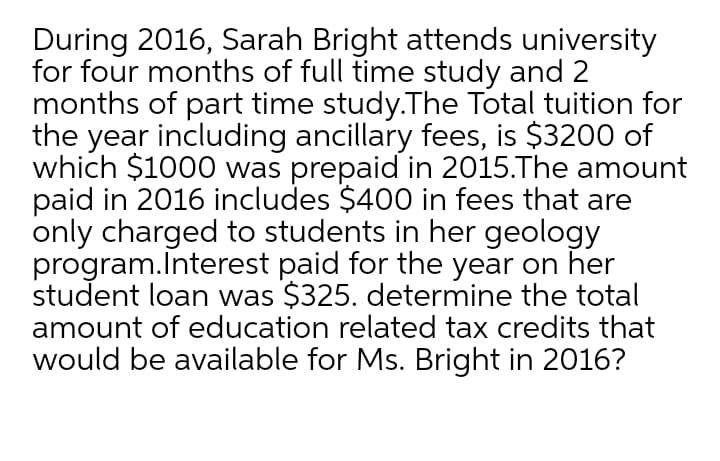

During 2016, Sarah Bright attends university for four months of full time study and 2 months of part time study.The Total tuition for the year including ancillary fees, is $3200 of which $1000 was prepaid in 2015.The amount paid in 2016 includes $400 in fees that are only charged to students in her geology program.Interest paid for the year on her student loan was $325. determine the total amount of education related tax credits that would be available for Ms. Bright in 2016?

During 2016, Sarah Bright attends university for four months of full time study and 2 months of part time study.The Total tuition for the year including ancillary fees, is $3200 of which $1000 was prepaid in 2015.The amount paid in 2016 includes $400 in fees that are only charged to students in her geology program.Interest paid for the year on her student loan was $325. determine the total amount of education related tax credits that would be available for Ms. Bright in 2016?

Chapter6: Business Expenses

Section: Chapter Questions

Problem 69P

Related questions

Question

Transcribed Image Text:During 2016, Sarah Bright attends university

for four months of full time study and 2

months of part time study.The Total tuition for

the year including ancillary fees, is $3200 of

which $1000 was prepaid in 2015.The amount

paid in 2016 includes $400 in fees that are

only charged to students in her geology

program.Interest paid for the year on her

student loan was $325. determine the total

amount of education related tax credits that

would be available for Ms. Bright in 2016?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT