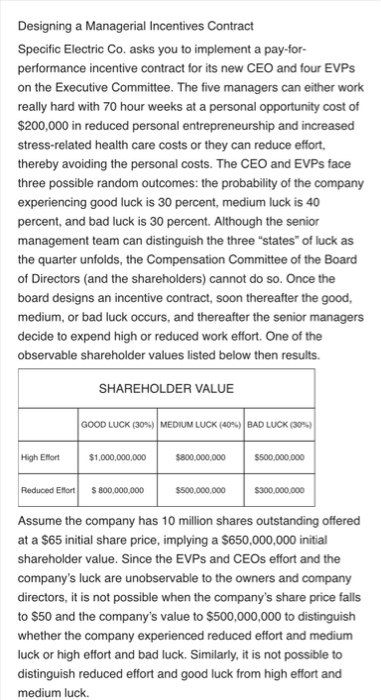

Designing a Managerial Incentives Contract Specific Electric Co. asks you to implement a pay-for- performance incentive contract for its new CEO and four EVPS on the Executive Committee. The five managers can either work really hard with 70 hour weeks at a personal opportunity cost of $200,000 in reduced personal entrepreneurship and increased stress-related health care costs or they can reduce effort, thereby avoiding the personal costs. The CEO and EVPS face three possible random outcomes: the probability of the company experiencing good luck is 30 percent, medium luck is 40 percent, and bad luck is 30 percent. Although the senior management team can distinguish the three "states" of luck as the quarter unfolds, the Compensation Committee of the Board of Directors (and the shareholders) cannot do so. Once the board designs an incentive contract, soon thereafter the good, medium, or bad luck occurs, and thereafter the senior managers decide to expend high or reduced work effort. One of the observable shareholder values listed below then results. SHAREHOLDER VALUE GOOD LUCK (30%) MEDIUM LUCK (40%) BAD LUCK (30 High Effort $1,000,000.000 se00.000.000 S500.000.000 Reduced Efort s800.000.000 S500.000.000 s30.000.000 Assume the company has 10 million shares outstanding offered at a $65 initial share price, implying a $650,000,000 initial

Designing a Managerial Incentives Contract Specific Electric Co. asks you to implement a pay-for- performance incentive contract for its new CEO and four EVPS on the Executive Committee. The five managers can either work really hard with 70 hour weeks at a personal opportunity cost of $200,000 in reduced personal entrepreneurship and increased stress-related health care costs or they can reduce effort, thereby avoiding the personal costs. The CEO and EVPS face three possible random outcomes: the probability of the company experiencing good luck is 30 percent, medium luck is 40 percent, and bad luck is 30 percent. Although the senior management team can distinguish the three "states" of luck as the quarter unfolds, the Compensation Committee of the Board of Directors (and the shareholders) cannot do so. Once the board designs an incentive contract, soon thereafter the good, medium, or bad luck occurs, and thereafter the senior managers decide to expend high or reduced work effort. One of the observable shareholder values listed below then results. SHAREHOLDER VALUE GOOD LUCK (30%) MEDIUM LUCK (40%) BAD LUCK (30 High Effort $1,000,000.000 se00.000.000 S500.000.000 Reduced Efort s800.000.000 S500.000.000 s30.000.000 Assume the company has 10 million shares outstanding offered at a $65 initial share price, implying a $650,000,000 initial

Chapter12: Balanced Scorecard And Other Performance Measures

Section: Chapter Questions

Problem 2PA: Florentino Allers is the production manager of Electronics Manufacturer. Due to limited capacity,...

Related questions

Question

Design an incentive plan that seeks to elicit high effort by granting restricted stock. Show that one-half million shares granted at $70 improves shareholder value relative to all prior alternatives.

Transcribed Image Text:Designing a Managerial Incentives Contract

Specific Electric Co. asks you to implement a pay-for-

performance incentive contract for its new CEO and four EVPS

on the Executive Committee. The five managers can either work

really hard with 70 hour weeks at a personal opportunity cost of

$200,000 in reduced personal entrepreneurship and increased

stress-related health care costs or they can reduce effort,

thereby avoiding the personal costs. The CEO and EVPS face

three possible random outcomes: the probability of the company

experiencing good luck is 30 percent, medium luck is 40

percent, and bad luck is 30 percent. Although the senior

management team can distinguish the three "states" of luck as

the quarter unfolds, the Compensation Committee of the Board

of Directors (and the shareholders) cannot do so. Once the

board designs an incentive contract, soon thereafter the good,

medium, or bad luck occurs, and thereafter the senior managers

decide to expend high or reduced work effort. One of the

observable shareholder values listed below then results.

SHAREHOLDER VALUE

GOOD LUCK (30%) MEDIUM LUCK (40%) BAD LUCK (30

High Effort

$1,000,000.000

se00.000.000

S500.000.000

Reduced Efort s800.000.000

S500.000.000

s30.000.000

Assume the company has 10 million shares outstanding offered

at a $65 initial share price, implying a $650,000,000 initial

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Essentials Of Business Analytics

Statistics

ISBN:

9781285187273

Author:

Camm, Jeff.

Publisher:

Cengage Learning,

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Essentials Of Business Analytics

Statistics

ISBN:

9781285187273

Author:

Camm, Jeff.

Publisher:

Cengage Learning,

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning