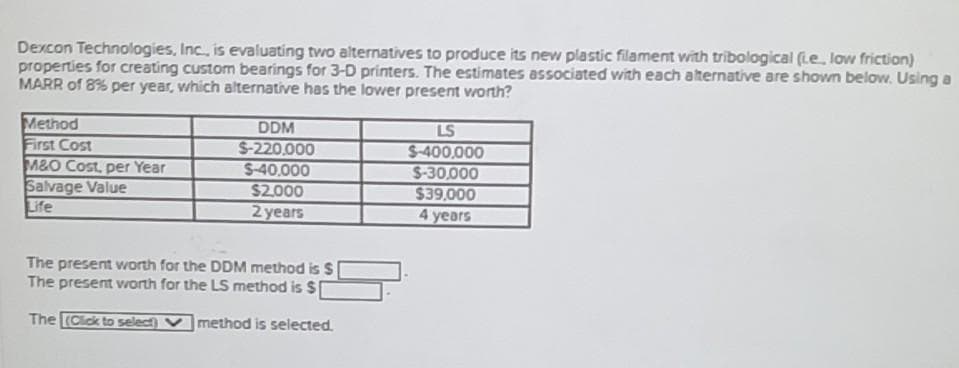

Dexcon Technologies, Inc., is evaluating two alternatives to produce its new plastic filament with tribological (Le. low friction) properties for creating custom bearings for 3-D printers. The estimates associated with each alternative are shown below. Using a MARR of 8% per year, which alternative has the lower present worth? Method First Cost M&O Cost, per Year Salvage Value Life DDM S-220,000 $-40,000 $2.000 2 years LS $-400,000 S-30,000 $39,000 4 years The present worth for the DDM method is S The present vorth for the LS method is $ The (Cick to select) V method is selected.

Q: The production department of Y Company is planning to purchase a new machine to improve product…

A: Decision-making process: Decision making can be defined as the process of making choices through the…

Q: AKO Tire Company is evaluating whether it should retain the current melting process that uses a…

A: To calculate the replacement value, NPV is calculated. It is the net current worth of cash flows…

Q: Esquire Company needs to acquire a molding machine to be used in its manufacturing process. Two…

A: Net present value is the net value of all the present value of benefits and cost to be incurred or…

Q: A mining company need to decide which of the equipment models to use in a project that will last for…

A: Using excel

Q: Hunt Ltd is considering replacing all its offset printing machinery. The cost on 1.1.X1 will be £2m.…

A: Payback period of investment means in how much period or number of years the initial investment…

Q: You are evaluating two different silicon wafer milling machines. The Techron I costs $216,000, has a…

A: Given: Techron 1 Initial cost = $216000 Life = 3 years Pretax operating cost = $55000 Depreciation…

Q: Poly-Chem Plastics is considering two types of injection molding machines: hydraulic and electric.…

A: here to solve this question we have to calculate the IRR of incremental cash flow of both the…

Q: a) Laser beams are being used in a large construction project to achieve the exact alignment of…

A: MARR = 15% N = 4 years

Q: A company that makes food-friendly silicone (for use in cooking and baking pan coatings) is…

A: Here, To Find: Present Worth =?

Q: A small company that manufactures vibration isolation platforms is trying to decide whether it…

A: Amount ($) Cost of the new machine (C) Less: Sale proceeds of old components (D)…

Q: Should the company buy or rent a new machine?

A:

Q: Bailey, Inc., is considering buying a new gang punch that would allow them to produce circuit boards…

A: Present worth of this investment :— It is the sum of all present value of future cash flows. It is…

Q: EIF Manufacturing Company needs to overhaul its drill press or buy a new one. The facts have been…

A: Net Present ValueNet Present Value or net present worth applies to a series of cash flows occurring…

Q: The production department of Y Company is planning to purchase a new machine to improve product…

A:

Q: Hunt Ltd is considering replacing all its offset printing machinery. The cost on 1.1.X1 will be £2m.…

A: Accounting is a systematic process where accounting transactions are recorded and financial…

Q: You are evaluating two different silicon wafer milling machines. The Techron I costs $288,000, has a…

A:

Q: Esquire Company needs to acquire a molding machine to be used in its manufacturing process. Two…

A: The net present value (NPV) in case of annual cash outflows can be calculated as follows:- The…

Q: Lakeside Inc. is considering replacing old production equipment with state-of-the-art technology…

A: Annual cost savings = Monthly savings x 12 months = $10,000 x 12 = $120,000

Q: 3D Systems Corporation was assessing between two natural fibers as a reinforcing fiber to ABS…

A:

Q: Dick Dickerson Construction, Inc. has asked you to help them select a new backhoe. You have a choice…

A: Annual worth is the amount which is expected to be generated from the investment on annual basis. By…

Q: Dexcon Technologies, Inc., is evaluating two alternatives to produce its new plastic filament with…

A: Capital budgeting refers to the evaluation of the profitability of potential investment and projects…

Q: Bailey, Inc., is considering buying a new gang punch that would allow circuit boards to be produced…

A: Capital budgeting techniques can be used to find out investment decisions such as to accept or…

Q: Assume this system costs P 3 million to install and an estimated P 200,000 per year for all…

A: Investment appraisal deals with evaluating various investment opportunities and their profitability.…

Q: Kobe Company has a factory machine with a book value of $90,000 and a remaining useful life of 5…

A: Formula:Variable cost for 4 years=Annual variable cost×4 years

Q: An electric switch manufacturing company has to choose one of three different assembly methods.…

A: Capital budgeting approaches are the methods that are used by management in evaluating various…

Q: A supplier that sells laboratory supplies anticipates an increase in profit of 43,000 TL per year…

A: Net present value is the present value of net benefits less present value of cost. If the net…

Q: You are evaluating two different silicon wafer milling machines. The Techron I costs $285,000, has a…

A: Given: Techron 1 cost is $285,000 Techron 1 pre tax operating cost is $46,000 Techron 11 cost is…

Q: Bailey, Inc., is considering buying a new gang punch that would allow them to produce circuit boards…

A: MARR is the minimum rate that a company is willing to earn from a project. It is also known as the…

Q: The production department of Y Company is planning to purchase a new machine to improve product…

A: If company decides to buy the machine then the yearly cost would be £4,500 (£4,200+£300) and initial…

Q: company in Hànover is considering the purchase of a drill press with fuzzy-logic software to improve…

A: The decision of choosing a Machine is given on the basis of NPV.

Q: A company that makes food-friendly silicone (for use in cooking and baking pan coatings) is…

A: PW=-P+A(P/A,i,n)+F(P/F,i,n)where,PW=Present WorthP=The initial costA=Amount of annual net…

Q: The equivalent annual worth of the process currently used in manufacturing motion controllers is AW…

A: For evaluating the alternatives for the selection of one alternative, we can use the net present…

Q: Xinhong Company is considering replacing one of its manufacturing machines. The machine has a book…

A: Calculation of total changes in net income if alternative A is adopted: Alternative A Increase…

Q: A small company that manufactures vibration isolation platforms is trying to decide whether it…

A: The question is based on the concept of replacement analysis to determine Existing system D can be…

Q: Two machines with the following cost estimates are under consideration for a dishwasher assembly…

A: Year Cash Flow Present Value of Cash Flow = Cash Flow / (1+Interest%)^Year Working 0 -300,000.00…

Q: Dexcon Technologies, Inc., is evaluating two alternatives to produce its new plastic filament with…

A:

Q: A mechanical engineer at Anode Metals is considering five equivalent projects, some of which have…

A: The net present value is one of the capital budgeting techniques which can be used to evaluate…

Q: An assembly operation at a software company currently requires $100,000 per year in labor costs. A…

A: IRR method provides a benchmark return for equating future worth and present worth.

Q: You are evaluating two different silicon wafer milling machines. The Techron I costs $265,000, has a…

A: The data and working calculations are given in the following table Techron 1 year 0…

Q: years. One person will operate the machine at a rate of Php24 per hour. The expected output is 8…

A: Given data initial cost 23000 8000 useful life 10year 5year AMC 3500 1500 salvage value 4400 0…

Q: You are evaluating two different silicon wafer milling machines. The Techron I costs $249,000, has a…

A: The question is based on the concept of Financial Management.

Q: Dexcon Technologies, Inc., is evaluating two alternatives to produce its new plastic filamen with…

A: Solution: - Calculation of present worth for DDM method as follows under: -

Q: A small company that manufactures vibration isolation platforms is trying to decide whether it…

A: With the passage of time, old equipment or assets become less efficient and profitable. These old…

Q: The costs associated with manufacturing a multifunction portable gas analyzer are estimated. At an…

A: Incremental NPV is the method of project evaluation used when the project is mutually exclusive and…

Q: The present value of the net initial cash flows of this project today is closest to: a) CAD…

A: Net initial cash flows mean those cash flows which a company is going to incur for the investment in…

Q: Esquire Company needs to acquire a molding machine to be used in its manufacturing process. Two…

A: Answer 1) Calculation of Present value of cash flows from Machine A Present value of cash flows =…

Q: An electronics firm is planning to manufacture a new handheld gaming device for the preteen market.…

A: data below has been estimated for the product.

Q: compute the EAC for both machines

A: EAC stands for Equivalent Annual Cost. It is the annual cost which is incurred for a project. To…

3

Step by step

Solved in 2 steps

- Flanders Manufacturing is considering purchasing a new machine that will reduce variable costs per part produced by $0.15. The machine will increase fixed costs by $18,250 per year. The information they will use to consider these changes is shown here.Gina Ripley, president of Dearing Company, is considering the purchase of a computer-aided manufacturing system. The annual net cash benefits and savings associated with the system are described as follows: The system will cost 9,000,000 and last 10 years. The companys cost of capital is 12 percent. Required: 1. Calculate the payback period for the system. Assume that the company has a policy of only accepting projects with a payback of five years or less. Would the system be acquired? 2. Calculate the NPV and IRR for the project. Should the system be purchasedeven if it does not meet the payback criterion? 3. The project manager reviewed the projected cash flows and pointed out that two items had been missed. First, the system would have a salvage value, net of any tax effects, of 1,000,000 at the end of 10 years. Second, the increased quality and delivery performance would allow the company to increase its market share by 20 percent. This would produce an additional annual net benefit of 300,000. Recalculate the payback period, NPV, and IRR given this new information. (For the IRR computation, initially ignore salvage value.) Does the decision change? Suppose that the salvage value is only half what is projected. Does this make a difference in the outcome? Does salvage value have any real bearing on the companys decision?New-Project Analysis The Campbell Company is considering adding a robotic paint sprayer to its production line. The sprayer’s base price is $1,080,000, and it would cost another $22,500 to install it. The machine falls into the MACRS 3-year class, and it would be sold after 3 years for $605,000. The MACRS rates for the first 3 years are 0.3333, 0.4445, and 0.1481. The machine would require an increase in net working capital (inventory) of $15,500. The sprayer would not change revenues, but it is expected to save the firm $380,000 per year in before-tax operating costs, mainly labor. Campbell’s marginal tax rate is 35%. What is the Year-0 cash flow? What are the net operating cash flows in Years 1, 2, and 3? What is the additional Year-3 cash flow (i.e., the after-tax salvage and the return of working capital)? If the project’s cost of capital is 12%, should the machine be purchased?

- Den-Tex Company is evaluating a proposal to replace its HID (high intensity discharge) lighting with LED (light emitting diode) lighting throughout its warehouse. LED lighting consumes less power and lasts longer than HID lighting for similar performance. The following information was developed: a. Determine the investment cost for replacing the 700 fixtures. b. Determine the annual utility cost savings from employing the new energy solution. c. Should the proposal be accepted? Evaluate the proposal using net present value, assuming a 15-year life and 8% minimum rate of return. (Present value factors are available in Appendix A.)Dauten is offered a replacement machine which has a cost of 8,000, an estimated useful life of 6 years, and an estimated salvage value of 800. The replacement machine is eligible for 100% bonus depreciation at the time of purchase- The replacement machine would permit an output expansion, so sales would rise by 1,000 per year; even so, the new machines much greater efficiency would cause operating expenses to decline by 1,500 per year The new machine would require that inventories be increased by 2,000, but accounts payable would simultaneously increase by 500. Dautens marginal federal-plus-state tax rate is 25%, and its WACC is 11%. Should it replace the old machine?Home Garden Inc. is considering the construction of a distribution warehouse in West Virginia to service its east coast stores based on the following estimates: a. Determine the net present value of building the warehouse, assuming a construction cost of 20,000,000, an annual net cost savings of 4,000,000, and a desired rate of return of 14%. Use the present value tables provided in Appendix A. b. Determine the net present value of building the warehouse, assuming a construction cost of 25,000,000, an annual net cost savings of 2,500,000, and a desired rate of return of 14%. Use the present value tables provided in Appendix A. c. Interpret the results of parts (a) and (b).

- Consolidated Aluminum is considering the purchase of a new machine that will cost $308,000 and provide the following cash flows over the next five years: $88,000, 92,000, $91,000, $72,000, and $71,000. Calculate the IRR for this piece of equipment. For further instructions on internal rate of return in Excel, see Appendix C.The J.R. Ryland Computer Company is considering a plant expansion to enable the company to begin production of a new computer product. The companys president must determine whether to make the expansion a medium- or large-scale project. Demand for the new product is uncertain, which for planning purposes may be low demand, medium demand, or high demand. The probability estimates for demand are 0.20, 0.50, and 0.30, respectively. Letting x and y indicate the annual profit in thousands of dollars, the firms planners developed the following profit forecasts for the medium-and large-scale expansion projects. a. Compute the expected value for the profit associated with the two expansion alternatives. Which decision is preferred for the objective of maximizing the expected profit? b. Compute the variance for the profit associated with the two expansion alternatives. Which decision is preferred for the objective of minimizing the risk or uncertainty?Nico Parts, Inc., produces electronic products with short life cycles (of less than two years). Development has to be rapid, and the profitability of the products is tied strongly to the ability to find designs that will keep production and logistics costs low. Recently, management has also decided that post-purchase costs are important in design decisions. Last month, a proposal for a new product was presented to management. The total market was projected at 200,000 units (for the two-year period). The proposed selling price was 130 per unit. At this price, market share was expected to be 25 percent. The manufacturing and logistics costs were estimated to be 120 per unit. Upon reviewing the projected figures, Brian Metcalf, president of Nico, called in his chief design engineer, Mark Williams, and his marketing manager, Cathy McCourt. The following conversation was recorded: BRIAN: Mark, as you know, we agreed that a profit of 15 per unit is needed for this new product. Also, as I look at the projected market share, 25 percent isnt acceptable. Total profits need to be increased. Cathy, what suggestions do you have? CATHY: Simple. Decrease the selling price to 125 and we expand our market share to 35 percent. To increase total profits, however, we need some cost reductions as well. BRIAN: Youre right. However, keep in mind that I do not want to earn a profit that is less than 15 per unit. MARK: Does that 15 per unit factor in preproduction costs? You know we have already spent 100,000 on developing this product. To lower costs will require more expenditure on development. BRIAN: Good point. No, the projected cost of 120 does not include the 100,000 we have already spent. I do want a design that will provide a 15-per-unit profit, including consideration of preproduction costs. CATHY: I might mention that post-purchase costs are important as well. The current design will impose about 10 per unit for using, maintaining, and disposing our product. Thats about the same as our competitors. If we can reduce that cost to about 5 per unit by designing a better product, we could probably capture about 50 percent of the market. I have just completed a marketing survey at Marks request and have found out that the current design has two features not valued by potential customers. These two features have a projected cost of 6 per unit. However, the price consumers are willing to pay for the product is the same with or without the features. Required: 1. Calculate the target cost associated with the initial 25 percent market share. Does the initial design meet this target? Now calculate the total life-cycle profit that the current (initial) design offers (including preproduction costs). 2. Assume that the two features that are apparently not valued by consumers will be eliminated. Also assume that the selling price is lowered to 125. a. Calculate the target cost for the 125 price and 35 percent market share. b. How much more cost reduction is needed? c. What are the total life-cycle profits now projected for the new product? d. Describe the three general approaches that Nico can take to reduce the projected cost to this new target. Of the three approaches, which is likely to produce the most reduction? 3. Suppose that the Engineering Department has two new designs: Design A and Design B. Both designs eliminate the two nonvalued features. Both designs also reduce production and logistics costs by an additional 8 per unit. Design A, however, leaves post-purchase costs at 10 per unit, while Design B reduces post-purchase costs to 4 per unit. Developing and testing Design A costs an additional 150,000, while Design B costs an additional 300,000. Assuming a price of 125, calculate the total life-cycle profits under each design. Which would you choose? Explain. What if the design you chose cost an additional 500,000 instead of 150,000 or 300,000? Would this have changed your decision? 4. Refer to Requirement 3. For every extra dollar spent on preproduction activities, how much benefit was generated? What does this say about the importance of knowing the linkages between preproduction activities and later activities?

- Mallette Manufacturing, Inc., produces washing machines, dryers, and dishwashers. Because of increasing competition, Mallette is considering investing in an automated manufacturing system. Since competition is most keen for dishwashers, the production process for this line has been selected for initial evaluation. The automated system for the dishwasher line would replace an existing system (purchased one year ago for 6 million). Although the existing system will be fully depreciated in nine years, it is expected to last another 10 years. The automated system would also have a useful life of 10 years. The existing system is capable of producing 100,000 dishwashers per year. Sales and production data using the existing system are provided by the Accounting Department: All cash expenses with the exception of depreciation, which is 6 per unit. The existing equipment is being depreciated using straight-line with no salvage value considered. The automated system will cost 34 million to purchase, plus an estimated 20 million in software and implementation. (Assume that all investment outlays occur at the beginning of the first year.) If the automated equipment is purchased, the old equipment can be sold for 3 million. The automated system will require fewer parts for production and will produce with less waste. Because of this, the direct material cost per unit will be reduced by 25 percent. Automation will also require fewer support activities, and as a consequence, volume-related overhead will be reduced by 4 per unit and direct fixed overhead (other than depreciation) by 17 per unit. Direct labor is reduced by 60 percent. Assume, for simplicity, that the new investment will be depreciated on a pure straight-line basis for tax purposes with no salvage value. Ignore the half-life convention. The firms cost of capital is 12 percent, but management chooses to use 20 percent as the required rate of return for evaluation of investments. The combined federal and state tax rate is 40 percent. Required: 1. Compute the net present value for the old system and the automated system. Which system would the company choose? 2. Repeat the net present value analysis of Requirement 1, using 12 percent as the discount rate. 3. Upon seeing the projected sales for the old system, the marketing manager commented: Sales of 100,000 units per year cannot be maintained in the current competitive environment for more than one year unless we buy the automated system. The automated system will allow us to compete on the basis of quality and lead time. If we keep the old system, our sales will drop by 10,000 units per year. Repeat the net present value analysis, using this new information and a 12 percent discount rate. 4. An industrial engineer for Mallette noticed that salvage value for the automated equipment had not been included in the analysis. He estimated that the equipment could be sold for 4 million at the end of 10 years. He also estimated that the equipment of the old system would have no salvage value at the end of 10 years. Repeat the net present value analysis using this information, the information in Requirement 3, and a 12 percent discount rate. 5. Given the outcomes of the previous four requirements, comment on the importance of providing accurate inputs for assessing investments in automated manufacturing systems.Talbot Industries is considering launching a new product. The new manufacturing equipment will cost $17 million, and production and sales will require an initial $5 million investment in net operating working capital. The company’s tax rate is 25%. What is the initial investment outlay? The company spent and expensed $150,000 on research related to the new product last year. What is the initial investment outlay? Rather than build a new manufacturing facility, the company plans to install the equipment in a building it owns but is not now using. The building could be sold for $1.5 million after taxes and real estate commissions. What is the initial investment outlay?