Detailed explanation and steps

Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Don R. Hansen, Maryanne M. Mowen

Chapter12: Activity-based Management

Section: Chapter Questions

Problem 1CE: Cicleta Manufacturing has four activities: receiving materials, assembly, expediting products, and...

Related questions

Question

Detailed explanation and steps

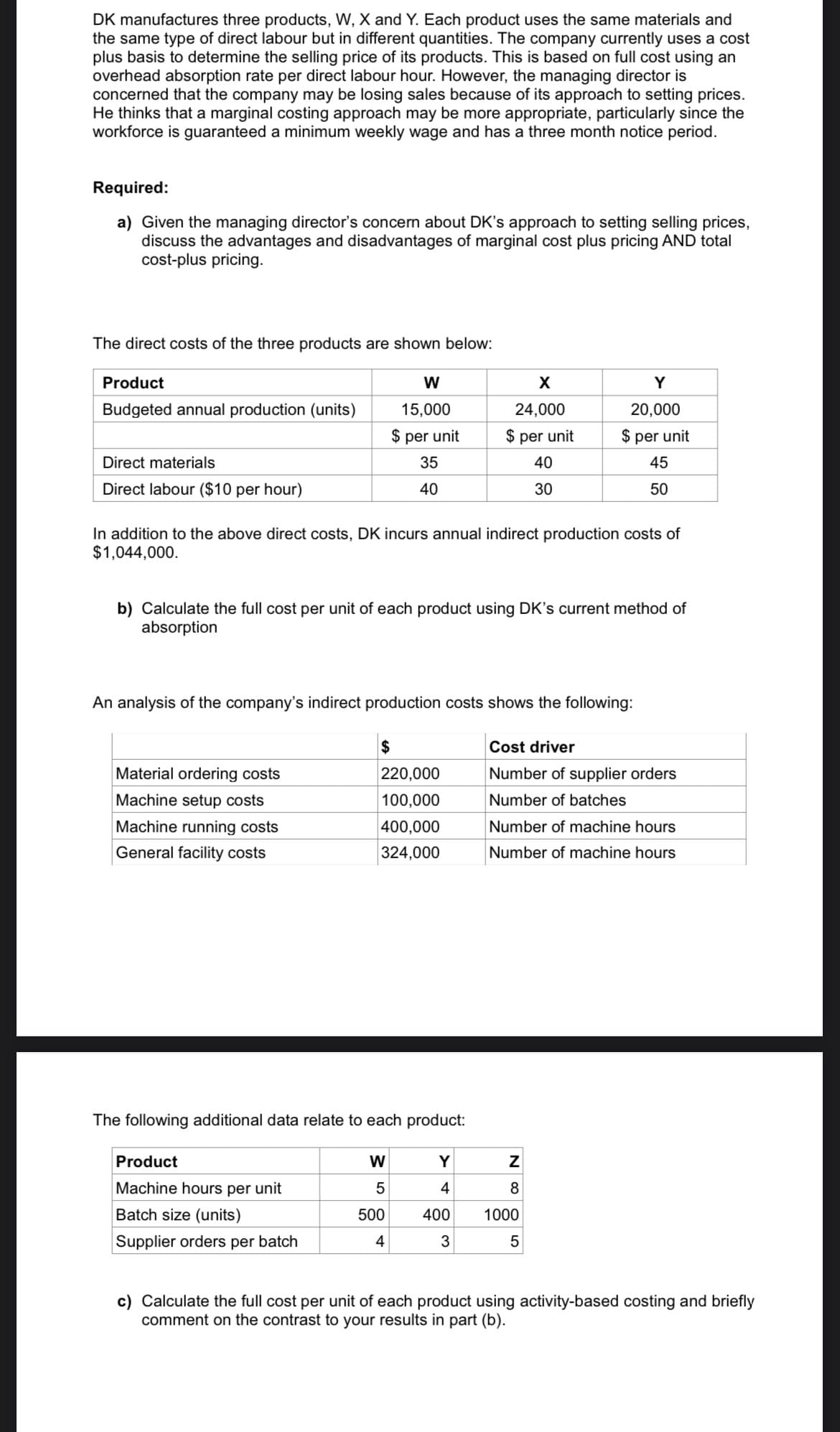

Transcribed Image Text:DK manufactures three products, W, X and Y. Each product uses the same materials and

the same type of direct labour but in different quantities. The company currently uses a cost

plus basis to determine the selling price of its products. This is based on full cost using an

overhead absorption rate per direct labour hour. However, the managing director is

concerned that the company may be losing sales because of its approach to setting prices.

He thinks that a marginal costing approach may be more appropriate, particularly since the

workforce is guaranteed a minimum weekly wage and has a three month notice period.

Required:

a) Given the managing director's concern about DK's approach to setting selling prices,

discuss the advantages and disadvantages of marginal cost plus pricing AND total

cost-plus pricing.

The direct costs of the three products are shown below:

Product

Y

Budgeted annual production (units)

15,000

24,000

20,000

$ per unit

$ per unit

$ per unit

Direct materials

35

40

45

Direct labour ($10 per hour)

40

30

50

In addition to the above direct costs, DK incurs annual indirect production costs of

$1,044,000.

b) Calculate the full cost per unit of each product using DK's current method of

absorption

An analysis of the company's indirect production costs shows the following:

$

Cost driver

Material ordering costs

220,000

Number of supplier orders

Machine setup costs

100,000

Number of batches

Machine running costs

400,000

Number of machine hours

General facility costs

324,000

Number of machine hours

The following additional data relate to each product:

Product

W

Y

Machine hours per unit

4

8

Batch size (units)

500

400

1000

Supplier orders per batch

4

3

c) Calculate the full cost per unit of each product using activity-based costing and briefly

comment on the contrast

your results in part (b).

N 00

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Essentials of Business Analytics (MindTap Course …

Statistics

ISBN:

9781305627734

Author:

Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:

Cengage Learning