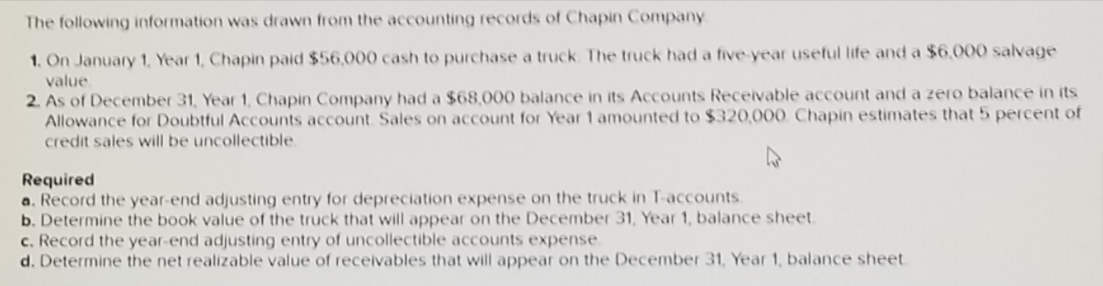

The following information was drawn from the accounting records of Chapin Company 1. On January 1, Year 1, Chapin paid $56,000 cash to purchase a truck The truck had a five year useful life and a $6,000 salvage value 2. As of December 31, Year 1, Chapin Company had a $68,000 balance in its Accounts Receivable account and a zero balance in its Allowance for Doubtful Accounts account Sales on account for Year 1 amounted to $320,000. Chapin estimates that 5 percent of credit sales will be uncollectible Required a. Record the year-end adjusting entry for depreciation expense on the truck in T-accounts. b. Determine the book value of the truck that will appear on the December 31, Year 1, balance sheet. c. Record the year-end adjusting entry of uncollectible accounts expense d. Determine the net realizable value of receivables that will appear on the December 31, Year 1, balance sheet

Q: View the data below and then answer the question below: Company Name: WaitRose Sales - $2,100 (20%…

A: Net credit sales = Sales x credit sales % = 2,100 x 80% = 1,680

Q: The following list of account balances were extracted from the accounting records of Don's…

A: Statement of profit and loss and other comprehensive income is a financial statement summarizing the…

Q: Based on the following post-closing trial balance of Rigodon Corporation on June 30, the end of its…

A: Lets understand the basics. As per balance sheet equation, total asset is always equal to…

Q: Consider each of the transactions below. All of the expenditures were made in cash. What are each of…

A: The financial transactions are initially recorded in the form of journal entry.

Q: On October 17, Nickle Company purchased a building and a plot of land for $582,300. The building was…

A: Introduction: Journals: Recording of a business transactions in a chronological order. First step in…

Q: ZELDEN GENERAL SERVICES has been operating for 5 years. It is engaged in various Repairs of…

A: Allowance for doubtful accounts is the provision created in the books of accounts for the estimated…

Q: The account of Jim Boy Trading Co. has the following balances on January 1, 2001 Jim Boy Trading Co.…

A: Journal Entries Sr. No. Particular Debit credit 1 Cash A/c 50,000 To…

Q: On July 31, 20Y7, the balances of the accounts appearing in the ledger of Yang Interiors Company, a…

A: A closing journal entry is an entry passed at the end of the accounting period. The entry is passed…

Q: he following transactions took place during 2021 and were not recorded in the book’s of Monpa: 1.…

A: Journal : It is the primary book of accounts where all the business transaction are recorded at…

Q: The following transactions were completed by The Irvine Company during the current fiscal year ended…

A: Answer 3: Expected net realizable value of accounts receivable as of December 31:

Q: The following transactions were completed by Irvine Company during the current fiscal year ended…

A: Hey, since there are multiple sub-parts questions posted, we will answer the first three sub-parts…

Q: following transactions were completed by Irvine Company during the current fiscal year ended…

A: Since we only answer up to 3 sub-parts, we’ll answer the first 3. Please resubmit the question and…

Q: Stark company has the following adjusted accounts and normal balances at its December 31 year-end. $…

A: The financial statements are prepared by the business entity to show the performance of the…

Q: Quality Move Company made the following expenditures on one of its delivery trucks: Mar. 20…

A: Journal entry: A journal entry is a systematic record of the economic transaction of a company.

