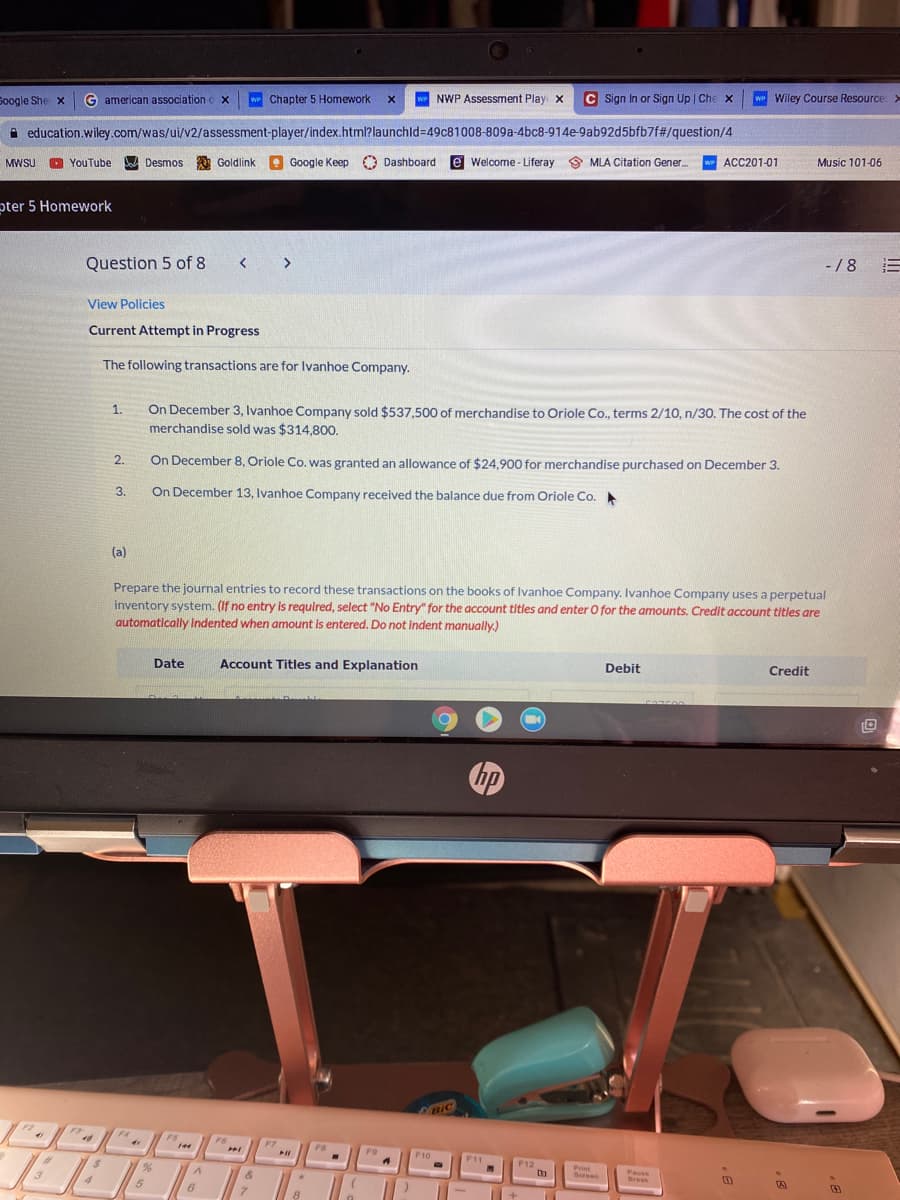

Current Attempt in Progress The following transactions are for Ivanhoe Company. On December 3, Ivanhoe Company sold $537,500 of merchandise to Oriole Co., terms 2/10, n/30. The cost of the merchandise sold was $314,800. 1. 2. On December 8, Oriole Co. was granted an allowance of $24,900 for merchandise purchased on December 3. 3. On December 13, Ivanhoe Company received the balance due from Oriole Co. (a) Prepare the journal entries to record these transactions on the books of Ivanhoe Company. Ivanhoe Company uses a perpetual inventory system. (If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. Credit account titles are automatically Indented when amount is entered. Do not indent manually.)

Current Attempt in Progress The following transactions are for Ivanhoe Company. On December 3, Ivanhoe Company sold $537,500 of merchandise to Oriole Co., terms 2/10, n/30. The cost of the merchandise sold was $314,800. 1. 2. On December 8, Oriole Co. was granted an allowance of $24,900 for merchandise purchased on December 3. 3. On December 13, Ivanhoe Company received the balance due from Oriole Co. (a) Prepare the journal entries to record these transactions on the books of Ivanhoe Company. Ivanhoe Company uses a perpetual inventory system. (If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. Credit account titles are automatically Indented when amount is entered. Do not indent manually.)

SWFT Essntl Tax Individ/Bus Entities 2020

23rd Edition

ISBN:9780357391266

Author:Nellen

Publisher:Nellen

Chapter2: Working With The Tax Law

Section: Chapter Questions

Problem 3RP

Related questions

Question

Transcribed Image Text:Soogle She x

G american association

w Chapter 5 Homework

we NWP Assessment Play x

C Sign In or Sign Up | Che x

we Wiley Course Resource:>

A education.wiley.com/was/ui/v2/assessment-player/index.html?launchld349c81008-809a-4bc8-914e-9ab92d5bfb7f#/question/4

MWSU

YouTube

Desmos Goldlink

e

Google Keep O Dashboard

e Welcome - Liferay 9 MLA Citation Gener.

w ACC201-01

Music 101-06

pter 5 Homework

Question 5 of 8

- /8

View Policies

Current Attempt in Progress

The following transactions are for Ivanhoe Company.

On December 3, Ivanhoe Company sold $537,500 of merchandise to Oriole Co., terms 2/10, n/30. The cost of the

merchandise sold was $314,800.

1.

2.

On December 8, Oriole Co. was granted an allowance of $24,900 for merchandise purchased on December 3.

3.

On December 13, Ivanhoe Company received the balance due from Oriole Co.

(a)

Prepare the journal entries to record these transactions on the books of Ivanhoe Company. Ivanhoe Company uses a perpetual

inventory system. (If no entry is required, select "No Entry" for the account titles and enter O for the amounts. Credit account titles are

automatically Indented when amount is entered. Do not indent manually.)

Date

Account Titles and Explanation

Debit

Credit

hp

BIC

F2

FF

F4

FS

F6

144

FT

FB

F9

F10

%23

F11

F12

3

Print

Sereen

Pause

Break

6.

.

Transcribed Image Text:2- Google She x

G american association c x

w Chapter 5 Homework

NWP Assessment Play x

C Sign in or Sign Up | Che x

Wiley Course Resource x +

i education.wiley.com/was/ui/v2/assessment-player/index.html?launchld=49c81008-809a-4bc8-914e-9ab92d5bfb7f#/question/4

A MWSU

O YouTube

Desmos Goldlink e Google Keep O Dashboard

e Welcome - Liferay 9 MLA Citation Gener.

ACC201-01

Music 101-06

hapter 5 Homework

Question 5 of 8

-/8 E

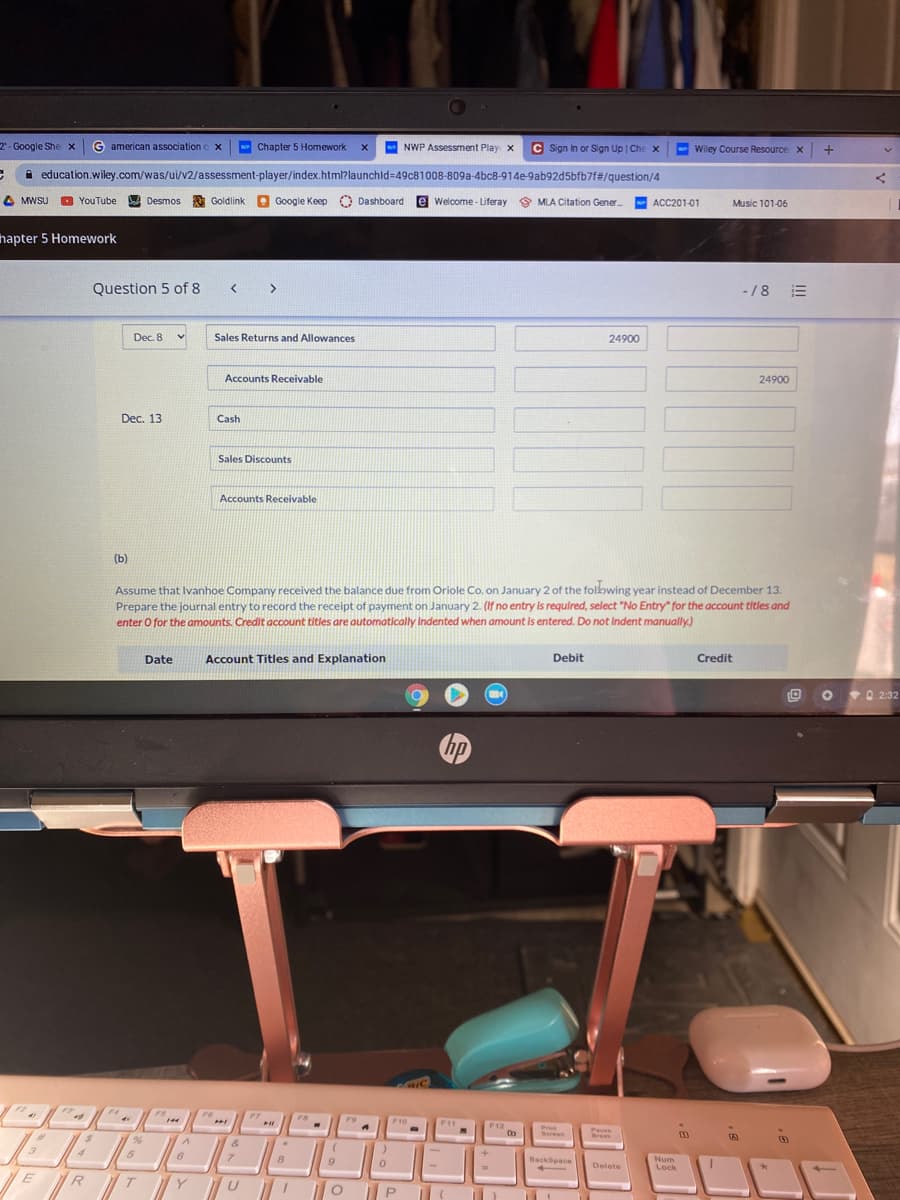

Dec. 8

Sales Returns and Allowances

24900

Accounts Receivable

24900

Dec. 13

Cash

Sales Discounts

Accounts Receivable

(b)

Assume that Ivanhoe Company received the balance due from Oriole Co. on January 2 of the folbwing year instead of December 13.

Prepare the journal entry to record the receipt of payment on January 2. (If no entry is required, select "No Entry" for the account titles and

enter O for the amounts. Credit account titles are automatically indented when amount is entered. Do not indent manually.)

Date

Account Titles and Explanation

Debit

Credit

•O 2:32

hp

F3

F4

F6

F7

F10

F11

F12

Print

Sereen

Pause

Break

3

5

6.

BackSpace

Num

Lock

Delete

TY U ' |O P

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you