold in crates containing 100 individually packaged one-quart containers. Affixed to each one-

quart container is the distinctive Florida Berry Basket logo inviting buyers to "Enjoy the berry best strawberries in the world!" The selling price is $80 per crate, variable costs are $50 per

crate, and fixed costs are $277,000 per year. In the year 2008, Florida Berry Basket sold 46,000 crates.

(a) Prepare a contribution income statement for the year ended December 31, 2008. HINT: Use a negative sign with both "costs" answers.

FLORIDA BERRY BASKET

Income Statement

For the Year Ended December 31, 2008

Sales

2$

Variable costs

Contribution margin

Fixed costs

Net income

$

(b) Determine the company's 2008 operating leverage. (Round your answer to two decimal places.)

(c) Calculate the percentage change in profits if sales decrease by 10 percent. (Round your answer to one decimal place.)

% decrease

(d) Management is considering the purchase of several berry-picking machines. This will increase annual fixed costs to $377,000 and reduce variable costs to $47.50 per crate. Calculate the

effect of this acquisition on operating leverage and explain any change. (Round your answer to two decimal places.)

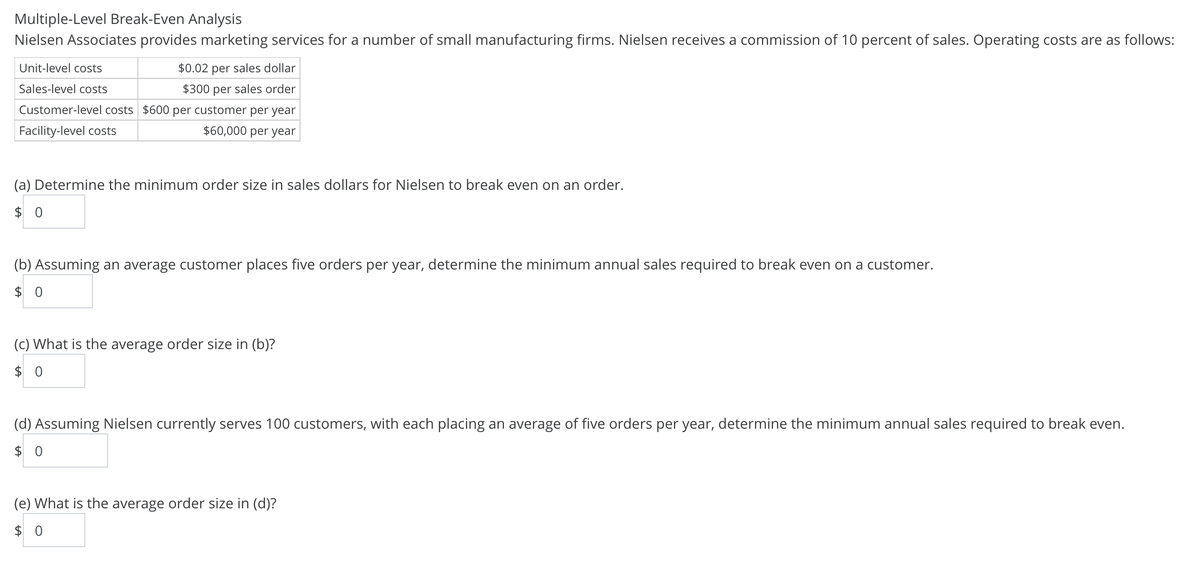

Transcribed Image Text:Multiple-Level Break-Even Analysis

Nielsen Associates provides marketing services for a number of small manufacturing firms. Nielsen receives a commission of 10 percent of sales. Operating costs are as follows:

Unit-level costs

$0.02 per sales dollar

Sales-level costs

$300 per sales order

Customer-level costs $600 per customer per year

Facility-level costs

$60,000 per year

(a) Determine the minimum order size in sales dollars for Nielsen to break even on an order.

$ 0

(b) Assuming an average customer places five orders per year, determine the minimum annual sales required to break even on a customer.

$ 0

(c) What is the average order size in (b)?

$ 0

(d) Assuming Nielsen currently serves 100 customers, with each placing an average of five orders per year, determine the minimum annual sales required to break even.

$ 0

(e) What is the average order size in (d)?

$ 0

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning