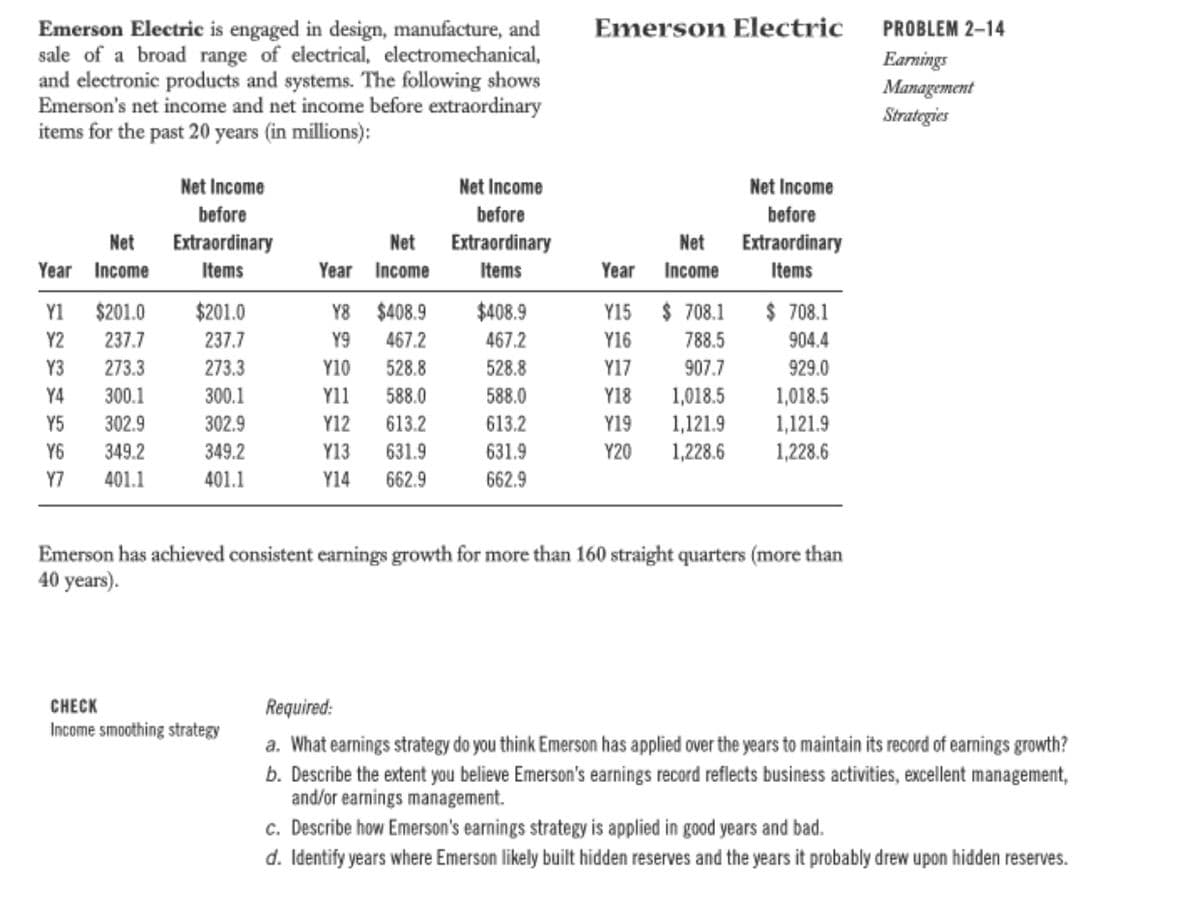

Emerson Electric Emerson Electric is engaged in design, manufacture, and sale of a broad range of electrical, electromechanical, and electronic products and systems. The following shows Emerson's net income and net income before extraordinary items for the past 20 years (in millions): PROBLEM 2-14 Earnings Management Strategies Net Income Net Income Net Income before before before Net Extraordinary Net Extraordinary Net Extraordinary Items Year Income Items Year Income Items Year Income Y1 $201.0 $201.0 Y8 $408.9 $408.9 Y15 $ 708.1 $ 708.1 Y2 237.7 237.7 Y9 467.2 467.2 Y16 788.5 904.4 Y3 273.3 273.3 Y10 528.8 528.8 Y17 907.7 929.0 1,018.5 1,121.9 1,228.6 1,018.5 1,121.9 1,228.6 Y4 300.1 300.1 Y11 588.0 588.0 Y18 Y5 302.9 302.9 Y12 613.2 613.2 Y19 Y6 349.2 349.2 Y13 631.9 631.9 Y20 Y7 401.1 401.1 Y14 662.9 662.9 Emerson has achieved consistent earnings growth for more than 160 straight quarters (more than 40 years). CHECK Required: Income smoothing strategy a. What earnings strategy do you think Emerson has applied over the years to maintain its record of earnings growth? b. Describe the extent you believe Emerson's earnings record reflects business activities, excellent management, and/or earnings management. c. Describe how Emerson's earnings strategy is applied in good years and bad. d. Identify years where Emerson likely built hidden reserves and the years it probably drew upon hidden reserves.

Emerson Electric Emerson Electric is engaged in design, manufacture, and sale of a broad range of electrical, electromechanical, and electronic products and systems. The following shows Emerson's net income and net income before extraordinary items for the past 20 years (in millions): PROBLEM 2-14 Earnings Management Strategies Net Income Net Income Net Income before before before Net Extraordinary Net Extraordinary Net Extraordinary Items Year Income Items Year Income Items Year Income Y1 $201.0 $201.0 Y8 $408.9 $408.9 Y15 $ 708.1 $ 708.1 Y2 237.7 237.7 Y9 467.2 467.2 Y16 788.5 904.4 Y3 273.3 273.3 Y10 528.8 528.8 Y17 907.7 929.0 1,018.5 1,121.9 1,228.6 1,018.5 1,121.9 1,228.6 Y4 300.1 300.1 Y11 588.0 588.0 Y18 Y5 302.9 302.9 Y12 613.2 613.2 Y19 Y6 349.2 349.2 Y13 631.9 631.9 Y20 Y7 401.1 401.1 Y14 662.9 662.9 Emerson has achieved consistent earnings growth for more than 160 straight quarters (more than 40 years). CHECK Required: Income smoothing strategy a. What earnings strategy do you think Emerson has applied over the years to maintain its record of earnings growth? b. Describe the extent you believe Emerson's earnings record reflects business activities, excellent management, and/or earnings management. c. Describe how Emerson's earnings strategy is applied in good years and bad. d. Identify years where Emerson likely built hidden reserves and the years it probably drew upon hidden reserves.

Managerial Accounting

15th Edition

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:Carl Warren, Ph.d. Cma William B. Tayler

Chapter7: Variable Costing For Management

analysis

Section: Chapter Questions

Problem 1MAD

Related questions

Question

Transcribed Image Text:Emerson Electric

Emerson Electric is engaged in design, manufacture, and

sale of a broad range of electrical, electromechanical,

and electronic products and systems. The following shows

Emerson's net income and net income before extraordinary

items for the past 20 years (in millions):

PROBLEM 2–14

Earnings

Management

Strategies

Net Income

Net Income

Net Income

before

before

before

Net

Extraordinary

Net

Extraordinary

Items

Net

Extraordinary

Year Income

Items

Year Income

Year

Income

Items

Y1

$201.0

$201.0

Y8

$408.9

$408.9

Y15

$ 708.1

$ 708.1

Y2

237.7

237.7

Y9

467.2

467.2

Y16

788.5

904.4

Y3

273.3

273.3

Y10

528.8

528.8

Y17

907.7

929.0

300.1

300.1

Y11

588.0

588.0

1,018.5

1,121.9

1,228.6

Y4

Y18

1,018.5

613.2

613.2

1,121.9

1,228.6

Y5

302.9

302.9

Y12

Y19

Y6

349.2

349.2

Y13

631.9

631.9

Y20

Y7

401.1

401.1

Y14

662.9

662.9

Emerson has achieved consistent earnings growth for more than 160 straight quarters (more than

40 years).

CHECK

Required:

Income smoothing strategy

a. What earnings strategy do you think Emerson has applied over the years to maintain its record of earmings growth?

b. Describe the extent you believe Emerson's earnings record reflects business activities, excellent management,

and/or earnings management.

c. Describe how Emerson's earnings strategy is applied in good years and bad.

d. Identify years where Emerson likely built hidden reserves and the years it probably drew upon hidden reserves.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning