Managerial Economics: Applications, Strategies and Tactics (MindTap Course List)

14th Edition

ISBN:9781305506381

Author:James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Chapter1: Introduction And Goals Of The Firm

Section: Chapter Questions

Problem 2.5CE: Energy entrepreneur T. Boone Pickens has proposed converting the trucking fleet in the United States...

Related questions

Question

please answer the 3 parts a, b,c

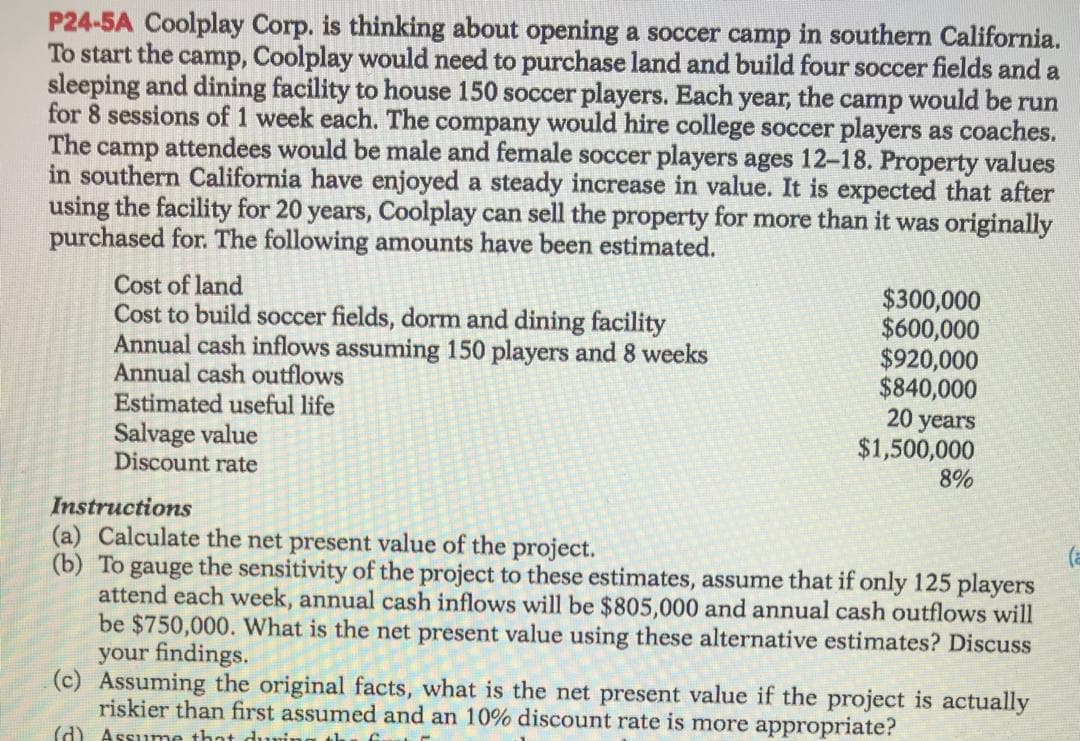

Transcribed Image Text:P24-5A Coolplay Corp. is thinking about opening a soccer camp in southern California.

To start the camp, Coolplay would need to purchase land and build four soccer fields and a

sleeping and dining facility to house 150 soccer players. Each year, the camp would be run

for 8 sessions of 1 week each. The company would hire college soccer players as coaches.

The camp attendees would be male and female soccer players ages 12-18. Property values

in southern California have enjoyed a steady increase in value. It is expected that after

using the facility for 20 years, Coolplay can sell the property for more than it was originally

purchased for. The following amounts have been estimated.

Cost of land

Cost to build soccer fields, dorm and dining facility

Annual cash inflows assuming 150 players and 8 weeks

Annual cash outflows

Estimated useful life

Salvage value

Discount rate

$300,000

$600,000

$920,000

$840,000

20 years

$1,500,000

8%

Instructions

(a) Calculate the net present value of the project.

(b) To gauge the sensitivity of the project to these estimates, assume that if only 125 players

attend each week, annual cash inflows will be $805,000 and annual cash outflows will

be $750,000. What is the net present value using these alternative estimates? Discuss

your findings.

(c) Assuming the original facts, what is the net present value if the project is actually

riskier than first assumed and an 10% discount rate is more appropriate?

(a

(d) Assume that durin

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Economics: Applications, Strategies an…

Economics

ISBN:

9781305506381

Author:

James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:

Cengage Learning

Managerial Economics: Applications, Strategies an…

Economics

ISBN:

9781305506381

Author:

James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:

Cengage Learning