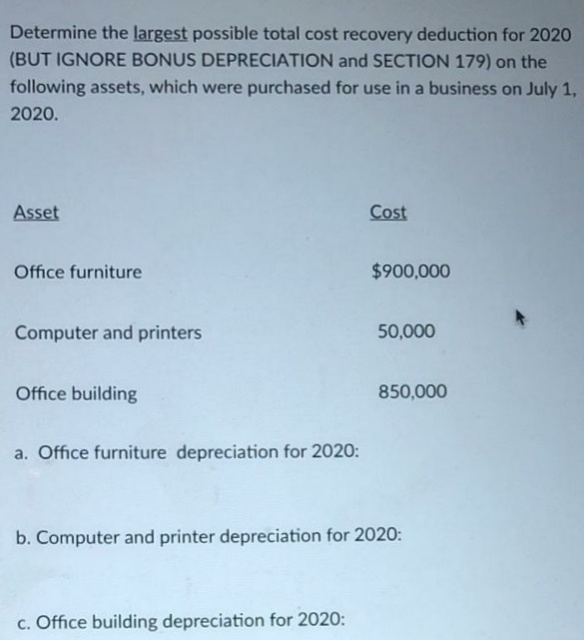

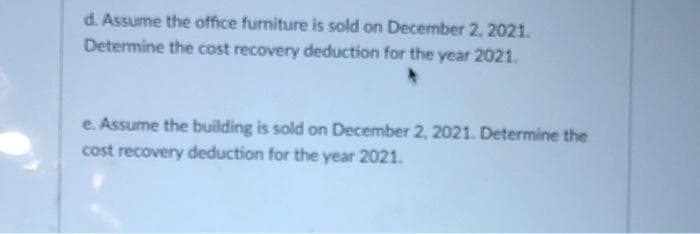

Determine the largest possible total cost recovery deduction for 2020 (BUT IGNORE BONUS DEPRECIATION and SECTION 179) on the following assets, which were purchased for use in a business on July 1, 2020.

Q: Blossom Co. at the end of 2020, its first year of operations, prepared a reconciliation between…

A: Solution Given Pretax financial income =$3550000 Estimated litigation expense…

Q: An asset (not an automobile) put in service in June 2019 has a depreciable basis of $535,000 and a…

A: Depreciable basis on how much value of asset depreciation is to be charged and MACRS is Modified…

Q: At the beginning of the year 2019. Itlog Company has an investment property acquired at a cost of $…

A: At beginning of year 2019, Itlog company acquired property at cost = $2000000 Useful life of…

Q: An asset (not an automobile) put in service in June 2020 has a depreciable basis of $1,055,000, a…

A: but subject to the amount of taxable income

Q: Chaz Corporation has taxable income in 2020 of $368,000 for purposes of computing the §179 expense…

A: Taxable Income:- When an individual earns income from the resources available, then it has to pay…

Q: On 30 April 2020, Business Taxpayer sold an office building it had placed in service on 1 August…

A: Depreciation - It is method of accounting to allocate cost of assets over a useful life of assets.

Q: A Company has used the cost-to-cost percentage-of-completion (Over time) method of recognizing…

A: Solution: Total estimated gross profit by the end of 2019 = Gross profit for 2018 + Gross profit for…

Q: Bonus depreciation in 2019 generally permits taxpayers to deduct 100% of the cost of the asset in…

A: Tax Cuts and Jobs Act (TCJA 2017) have decreased the corporate income tax. TCJA is a Congressional…

Q: In 2020, Sandstorm Corporation incurs $25,000 in research and experimental expenses. Benefits from…

A: 174 - Research and experimental expenditures (a)Treatment as expenses A taxpayer may treat…

Q: a. Determine Orange's cost recovery for 2020. The office furniture is classified as seven-year dass…

A: a. O uses an additional first year, depreciation for office furniture. Hence, he can deduct entire…

Q: Sunland Co. at the end of 2020, its first year of operations, prepared a reconciliation between…

A: Income taxes payable = Taxable income * Income tax rate

Q: What is the maximum CCA (depreciation expenses) applicable when the immovable value (CC) is $500,000…

A: Depreciation is an expense for the company that represents the reduction in the value of an asset…

Q: LOSLOS Company has estimated that total depreciation expense for the year ending December 31, 2021…

A: Total expenses for the year ended December 31, 2021 = total depreciation expense for the year +…

Q: At December 31, 2020 Company B had one temporary difference (related to depreciation) that resulted…

A: Tax is the amount which an individual is liable to pay the government for business operation within…

Q: On May 15, 2020, an asset with a depreciable basis of $40,000 is put into service. The half-year…

A: Accounting: It is the process of recording any financial transactions incurred in the financial year…

Q: Assume that TDW Corporation (calendar-year-end) has 2020 taxable income of $692,000 for purposes of…

A: Particulars Amount Total of Qualified Assets under Section 179 $3,434,000 Less: Threshold for…

Q: Nathan Construction Inc. has consistently used the percentage-of-completion method of recognizing…

A: Revenue is recognized on the basis of percentage of work completed. Percentage of work completed is…

Q: Suppose that a company purchases a computer to be used in the manufacturing department at the…

A: Depreciation under accelerated depreciation method for 2019: Depreciation…

Q: In 2020, LRRR Corp., a calendar year corporation, acquired and placed in service the assets listed…

A: “Since you have posted a question with multiple sub-parts, we will solve the first three sub-parts…

Q: How much is the maximum cost recovery deduction for 2019? Assuming they claimed the maximum in 2020,…

A: “Since you have posted many questions, we will solve first for you. To get the remaining questions…

Q: furnit r equi

A: Introduction Depreciation expense can be defined as a non-cash expenditure which represents the…

Q: Headland Construction Company began work on a $417,500 construction contract in 2020. During 2020,…

A: Under construction process, the revenue or loss can be calculated on the basis of percentage of work…

Q: Assume that by December 31, 2020, the segment had not yet been sold but was considered held for…

A: Operations that do not remain as a part of the business in the future.

Q: In addition, determine the January 1, 2021 UCC balanc

A: Step 1 Deposition of assets over the opening UCC balance leads to increase or decrease in net…

Q: In March 2020, Jones Company purchased a Mercedes for use in its business at a cost of $73,000.…

A: Introduction:- In March 2020, Jones Company purchased a Mercedes for use in its business at a cost…

Q: How much is the maximum cost recovery deduction for 2019? Assuming they claimed the maximum in 2020,…

A: “Since you have posted a question with multiple sub parts, we will solve first 3 sub parts for you.…

Q: a. Compute the maximum depreciation deduction that Redwood can take in 2021 and igen 2022 on each of…

A: Item Cost Year of acquisition Year of Property Sec 179 deduction (half) Balance Depreciation rate…

Q: Calculate depreciation expense using the activity-based method for 2021 and 2022, assuming a…

A: Year Depreciation expenses 2021 $4,280 2022 $5,840

Q: At the beginning of 2020, Best Inc. has two assets in Class 10. The cost of each asset was $72,000…

A: Step 1 Deposition of assets over the opening UCC balance leads to increase or decrease in net…

Q: At the beginning of the year 2019, Trunk Company has an investment property acquired at a cost of…

A: “Since you have asked multiple questions, we will solve the first question for you. If you want any…

Q: On June 1, 2020, Irene plačes in is used 70% for business and 30% for personal use. (Assume this…

A: Step 1 Cost recovery refers to the deduction of a portion of the cost of an asset, used in a…

Q: Arlington LLC purchased an automobile for $76,000 on July 5, 2021. What is Arlington's depreciation…

A: Depreciation is non-cash expense which writes down the value of asset. It is calculated based on…

Q: Vilma Company has estimated that total depreciation expense for the year ended December 31, 2020…

A: Interim reporting means to report the data in the financial statements for a period which is shorter…

Q: Oriole Co. at the end of 2020, its first year of operations, prepared a reconciliation between…

A: Deferred tax asset can be defined as a balance sheet item which shows the tax expenses that are…

Q: On January 1, 2020, equipment costing $582,800 is purchased. For financial reporting purposes, the…

A: Compute the income tax expense: Amount due per tax return $132,100 Tax rate 20% Income…

Q: On May 1, 2020, Goodman Company began construction of a building. Expenditures of $600,000 were…

A: Fixed Assets: It refers to the long-term assets having a useful life of more than a year which is,…

Q: he income tax rate is 30% for all years. Income tax payable is?

A: Income Tax is a form of indirect tax. It is the tax payable on the amount of income earned during a…

Q: Sheridan Co. at the end of 2020, its first year of operations, prepared a reconciliation between…

A: Income taxes payable = taxable income * tax rate

Q: Blossom Construction Company uses the percentage-of-completion method of accounting. In 2021,…

A: Gross Profit = Revenue - Cost incurred Cost incurred is given = $22000000 Now only Revenue needs…

Q: percentage-of-completion method

A: Under percentage of completion method is a revenue recognition method under which revenues and…

Q: On March 10, 2020, Night Corporation purchased $2,400,000 of machinery and equipment (7-year…

A: Given that, Night corporation purchased on March 10, 2020 7-year Machine and Equipment = $2400000…

Q: PRANCER Company, at the end of 2021, its first year of operations, prepared a reconciliation between…

A: Total tax = Taxable amount x income tax rate = 250000 x 30% = 75,000

Q: At the beginning of the year 2019, Trunk Company has an investment property acquired at a cost of…

A: Investment is the activity where the investors invest money with the intention of making a profit…

Q: Assume that Carla Vista Company will continue to use this copyright in the future. As of December…

A: Amortization expense is the write-off of an intangible asset over its anticipated useful life, which…

Q: 16,100 2022... 9,700

A: Depreciation refers to the cost or basic value of the fixed asset which is estimated over useful…

Q: ,470,000 Computer equipment February 10 455,000 Office building April 2 570,000 Total $…

A: Depreciation:- Depreciation referred as decreasing in the value of an asset on a regular basis until…

Q: At the beginning of the year 2019. Itlog Company has an investment property acquired at a cost of $…

A: At beginning of the year 2019, Itlog company acquired property at cost = $2000000 Useful life = 25…

Q: ABC Inc. began operations on July 1,2019. The company recognizes income from long term construction…

A: Solution Concept When the income recognized in financial statement is greater than the income as per…

Step by step

Solved in 2 steps

- Calculate the following: The first year of depreciation on a residential rental building costing $250,000 purchased June 2,2019. $_____________ The second year (2020) of depreciation on a computer costing $5,000 purchased in May 2019, using the half-year convention and accelerated depreciation considering any bonus depreciation taken. $______________ The first year of depreciation on a computer costing $2,800 purchased in May 2019, using the half-year convention and straight-line depreciation with no bonus depreciation. $______________ The third year of depreciation on business furniture costing $10,000 purchased in March 2017, using the half-year convention and accelerated depreciation but no bonus depreciation. $______________Refer to the information for Cox Inc. above. What amount would Cox record as depreciation expense for 2019 if the units-of-production method were used ( Note: Round your answer to the nearest dollar)? a. $179,400 b. $184,000 c. $218,400 d. $224,000Gray Companys financial statements showed income before income taxes of 4,030,000 for the year ended December 31, 2020, and 3,330,000 for the year ended December 31, 2019. Additional information is as follows: Capital expenditures were 2,800,000 in 2020 and 4,000,000 in 2019. Included in the 2020 capital expenditures is equipment purchased for 1,000,000 on January 1, 2020, with no salvage value. Gray used straight-line depreciation based on a 10-year estimated life in its financial statements. As a result of additional information now available, it is estimated that this equipment should have only an 8-year life. Gray made an error in its financial statements that should be regarded as material. A payment of 180,000 was made in January 2020 and charged to expense in 2020 for insurance premiums applicable to policies commencing and expiring in 2019. No liability had been recorded for this item at December 31, 2019. The allowance for doubtful accounts reflected in Grays financial statements was 7,000 at December 31, 2020, and 97,000 at December 31, 2019. During 2020, 90,000 of uncollectible receivables were written off against the allowance for doubtful accounts. In 2019, the provision for doubtful accounts was based on a percentage of net sales. The 2020 provision has not yet been recorded. Net sales were 58,500,000 for the year ended December 31, 2020, and 49,230,000 for the year ended December 31, 2019. Based on the latest available facts, the 2020 provision for doubtful accounts is estimated to be 0.2% of net sales. A review of the estimated warranty liability at December 31, 2020, which is included in other liabilities in Grays financial statements, has disclosed that this estimated liability should be increased 170,000. Gray has two large blast furnaces that it uses in its manufacturing process. These furnaces must be periodically relined. Furnace A was relined in January 2014 at a cost of 230,000 and in January 2019 at a cost of 280,000. Furnace B was relined for the first time in January 2020 at a cost of 300,000. In Grays financial statements, these costs were expensed as incurred. Since a relining will last for 5 years, Grays management feels it would be preferable to capitalize and depreciate the cost of the relining over the productive life of the relining. Gray has decided to nuke a change in accounting principle from expensing relining costs as incurred to capitalizing them and depreciating them over their productive life on a straight-line basis with a full years depreciation in the year of relining. This change meets the requirements for a change in accounting principle under GAAP. Required: 1. For the years ended December 31, 2020 and 2019, prepare a worksheet reconciling income before income taxes as given previously with income before income taxes as adjusted for the preceding additional information. Show supporting computations in good form. Ignore income taxes and deferred tax considerations in your answer. The worksheet should have the following format: 2. As of January 1, 2020, compute the retrospective adjustment of retained earnings for the change in accounting principle from expensing to capitalizing relining costs. Ignore income taxes and deferred tax considerations in your answer.

- At the end of 2020, Magenta Manufacturing Company discovered that construction cost had been capitalized as a cost of the factory building in 2015 when it should have been treated as a cost of production equipment installation costs. As a result of the misclassification, the depreciation through 2018 was understated by 110,000, and depreciation for 2019 was understated by 90,000. What would be the consequences of correcting for the misclassification of the property cost? a. The taxpayer uses the FIFO inventory method, and 25% of goods produced during the period were included in the ending inventory. b. The taxpayer uses the LIFO inventory method, and no new LIFO layer was added during 2019.On July 1, 2018, Mundo Corporation purchased factory equipment for 50,000. Residual value was estimated at 2,000. The equipment will be depreciated over 10 years using the double-declining balance method. Counting the year of acquisition as one-half year, Mundo should record 2019 depredation expense of: a. 7,680 b. 9,000 c. 9,600 d. 10,000On May 10, 2019, Horan Company purchased equipment for 25,000. The equipment has an estimated service life of 5 years and zero residual value. Assume that the straight-line depreciation method is used. Required: Compute the depreciation expense for 2019 for each of the following four alternatives: 1. Horan computes depreciation expense to the nearest day. (Use 12 months of 30 days each and round the daily depreciation rate to 2 decimal places.) 2. Horan computes depreciation expense to the nearest month. Assets purchased in the first half of the month are considered owned for the whole month. 3. Horan computes depreciation expense to the nearest whole year. Assets purchased in the first half of the year are considered owned for the whole year. 4. Horan records one-half years depreciation expense on all assets purchased during the year.

- Hunter Company purchased a light truck on January 2, 2019 for 18,000. The truck, which will be used for deliveries, has the following characteristics: Estimated life: 5 years Estimated residual value: 3,000 Depreciation method for financial statements: straight-line method Depreciation for income tax purposes: MACRS (3-year life) From 2019 through 2023, each year, Hunter had sales of 100,000, cost of goods sold of 60,000, and operating expenses (excluding depreciation) of 15,000. The truck was disposed of on December 31, 2023, for 2,000. Required: 1. Prepare an income statement for financial reporting through pretax accounting income for each of the 5 years, 2019 through 2023. 2. Prepare, instead, an income statement for income tax purposes through taxable income for each of the 5 years, 2019 through 2023. 3. Compare the total income for all 5 years under Requirements 1 and 2.At the beginning of 2020, Holden Companys controller asked you to prepare correcting entries for the following three situations: 1. Machine X was purchased for 100,000 on January 1, 2015. Straight-line depreciation has been recorded for 5 years, and the Accumulated Depreciation account has a balance of 45,000. The estimated residual value remains at 10,000, but the service life is now estimated to be 1 year longer than originally estimated. 2. Machine Y was purchased for 40,000 on January 1, 2018. It had an estimated residual value of 4,000 and an estimated service life of 8 years. It has been depreciated under the sum-of-the-years-digits method for 2 years. Now, the company has decided to change to the straight-line method. 3. Machine Z was purchased for 80,000 on January 1, 2019. Double-declining-balance depreciation has been recorded for 1 year. The estimated residual value is 8,000 and the estimated service life is 5 years. The computation of the depreciation erroneously included the estimated residual value. Required: Prepare any necessary correcting journal entries for each situation. Also prepare the journal entry for each situation to record the depreciation for 2020. Ignore income taxes.Hathaway Company purchased a copying machine for 8,700 on October 1, 2019. The machines residual value was 500 and its expected service life was 5 years. Hathaway computes depreciation expense to the nearest whole month. Required: 1. Compute depredation expense (rounded to the nearest dollar) for 2019 and 2020 using the: a. straight-line method b. sum-of-the-years-digits method c. double-declining-balance method 2. Next Level Which method produces the highest book value at the end of 2020? 3. Next Level Which method produces the highest charge to income in 2020? 4. Next Level Over the life of the asset, which method produces the greatest amount of depreciation expense?

- Referring to PA7 where Kenzie Company purchased a 3-D printer for $450,000, consider how the purchase of the printer impacts not only depreciation expense each year but also the assets book value. What amount will be recorded as depreciation expense each year, and what will the book value be at the end of each year after depreciation is recorded?Chapman Inc. purchased a piece of equipment in 2018. Chapman depreciated the equipment on a straight-line basis over a useful life of 10 years and used a residual value of $12,000. Chapmans depreciation expense for 2019 was $11,000. What was the original cost of the building? a. $98,000 b. $110,000 c. $122,000 d. $134,000Comprehensive: Acquisition, Subsequent Expenditures, and Depreciation On January 2, 2019, Lapar Corporation purchased a machine for 50,000. Lapar paid shipping expenses of 500, as well as installation costs of 1,200. The company estimated that the machine would have a useful life of 10 years and a residual value of 3,000. On January 1, 2020, Lapar made additions costing 3,600 to the machine in order to comply with pollution-control ordinances. These additions neither prolonged the life of the machine nor increased the residual value. Required: 1. If Lapar records depreciation expense under the straight-line method, how much is the depreciation expense for 2020? 2. Assume Lapar determines the machine has three significant components as shown below. If Lapar uses IFRS, what is the amount of depreciation expense that would be recorded?