Q: Use the following data from Burt Co., taken from the ledger after adjustment on December 31 the end…

A: a)

Q: The following transactions were completed by Daws Company during the current fiscal year ended…

A: 1. Record the January 1 credit balance of $25,795 in a T account for Allowance for Doubtful…

Q: Based on the following post-dosing trial balance of Rigodon Corporation on June 30, the end of its…

A: Liabilities are the sum of money owed by company to others . It is a financial obligation of company…

Q: Good Call is a delivery business that provides its services in cash and on credit. It has a large…

A: The income statement is one of the important financial statements of the business, which tells about…

Q: The following information was drawn from the accounting records of Chapin Company. 1. On January 1,…

A:

Q: During December, Camp David Inc. purchased $5,000 of supplies for use in its business. At the end of…

A: Supplies in Hand and the unpaid amount on December 31 will be shown on the balance sheet.

Q: On January 2, Dixie, Incorporated, pays a salvage company $1,000 to haul away a machine costing…

A: The journal entries are prepared to record day to day transactions of the business.

Q: How much is owner’s equity at year-en

A: we know that Assets = Liabilities + owner's equity so Owner's equity = Assets - Liabilities Owner's…

Q: 1. Record the January 1 credit balance of $26,000 in a T account for Allowance for Doubtful…

A: Solution: Introduction: Since as per BNED requirements, each question is answered to the maximum of…

Q: The following transactions were completed by Daws Company during the current fiscal year ended…

A: Accounts receivableAccounts receivable refers to the amounts to be received within a short period…

Q: The company Muebles de la Montaña has the following transactions in its ledger. It performs a…

A: The income statement is prepared to record the revenue and expenses of the current period.

Q: HELL'S KITCHEN Company has the following accounts information for the year ended December 31, 2021.…

A: Total assets includes both Current assets and Non current assets. Current assets: Current assets are…

Q: The following transactions were completed by Irvine Company during the current fiscal year ended…

A: An allowance for doubtful debt account is prepared to record the amount which have less chances to…

Q: n its first year of operations, Crane Company recognized $22,400 in service revenue, $4,800 of which…

A: In the above question we have asked to calculated net income under cash & accrual accounting…

Q: Here are the accounts in the ledger of Misha’s Jewel Box, with the balances as of December 31, the…

A: Decrease in Merchandise Inventory = Adjusted Merchandise Inventory - Unadjusted Merchandise…

Q: The following transactions were completed by Irvine Company during the current fiscal year ended…

A: (2) (a)

Q: You are given the following account balances as at year-end: Accounts Receivable: ₱36,000…

A: Calculation of Assets: Formula:

Q: Presented below is the trial balance of H.T Herbert Company for the year ended Dec. 31, 2020. H.T…

A: Balance sheet: It is a statement which reports both assets and liabilities as on a particular date…

Q: Could you answer both questions?

A: a. The effect of purchase on accounting equation: Increase total assets by a net amount of $15,383…

Q: Good Call is a delivery business that provides its services in cash and on credit. It has a large…

A: The Net profit/loss should be calculated by deducting all the expenses from the revenue which are…

Q: On April 15, Compton Co. paid $2,750 to upgrade a delivery truck and $55 for an oil change.…

A: If the useful life of an asset is added or the upgradation is done to an existing assets then the…

Q: jozaf automobile company purchased 58 motor truck at rs 70000 per truck from complex motor company…

A: Perpetual inventory system: Under this accounting method for companies moving large amounts of…

Q: The following accounts and account balances are available for Badger Auto Parts at December 31:…

A: Trial balance is a mathematical representation of the accounts. It includes both temporary accounts…

Q: In its first year of operations, Pharoah Company recognized $31,800 in service revenue, $6,400 of…

A: Cash basis is a major accounting method that recognizes revenues and expenses at the time cash is…

Q: The ledger accounts of the Q. Mendoza Company for the year ended December 31, 2011 are as follows:…

A: A journal entry is a form of accounting entry that is used to report a business transaction in a…

Q: In the year ended 31 December 20X7 Bobby traded in for £3,430 a vehicle costing £6,000 on 1 November…

A: The Cost of Vehicle shall include both monetary and non monetary consideration.

Q: Renue Spa had the following balances at December 31, Year 2: Cash of $12,000, Accounts Receivable of…

A: The accounts receivable means the amount that is not received. The amount of the accounts receivable…

Q: Bleeker Street Bounty Work Sheet (partial) For the year ended December 31, 20-- Account Title Income…

A: Ratio Analysis Ratio Analysis compares line items in the financial statements of a business and…

Q: On March 31, 20Y4, the balances of the accounts appearing in the ledger of Danns Furnishings…

A: Single step income statement offers a simple report of business profit ,using an equation to…

Q: Near the end of its first year of operations, December 31, 2021, Vaughn Designs Ltd. approached the…

A: Statement of changes in equity shows how much equity value of the business has changed over the…

Q: repare journal entries for each expenditure.

A:

Q: On July 31, 2019 the balances of the accounts appearing in the ledger of Pedroni Interiors company a…

A: Closing entries are used to transfer the balance from a temporary to a permanent account. We can say…

Q: In its first year of operations, Crane Company recognized $22,400 in service revenue, $4,800 of…

A: Under cash basis accounting, the revenue and expenses are recognised when cash transactions are…

Q: Prepare an unadjusted trial balance for Jameson Consultants, Inc., at the end of the current year

A: Unadjusted trial Balance is given below,

Q: The following transactions were completed by Daws Company during the current fiscal year ended…

A: Adjusting entries are prepared for the settlement of the accounts.

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 4 images

- Jada Company had the following transactions during the year: Purchased a machine for $500,000 using a long-term note to finance it Paid $500 for ordinary repair Purchased a patent for $45,000 cash Paid $200,000 cash for addition to an existing building Paid $60,000 for monthly salaries Paid $250 for routine maintenance on equipment Paid $10,000 for major repairs Depreciation expense recorded for the year is $25,000 If all transactions were recorded properly, what is the amount of increase to the Property, Plant, and Equipment section of Jadas balance sheet resulting from this years transactions? What amount did Jada report on the income statement for expenses for the year?The following transactions were completed by Hammond Auto Supply during January, which is the first month of this fiscal year. Terms of sale are 2/10, n/30. The balances of the accounts as of January 1 have been recorded in the general ledger in your Working Papers or in CengageNow. Hammond Auto Supply does not track cash sales by customer. Jan. 2Issued Ck. No. 6981 to JSS Management Company for monthly rent, 775. 2J. Hammond, the owner, invested an additional 3,500 in the business. 4Bought merchandise on account from Valencia and Company, invoice no. A691, 2,930; terms 2/10, n/30; dated January 2. 4Received check from Vega Appliance for 980 in payment of 1,000 invoice less discount. 4Sold merchandise on account to L. Paul, invoice no. 6483, 850. 6Received check from Petty, Inc., 637, in payment of 650 invoice less discount. 7Issued Ck. No. 6982, 588, to Fischer and Son, in payment of invoice no. C1272 for 600 less discount. 7Bought supplies on account from Doyle Office Supply, invoice no. 1906B, 108; terms net 30 days. 7Sold merchandise on account to Ellison and Clay, invoice no. 6484, 787. 9Issued credit memo no. 43 to L. Paul, 54, for merchandise returned. 11Cash sales for January 1 through January 10, 4,863.20. 11Issued Ck. No. 6983, 2,871.40, to Valencia and Company, in payment of 2,930 invoice less discount. 14Sold merchandise on account to Vega Appliance, invoice no. 6485, 2,050. Jan. 18Bought merchandise on account from Costa Products, invoice no. 7281D, 4,854; terms 2/10, n/60; dated January 16; FOB shipping point, freight prepaid and added to the invoice, 147 (total 5,001). 21Issued Ck. No. 6984, 194, to M. Miller for miscellaneous expenses not recorded previously. 21Cash sales for January 11 through January 20, 4,591. 23Issued Ck. No. 6985 to Forbes Freight, 96, for freight charges on merchandise purchased on January 4. 23Received credit memo no. 163, 376, from Costa Products for merchandise returned. 29Sold merchandise on account to Bruce Supply, invoice no. 6486, 1,835. 31Cash sales for January 21 through January 31, 4,428. 31Issued Ck. No. 6986, 53, to M. Miller for miscellaneous expenses not recorded previously. 31Recorded payroll entry from the payroll register: total salaries, 6,200; employees federal income tax withheld, 872; FICA Social Security tax withheld, 384.40, FICA Medicare tax withheld, 89.90. 31Recorded the payroll taxes: Social Security tax, 384.40, FICA Medicare tax, 89.90; state unemployment tax, 334.80; federal unemployment tax, 37.20. 31Issued Ck. No. 6987, 4,853.70, for salaries for the month. 31J. Hammond, the owner, withdrew 1,000 for personal use, Ck. No. 6988. Required 1. Record the transactions for January using a sales journal, page 73; a purchases journal, page 56; a cash receipts journal, page 38; a cash payments journal, page 45; and a general journal, page 100. Assume the periodic inventory method is used. 2. Post daily all entries involving customer accounts to the accounts receivable ledger. 3. Post daily all entries involving creditor accounts to the accounts payable ledger. 4. Post daily those entries involving the Other Accounts columns and the general journal to the general ledger. Write the owners name in the Capital and Drawing accounts. 5. Add the columns of the special journals and prove the equality of the debit and credit totals. 6. Post the appropriate totals of the special journals to the general ledger. 7. Prepare a trial balance. 8. Prepare a schedule of accounts receivable and a schedule of accounts payable. Do the totals equal the balances of the related controlling accounts?The following transactions were completed by Hammond Auto Supply during January, which is the first month of this fiscal year. Terms of sale are 2/10, n/30. The balances of the accounts as of January 1 have been recorded in the general ledger in your Working Papers or in CengageNow. Hammond Auto Supply does not track cash sales by customer. Jan. 2Issued Ck. No. 6981 to JSS Management Company for monthly rent, 775. 2J. Hammond, the owner, invested an additional 3,500 in the business. 4Bought merchandise on account from Valencia and Company, invoice no. A691, 2,930; terms 2/10, n/30; dated January 2. 4Received check from Vega Appliance for 980 in payment of 1,000 invoice less discount. 4Sold merchandise on account to L. Paul, invoice no. 6483, 850. 6Received check from Petty, Inc., 637, in payment of 650 invoice less discount. 7Issued Ck. No. 6982, 588, to Fischer and Son, in payment of invoice no. C1272 for 600 less discount. 7Bought supplies on account from Doyle Office Supply, invoice no. 1906B, 108; terms net 30 days. 7Sold merchandise on account to Ellison and Clay, invoice no. 6484, 787. 9Issued credit memo no. 43 to L. Paul, 54, for merchandise returned. 11Cash sales for January 1 through January 10, 4,863.20. 11Issued Ck. No. 6983, 2,871.40, to Valencia and Company, in payment of 2,930 invoice less discount. 14Sold merchandise on account to Vega Appliance, invoice no. 6485, 2,050. Jan. 18Bought merchandise on account from Costa Products, invoice no. 7281D, 4,854; terms 2/10, n/60; dated January 16; FOB shipping point, freight prepaid and added to the invoice, 147 (total 5,001). 21Issued Ck. No. 6984, 194, to M. Miller for miscellaneous expenses not recorded previously. 21Cash sales for January 11 through January 20, 4,591. 23Issued Ck. No. 6985 to Forbes Freight, 96, for freight charges on merchandise purchased on January 4. 23Received credit memo no. 163, 376, from Costa Products for merchandise returned. 29Sold merchandise on account to Bruce Supply, invoice no. 6486, 1,835. 31Cash sales for January 21 through January 31, 4,428. 31Issued Ck. No. 6986, 53, to M. Miller for miscellaneous expenses not recorded previously. 31Recorded payroll entry from the payroll register: total salaries, 6,200; employees federal income tax withheld, 872; FICA Social Security tax withheld, 384.40, FICA Medicare tax withheld, 89.90. 31Recorded the payroll taxes: Social Security tax, 384.40, FICA Medicare tax, 89.90; state unemployment tax, 334.80; federal unemployment tax, 37.20. 31Issued Ck. No. 6987, 4,853.70, for salaries for the month. 31J. Hammond, the owner, withdrew 1,000 for personal use, Ck. No. 6988. Required 1. Record the transactions in the general journal for January. If you are using Working Papers, start with page 1 in the journal. Assume the periodic inventory method is used. The chart of accounts is as follows: 2. Post daily all entries involving customer accounts to the accounts receivable ledger. 3. Post daily all entries involving creditor accounts to the accounts payable ledger. 4. Post daily the general journal entries to the general ledger. Write the owners name in the Capital and Drawing accounts. 5. Prepare a trial balance. 6. Prepare a schedule of accounts receivable and a schedule of accounts payable. Do the totals equal the balances of the related controlling accounts?

