FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

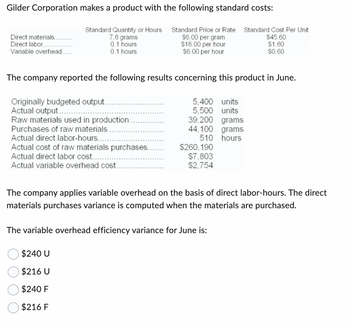

Transcribed Image Text:Gilder Corporation makes a product with the following standard costs:

Standard Quantity or Hours

7.6 grams

0.1 hours

0.1 hours

Direct materials.

Direct labor.

Variable overhead..

Actual direct labor-hours....

Actual cost of raw materials purchases..

Actual direct labor cost....

Actual variable overhead cost.

Standard Price or Rate Standard Cost Per Unit

$6.00 per gram

$16.00 per hour

$6.00 per hour

The company reported the following results concerning this product in June.

Originally budgeted output..

Actual output...

5,400 units

5,500 units

39,200 grams

44,100 grams

Raw materials used in production

Purchases of raw materials

510 hours

$260, 190

$240 U

$216 U

$240 F

$216 F

$7,803

$2,754

$45.60

$1.60

$0.60

The company applies variable overhead on the basis of direct labor-hours. The direct

materials purchases variance is computed when the materials are purchased.

The variable overhead efficiency variance for June is:

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Q.Prepare Revenues budget for Junearrow_forwardAnthon Corporation has provided the following information regarding last month's activities. Units produced (actual) Master production budget Direct materials Direct labor Overhead Standard costs per unit Direct materials Direct labor Variable overhead Actual costs Direct materials purchased and used Direct labor Overhead 10,500 $ 237,600 201,600 267,000 $ 3.96 per liter x 5 liters per unit of output $ 33.60 per hour x 0.5 hour per unit $ 28.50 per direct labor-hour $ 207,480 (53,200 liters) 176,472 (5,160 hours) 272,000 (58% is variable) Variable overhead is applied on the basis of direct labor-hours Required: Calculate all variable production cost price and efficiency variances and fixed production cost price and production volume variance- Note: Do not round intermediate calculations. Indicate the effect of each veriance by selecting "F" for favorable, or "U" for unfavorable. If there is no effect, do not select either option.arrow_forwardW A Corporation produces a single product. The cost of producing and selling a single unit of this product at the company's normal activity level of 40,000 units per month is as follows: Direct Materials.. $18.00 Direct Labor... Variable Manufacturing OH... Fixed Manufacturing OH. Variable S&A... Fixed S&A.. $6.80 Q. What is the minimum price A. $ $1.90 $5.10 $2.40 $11.60 The normal selling price of the product is $49.1 per unit. (16 An order has been received from an overseas customer for 1,000 units to be delivered this month at a special discounted price. This order would not change the total amount of the Company's fixed costs. The variable selling and administrative expense would be $0.10 less per unit on this order than on normal sales. Direct labor is a variable cost in this company. Suppose there is not enough idle capacity to produce all the units for the overseas customer and accepting the special order would require cutting back on production of 100 units for regular…arrow_forward

- Valaarrow_forwardKartman Corporation makes a product with the following standard costs: Standard Quantity Standard Cost or Hours Standard Price or Rate Per Unit $ 7.00 per pound $ 24.00 per hour $ 4.00 per hour $ 45.50 $ 14.40 $ 2.40 Direct materials 6.5 pounds Direct labor 0.6 hours Variable overhead 0.6 hours In June the company's budgeted production was 3,400 units but the actual production was 3,500 units. The company used 22,150 pounds of the direct material and 2,290 direct labor-hours to produce this output. During the month, the company purchased 25,400 pounds of the direct material at a cost of $170,180. The actual direct labor cost was $57,021 and the actual variable overhead cost was $8,931. The company applies variable overhead on the basis of direct labor-hours. The direct materials purchases variance is computed when the materials are purchased. The materials price variance for June is:arrow_forwardPlease do not give solution in image format thankuarrow_forward

- Question Content Area The standard costs and actual costs for factory overhead for the manufacture of 2,900 units of actual production are as follows: Standard Costs Line Item Description Value Fixed overhead (based on 10,000 hours) 3 hours per unit at $0.70 per hour Variable overhead 3 hours per unit at $1.93 per hour Actual Costs Total variable cost, $18,000 Total fixed cost, $8,200 The fixed factory overhead volume variance is a. $0 b. $728 unfavorable c. $910 unfavorable d. $728 favorablearrow_forwardPlease do not give solution in image format thankuarrow_forwardSpree Party Lights overhead expenses are: Indirect material, pounds per unit 0.30 Indirect material, cost per pound $2 Indirect labor hours 1 Indirect labor rate per hour $16.50 Variable maintenance per unit $0.70 Variable utilities per unit $0.10 Supervisor salaries $11,000 Maintenance salaries $10,000 Insurance $3,000 Depreciation $1,400 Prepare a manufacturing overhead budget if the number of units to produce for January, February, and March are 2,400, 3,100, and 2,600, respectively. Spree Party Lights Manufacturing Overhead Budget For the Quarter Ending January - March January February March Units to Produce fill in the blank 1 fill in the blank 2 fill in the blank 3 Variable Costs Indirect Material $fill in the blank 5 $fill in the blank 6 $fill in the blank 7 Indirect Labor fill in the blank 9 fill in the blank 10 fill in the blank 11 Maintenance fill in the blank 13 fill in the blank 14 fill in the blank 15 Utilities…arrow_forward

- hharrow_forwardRequired information [The following information applies to the questions displayed below.] A manufactured product has the following information for June. Direct materials Direct labor Overhead Units manufactured Standard Quantity and Cost 6 pounds @ $8 per pound 3 DLH @ $16 per DLH 3 DLH @ $13 per DLH (1) Prepare the standard cost card showing standard cost per unit. (2) Compute total budgeted cost for June production. (3) Compute total actual cost for June production. (4) Compute total cost variance for June. Actual Results 43,700 pounds @ $8.20 per pound 21,400 hours @ $16.60 per hour $ 287,500 7,200 unitsarrow_forwardDirect materials-1 pound plastic at $6 per pound Direct labor-2.50 hours at $11.35 per hour Variable manufacturing overhead Fixed manufacturing overhead Total standard cost per unit The predetermined manufacturing overhead rate is $10 per direct labor hour ($25.00 +2.50). It was computed from a master manufacturing overhead budget based on normal production of 14,500 direct labor hours (5,800 units) for the month. The master budget showed total variable costs of $101,500 ($7.00 per hour) and total fixed overhead costs of $43,500 ($3.00 per hour). Actual costs for October in producing 4,600 units were as follows. Direct materials (4,710 pounds) Direct labor (11,400 hours) Variable overhead Fixed overhead Total manufacturing costs $ 29,202 132,810 $ 6.00 28.38 17.50 7.50 $59.38 85,098 32,202 $279,312 The purchasing department buys the quantities of raw materials that are expected to be used in production each month. Raw materials inventories, therefore, can be ignored. Compute all of the…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education