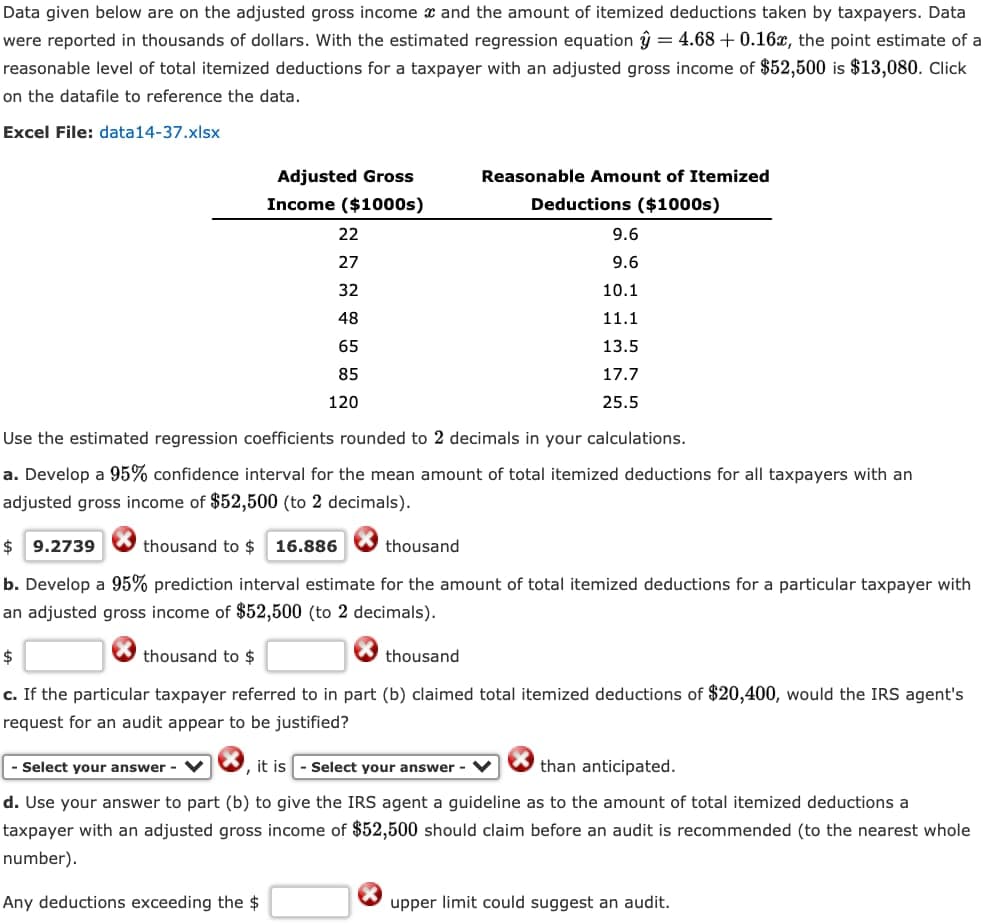

Data given below are on the adjusted gross income and the amount of itemized deductions taken by taxpayers. Data were reported in thousands of dollars. With the estimated regression equation ŷ = 4.68 +0.16x, the point estimate of a reasonable level of total itemized deductions for a taxpayer with an adjusted gross income of $52,500 is $13,080. Click on the datafile to reference the data. Excel File: data14-37.xlsx Adjusted Gross Income ($1000s) 22 N 27 Reasonable Amount of Itemized Deductions ($1000s) 9.6 9.6

Data given below are on the adjusted gross income and the amount of itemized deductions taken by taxpayers. Data were reported in thousands of dollars. With the estimated regression equation ŷ = 4.68 +0.16x, the point estimate of a reasonable level of total itemized deductions for a taxpayer with an adjusted gross income of $52,500 is $13,080. Click on the datafile to reference the data. Excel File: data14-37.xlsx Adjusted Gross Income ($1000s) 22 N 27 Reasonable Amount of Itemized Deductions ($1000s) 9.6 9.6

Functions and Change: A Modeling Approach to College Algebra (MindTap Course List)

6th Edition

ISBN:9781337111348

Author:Bruce Crauder, Benny Evans, Alan Noell

Publisher:Bruce Crauder, Benny Evans, Alan Noell

Chapter3: Straight Lines And Linear Functions

Section3.CR: Chapter Review Exercises

Problem 15CR: Life Expectancy The following table shows the average life expectancy, in years, of a child born in...

Related questions

Question

Transcribed Image Text:Data given below are on the adjusted gross income and the amount of itemized deductions taken by taxpayers. Data

were reported in thousands of dollars. With the estimated regression equation = 4.68 +0.16x, the point estimate of a

reasonable level of total itemized deductions for a taxpayer with an adjusted gross income of $52,500 is $13,080. Click

on the datafile to reference the data.

Excel File: data14-37.xlsx

Adjusted Gross

Income ($1000s)

22

27

32

48

65

85

120

Reasonable Amount of Itemized

Deductions ($1000s)

Use the estimated regression coefficients rounded to 2 decimals in your calculations.

a. Develop a 95% confidence interval for the mean amount of total itemized deductions for all taxpayers with an

adjusted gross income of $52,500 (to 2 decimals).

Any deductions exceeding the $

9.6

9.6

10.1

11.1

13.5

17.7

25.5

$9.2739

thousand to $ 16.886

thousand

b. Develop a 95% prediction interval estimate for the amount of total itemized deductions for a particular taxpayer with

an adjusted gross income of $52,500 (to 2 decimals).

thousand

$

thousand to $

c. If the particular taxpayer referred to in part (b) claimed total itemized deductions of $20,400, would the IRS agent's

request for an audit appear to be justified?

Select your answer - V

it is Select your answer -

than anticipated.

d. Use your answer to part (b) to give the IRS agent a guideline as to the amount of total itemized deductions a

taxpayer with an adjusted gross income of $52,500 should claim before an audit is recommended (to the nearest whole

number).

upper limit could suggest an audit.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Recommended textbooks for you

Functions and Change: A Modeling Approach to Coll…

Algebra

ISBN:

9781337111348

Author:

Bruce Crauder, Benny Evans, Alan Noell

Publisher:

Cengage Learning

Algebra and Trigonometry (MindTap Course List)

Algebra

ISBN:

9781305071742

Author:

James Stewart, Lothar Redlin, Saleem Watson

Publisher:

Cengage Learning

Glencoe Algebra 1, Student Edition, 9780079039897…

Algebra

ISBN:

9780079039897

Author:

Carter

Publisher:

McGraw Hill

Functions and Change: A Modeling Approach to Coll…

Algebra

ISBN:

9781337111348

Author:

Bruce Crauder, Benny Evans, Alan Noell

Publisher:

Cengage Learning

Algebra and Trigonometry (MindTap Course List)

Algebra

ISBN:

9781305071742

Author:

James Stewart, Lothar Redlin, Saleem Watson

Publisher:

Cengage Learning

Glencoe Algebra 1, Student Edition, 9780079039897…

Algebra

ISBN:

9780079039897

Author:

Carter

Publisher:

McGraw Hill

Algebra & Trigonometry with Analytic Geometry

Algebra

ISBN:

9781133382119

Author:

Swokowski

Publisher:

Cengage

Trigonometry (MindTap Course List)

Trigonometry

ISBN:

9781305652224

Author:

Charles P. McKeague, Mark D. Turner

Publisher:

Cengage Learning