- Consider the following situations and determine (1) which type of liability should be recognized (specific account), and (2) how much should be recognized in the current period (year). A. A business depreciates a building with a book value of $12,000, using straight-line depreciation, no salvage value, and a remaining useful life of six years. B. An organization has a line of credit with a supplier. The company purchases $35,500 worth of inventory on credit. Terms of purchase are 3/20, n/60. C. An employee earns $1,000 in pay and the employer withholds $46 for federal income tax. D. A customer pays $4,000 in advance for legal services. The lawyer has previously recognized 30% of the services as revenue. The remainder is outstanding.The following transactions were completed by Yang Restaurant Equipment during January, the first month of this fiscal year. Terms of sale are 2/10, n/30. The balances of the accounts as of January 1 have been recorded in the general ledger in your Working Papers or in CengageNow. Yang Restaurant Equipment does not track cash sales by customer. Jan. 2Issued Ck. No. 6981 to Tri-County Management Company for monthly rent, 850. 2L. Yang, the owner, invested an additional 4,500 in the business. 4Bought merchandise on account from Valentine and Company, invoice no. A694, 2,830; terms 2/10, n/30; dated January 2. 4Received check from Velez Appliance for 980 in payment of invoice for 1,000 less discount. 4Sold merchandise on account to L. Parrish, invoice no. 6483, 755. 6Received check from Peck, Inc., 637, in payment of 650 invoice less discount. 7Issued Ck. No. 6982, 588, to Frost and Son, in payment of invoice no. C127 for 600 less discount. 7Bought supplies on account from Dudley Office Supply, invoice no. 190B, 93.54; terms net 30 days. 7Sold merchandise on account to Ewing and Charles, invoice no. 6484, 1,115. 9Issued credit memo no. 43 to L. Parrish, 47, for merchandise returned. 11Cash sales for January 1 through January 10, 4,454.87. 11Issued Ck. No. 6983, 2,773.40, to Valentine and Company, in payment of 2,830 invoice less discount. 14Sold merchandise on account to Velez Appliance, invoice no. 6485, 2,100. 14Received check from L. Parrish, 693.84, in payment of 755 invoice, less return of 47 and less discount. Jan. 19Bought merchandise on account from Crawford Products, invoice no. 7281, 3,700; terms 2/10, n/60; dated January 16; FOB shipping point, freight prepaid and added to invoice, 142 (total 3,842). 21Issued Ck. No. 6984, 245, to A. Bautista for miscellaneous expenses not recorded previously. 21Cash sales for January 11 through January 20, 3,689. 23Received credit memo no. 163, 87, from Crawford Products for merchandise returned. 29Sold merchandise on account to Bradford Supply, invoice no. 6486, 1,697.20. 29Issued Ck. No. 6985 to Western Freight, 64, for freight charges on merchandise purchased January 4. 31Cash sales for January 21 through January 31, 3,862. 31Issued Ck. No. 6986, 65, to M. Pineda for miscellaneous expenses not recorded previously. 31Recorded payroll entry from the payroll register: total salaries, 5,899.95; employees federal income tax withheld, 795; FICA Social Security tax withheld, 365.80, FICA Medicare tax withheld, 85.50. 31Recorded the payroll taxes: FICA Social Security tax, 365.80; FICA Medicare tax, 85.50; state unemployment tax, 318.60; federal unemployment tax, 35.40. 31Issued Ck. No. 6987, 4,653.65, for salaries for the month. 31L. Yang, the owner, withdrew 1,000 for personal use, Ck. No. 6988. Required 1. Record the transactions in the general journal for January. If you are using Working Papers, start with page 1 in the journal. Assume the periodic inventory method is used. The chart of accounts is as follows: 2. Post daily all entries involving customer accounts to the accounts receivable ledger. 3. Post daily all entries involving creditor accounts to the accounts payable ledger. 4. Post daily the general journal entries to the general ledger. Write the owners name in the Capital and Drawing accounts. 5. Prepare a trial balance. 6. Prepare a schedule of accounts receivable and a schedule of accounts payable. Do the totals equal the balances of the related controlling accounts?The following transactions were completed by Yang Restaurant Equipment during January, the first month of this fiscal year. Terms of sale are 2/10, n/30. The balances of the accounts as of January 1 have been recorded in the general ledger in your Working Papers or in CengageNow. Yang Restaurant Equipment does not track cash sales by customer. Jan. 2Issued Ck. No. 6981 to Tri-County Management Company for monthly rent, 850. 2L. Yang, the owner, invested an additional 4,500 in the business. 4Bought merchandise on account from Valentine and Company, invoice no. A694, 2,830; terms 2/10, n/30; dated January 2. 4Received check from Velez Appliance for 980 in payment of invoice for 1,000 less discount. 4Sold merchandise on account to L. Parrish, invoice no. 6483, 755. 6Received check from Peck, Inc., 637, in payment of 650 invoice less discount. 7Issued Ck. No. 6982, 588, to Frost and Son, in payment of invoice no. C127 for 600 less discount. 7Bought supplies on account from Dudley Office Supply, invoice no. 190B, 93.54; terms net 30 days. 7Sold merchandise on account to Ewing and Charles, invoice no. 6484, 1,115. 9Issued credit memo no. 43 to L. Parrish, 47, for merchandise returned. 11Cash sales for January 1 through January 10, 4,454.87. 11Issued Ck. No. 6983, 2,773.40, to Valentine and Company, in payment of 2,830 invoice less discount. 14Sold merchandise on account to Velez Appliance, invoice no. 6485, 2,100. 14Received check from L. Parrish, 693.84, in payment of 755 invoice, less return of 47 and less discount. Jan. 19Bought merchandise on account from Crawford Products, invoice no. 7281, 3,700; terms 2/10, n/60; dated January 16; FOB shipping point, freight prepaid and added to invoice, 142 (total 3,842). 21Issued Ck. No. 6984, 245, to A. Bautista for miscellaneous expenses not recorded previously. 21Cash sales for January 11 through January 20, 3,689. 23Received credit memo no. 163, 87, from Crawford Products for merchandise returned. 29Sold merchandise on account to Bradford Supply, invoice no. 6486, 1,697.20. 29Issued Ck. No. 6985 to Western Freight, 64, for freight charges on merchandise purchased January 4. 31Cash sales for January 21 through January 31, 3,862. 31Issued Ck. No. 6986, 65, to M. Pineda for miscellaneous expenses not recorded previously. 31Recorded payroll entry from the payroll register: total salaries, 5,899.95; employees federal income tax withheld, 795; FICA Social Security tax withheld, 365.80, FICA Medicare tax withheld, 85.50. 31Recorded the payroll taxes: FICA Social Security tax, 365.80; FICA Medicare tax, 85.50; state unemployment tax, 318.60; federal unemployment tax, 35.40. 31Issued Ck. No. 6987, 4,653.65, for salaries for the month. 31L. Yang, the owner, withdrew 1,000 for personal use, Ck. No. 6988. Required 1. Record the transactions for January using a sales journal, page 91; a purchases journal, page 74; a cash receipts journal, page 56; a cash payments journal, page 63; and a general journal, page 119. Assume the periodic inventory method is used. 2. Post daily all entries involving customer accounts to the accounts receivable ledger. 3. Post daily all entries involving creditor accounts to the accounts payable ledger. 4. Post daily those entries involving the Other Accounts columns and the general journal to the general ledger. Write the owners name in the Capital and Drawing accounts. 5. Add the columns of the special journals and prove the equality of the debit and credit totals. 6. Post the appropriate totals of the special journals to the general ledger. 7. Prepare a trial balance. 8. Prepare a schedule of accounts receivable and a schedule of accounts payable. Do the totals equal the balances of the related controlling accounts?

- Johnson, Incorporated, had the following transactions during the year: Purchased a building for $5,000,000 using a mortgage for financing Paid $2,000 for ordinary repair on a piece of equipment Sold product on account to customers for $1,500,600 Paid $20,000 cash to add a storage shed in the corner of an existing building Paid $360,000 in monthly salaries Paid $25,000 for routine maintenance on equipment Paid $110,000 for extraordinary repairs Depreciation expense recorded for the year is $15,000. If all transactions were recorded properly, what is the amount of increase to the Property, Plant, and Equipment section of Johnsons balance sheet resulting from this years transactions? What amount did Johnson report on the income statement for expenses for the year?Analyzing the Accounts The controller for Summit Sales Inc. provides the following information on transactions that occurred during the year: a. Purchased supplies on credit, $18,600 b. Paid $14,800 cash toward the purchase in Transaction a c. Provided services to customers on credit1 $46,925 d. Collected $39,650 cash from accounts receivable e. Recorded depreciation expense, $8,175 f. Employee salaries accrued, $15,650 g. Paid $15,650 cash to employees for salaries earned h. Accrued interest expense on long-term debt, $1,950 i. Paid a total of $25,000 on long-term debt, which includes $1.950 interest from Transaction h j. Paid $2,220 cash for l years insurance coverage in advance k. Recognized insurance expense, $1,340, that was paid in a previous period l. Sold equipment with a book value of $7,500 for $7,500 cash m. Declared cash dividend, $12,000 n. Paid cash dividend declared in Transaction m o. Purchased new equipment for $28,300 cash. p. Issued common stock for $60,000 cash q. Used $10,700 of supplies to produce revenues Summit Sales uses the indirect method to prepare its statement of cash flows. Required: 1. Construct a table similar to the one shown at the top of the next page. Analyze each transaction and indicate its effect on the fundamental accounting equation. If the transaction increases a financial statement element, write the amount of the increase preceded by a plus sign (+) in the appropriate column. If the transaction decreases a financial statement element, write the amount of the decrease preceded by a minus sign (-) in the appropriate column. 2. Indicate whether each transaction results in a cash inflow or a cash outflow in the Effect on Cash Flows column. If the transaction has no effect on cash flow, then indicate this by placing none in the Effect on Cash Flows column. 3. For each transaction that affected cash flows, indicate whether the cash flow would be classified as a cash flow from operating activities, cash flow from investing activities, or cash flow from financing activities. If there is no effect on cash flows, indicate this as a non-cash activity.Johnson, Incorporated had the following transactions during the year: Purchased a building for $5,000,000 using a mortgage for financing Paid $2,000 for ordinary repair on a piece of equipment Sold product on account to customers for $1,500,600 Purchased a copyright for $5,000 cash Paid $20,000 cash to add a storage shed in the corner of an existing building Paid $360,000 in monthly salaries Paid $25,000 for routine maintenance on equipment Paid $110,000 for major repairs If all transactions were recorded properly, what amount did Johnson capitalize for the year, and what amount did Johnson expense for the year?

- Jada Company had the following transactions during the year: Purchased a machine for $500,000 using a long-term note to finance it Paid $500 for ordinary repair Purchased a patent for $45,000 cash Paid $200,000 cash for addition to an existing building Paid $60,000 for monthly salaries Paid $250 for routine maintenance on equipment Paid $10,000 for extraordinary repairs If all transactions were recorded properly, what amount did Jada capitalize for the year, and what amount did Jada expense for the year?A company purchased a building twenty years ago for $150,000. The building currently has an appraised market value of $235,000. The company reports the building on its balance sheet at $235,000. What concept or principle has been violated? A. separate entity concept B. recognition principle C. monetary measurement concept D. cost principleKrespy Corp. has a cash balance of $7,500 before the following transactions occur: A. received customer payments of $965 B. supplies purchased on account $435 C. services worth $850 performed, 25% is paid in cash the rest will be billed D. corporation pays $275 for an ad in the newspaper E. bill is received for electricity used $235. F. dividends of $2,500 are distributed What is the balance in cash after these transactions are journalized and posted?