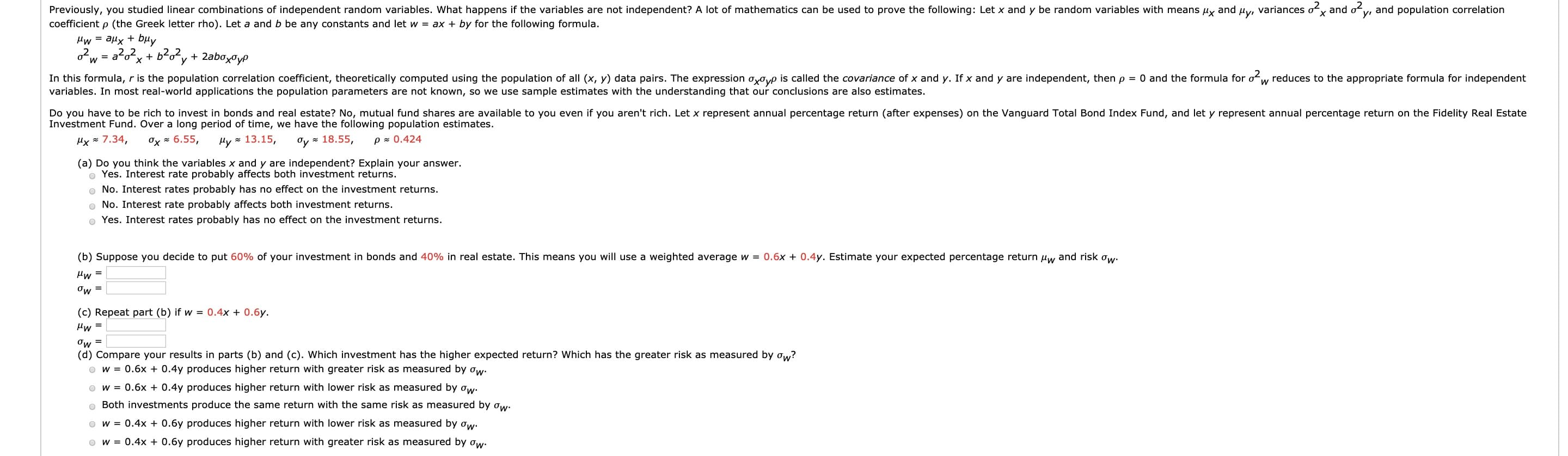

Do you have to be rich to invest in bonds and real estate? No, mutual fund shares are available to you even if you aren't rich. Let x represent annual percentage return (after expenses) on the Vanguard Total Bond Index Fund, and let y represent annual percentage return on the Fidelity Real Estate Investment Fund. Over a long period of time, we have the following population estimates. Hx = 7.34, Ox = 6.55, Hy = 13.15, Oy = 18.55, p z 0.424 (a) Do you think the variables x and y are independent? Explain your answer. o Yes. Interest rate probably affects both investment returns. o No. Interest rates probably has no effect on the investment returns. o No. Interest rate probably affects both investment returns. o Yes. Interest rates probably has no effect on the investment returns. (b) Suppose you decide to put 60% of your investment in bonds and 40% in real estate. This means you will use a weighted average w = 0.6x + 0.4y. Estimate your expected percentage return uw and risk ow. Pw = Ow = (c) Repeat part (b) if w = 0.4x + 0.6y. Hw = Ow = (d) Compare your results in parts (b) and (c). Which investment has the higher expected return? Which has the greater risk as measured by ow? O w = 0.6x + 0.4y produces higher return with greater risk as measured by ow. O w = 0.6x + 0.4y produces higher return with lower risk as measured by ow. o Both investments produce the same return with the same risk as measured by ow- O w = 0.4x + 0.6y produces higher return with lower risk as measured by ow: O w = 0.4x + 0.6y produces higher return with greater risk as measured by ow.

Do you have to be rich to invest in bonds and real estate? No, mutual fund shares are available to you even if you aren't rich. Let x represent annual percentage return (after expenses) on the Vanguard Total Bond Index Fund, and let y represent annual percentage return on the Fidelity Real Estate Investment Fund. Over a long period of time, we have the following population estimates. Hx = 7.34, Ox = 6.55, Hy = 13.15, Oy = 18.55, p z 0.424 (a) Do you think the variables x and y are independent? Explain your answer. o Yes. Interest rate probably affects both investment returns. o No. Interest rates probably has no effect on the investment returns. o No. Interest rate probably affects both investment returns. o Yes. Interest rates probably has no effect on the investment returns. (b) Suppose you decide to put 60% of your investment in bonds and 40% in real estate. This means you will use a weighted average w = 0.6x + 0.4y. Estimate your expected percentage return uw and risk ow. Pw = Ow = (c) Repeat part (b) if w = 0.4x + 0.6y. Hw = Ow = (d) Compare your results in parts (b) and (c). Which investment has the higher expected return? Which has the greater risk as measured by ow? O w = 0.6x + 0.4y produces higher return with greater risk as measured by ow. O w = 0.6x + 0.4y produces higher return with lower risk as measured by ow. o Both investments produce the same return with the same risk as measured by ow- O w = 0.4x + 0.6y produces higher return with lower risk as measured by ow: O w = 0.4x + 0.6y produces higher return with greater risk as measured by ow.

Linear Algebra: A Modern Introduction

4th Edition

ISBN:9781285463247

Author:David Poole

Publisher:David Poole

Chapter4: Eigenvalues And Eigenvectors

Section4.6: Applications And The Perron-frobenius Theorem

Problem 22EQ

Related questions

Topic Video

Question

Transcribed Image Text:Do you have to be rich to invest in bonds and real estate? No, mutual fund shares are available to you even if you aren't rich. Let x represent annual percentage return (after expenses) on the Vanguard Total Bond Index Fund, and let y represent annual percentage return on the Fidelity Real Estate

Investment Fund. Over a long period of time, we have the following population estimates.

Hx = 7.34,

Ox = 6.55,

Hy = 13.15,

Oy = 18.55,

p z 0.424

(a) Do you think the variables x and y are independent? Explain your answer.

o Yes. Interest rate probably affects both investment returns.

o No. Interest rates probably has no effect on the investment returns.

o No. Interest rate probably affects both investment returns.

o Yes. Interest rates probably has no effect on the investment returns.

(b) Suppose you decide to put 60% of your investment in bonds and 40% in real estate. This means you will use a weighted average w = 0.6x + 0.4y. Estimate your expected percentage return uw and risk ow.

Pw =

Ow =

(c) Repeat part (b) if w = 0.4x + 0.6y.

Hw =

Ow =

(d) Compare your results in parts (b) and (c). Which investment has the higher expected return? Which has the greater risk as measured by ow?

O w = 0.6x + 0.4y produces higher return with greater risk as measured by ow.

O w = 0.6x + 0.4y produces higher return with lower risk as measured by ow.

o Both investments produce the same return with the same risk as measured by ow-

O w = 0.4x + 0.6y produces higher return with lower risk as measured by ow:

O w = 0.4x + 0.6y produces higher return with greater risk as measured by ow.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, statistics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Linear Algebra: A Modern Introduction

Algebra

ISBN:

9781285463247

Author:

David Poole

Publisher:

Cengage Learning

Glencoe Algebra 1, Student Edition, 9780079039897…

Algebra

ISBN:

9780079039897

Author:

Carter

Publisher:

McGraw Hill

Linear Algebra: A Modern Introduction

Algebra

ISBN:

9781285463247

Author:

David Poole

Publisher:

Cengage Learning

Glencoe Algebra 1, Student Edition, 9780079039897…

Algebra

ISBN:

9780079039897

Author:

Carter

Publisher:

McGraw Hill