Each of the following situations is independent. A. Vallis Inc. manufactures machine parts for military an offer from another military subcontractor to provide 2.000 units of product ZR17 for $120,000. If Vallis does not purchase these parts ft continue to produce them in-house at the following drones. The company is considering om the subcontractor, it must bosts: Cost per Unit $28 $18 $16 $4 Direct materials Direct labour Variable overhead Allocated fixed overhead Required: a. Analyze the offer quantitatively to determine if Vallis should continue to manufacture the component or outsource it. b. Outline at least three qualitative considerations that Vallis should consider in this decision. Why are these factors that you have outlined important?

Each of the following situations is independent. A. Vallis Inc. manufactures machine parts for military an offer from another military subcontractor to provide 2.000 units of product ZR17 for $120,000. If Vallis does not purchase these parts ft continue to produce them in-house at the following drones. The company is considering om the subcontractor, it must bosts: Cost per Unit $28 $18 $16 $4 Direct materials Direct labour Variable overhead Allocated fixed overhead Required: a. Analyze the offer quantitatively to determine if Vallis should continue to manufacture the component or outsource it. b. Outline at least three qualitative considerations that Vallis should consider in this decision. Why are these factors that you have outlined important?

Chapter10: Short-term Decision Making

Section: Chapter Questions

Problem 4EA: Zena Technology sells arc computer printers for $55 per unit. Unit product costs are: A special...

Related questions

Question

Transcribed Image Text:Question 3:

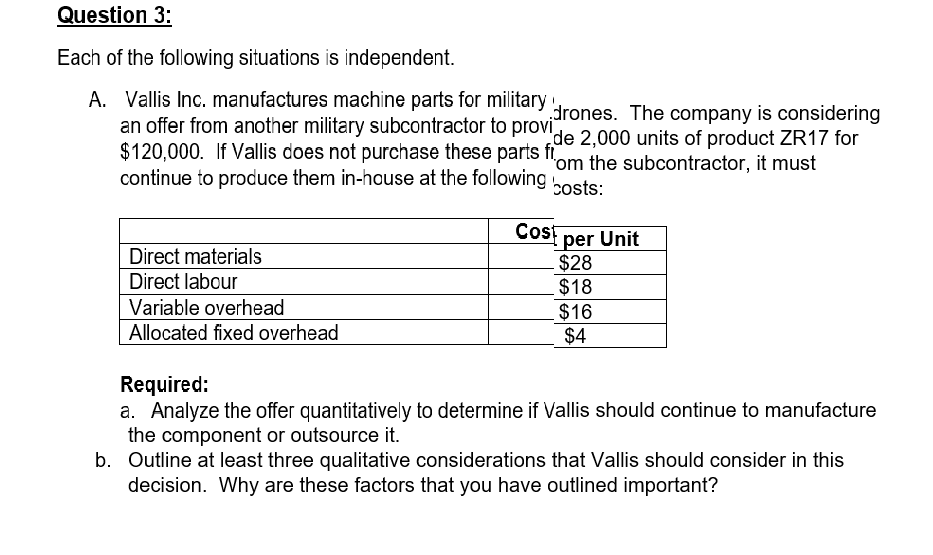

Each of the following situations is independent.

A. Vallis Inc. manufactures machine parts for military

an offer from another military subcontractor to provide 2.000 units of product ZR17 for

$120,000. If Vallis does not purchase these parts fi

continue to produce them in-house at the following

drones. The company is considering

'om the subcontractor, it must

costs:

Cosf

per Unit

$28

$18

$16

$4

Direct materials

Direct labour

Variable overhead

Allocated fixed overhead

Required:

a. Analyze the offer quantitatively to determine if Vallis should continue to manufacture

the component or outsource it.

b. Outline at least three qualitative considerations that Vallis should consider in this

decision. Why are these factors that you have outlined important?

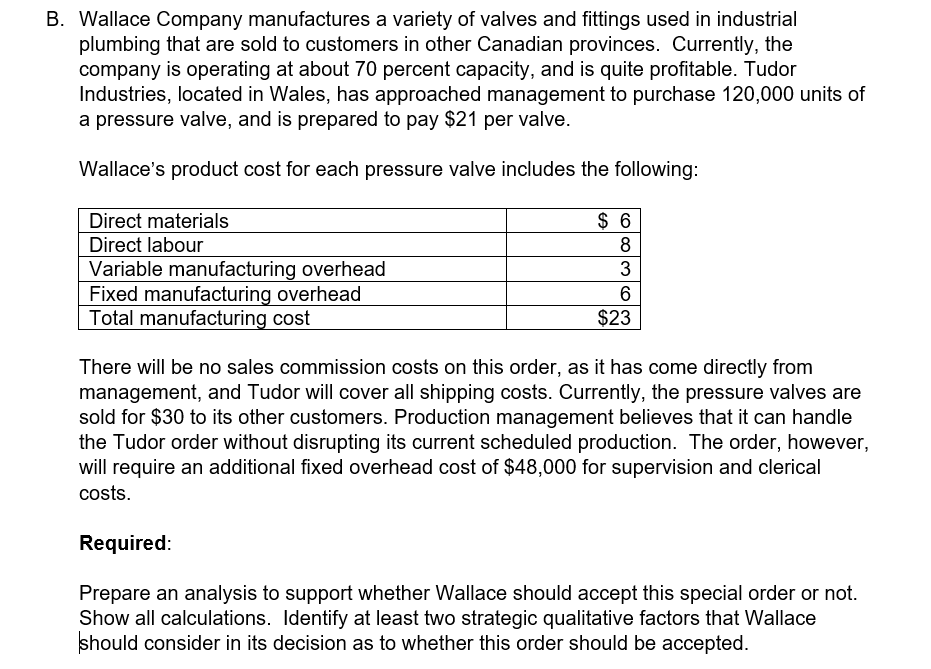

Transcribed Image Text:B. Wallace Company manufactures a variety of valves and fittings used in industrial

plumbing that are sold to customers in other Canadian provinces. Currently, the

company is operating at about 70 percent capacity, and is quite profitable. Tudor

Industries, located in Wales, has approached management to purchase 120,000 units of

a pressure valve, and is prepared to pay $21 per valve.

Wallace's product cost for each pressure valve includes the following:

Direct materials

$ 6

Direct labour

8

Variable manufacturing overhead

Fixed manufacturing overhead

Total manufacturing cost

3

$23

There will be no sales commission costs on this order, as it has come directly from

management, and Tudor will cover all shipping costs. Currently, the pressure valves are

sold for $30 to its other customers. Production management believes that it can handle

the Tudor order without disrupting its current scheduled production. The order, however,

will require an additional fixed overhead cost of $48,000 for supervision and clerical

costs.

Required:

Prepare an analysis to support whether Wallace should accept this special order or not.

Show all calculations. Identify at least two strategic qualitative factors that Wallace

should consider in its decision as to whether this order should be accepted.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College