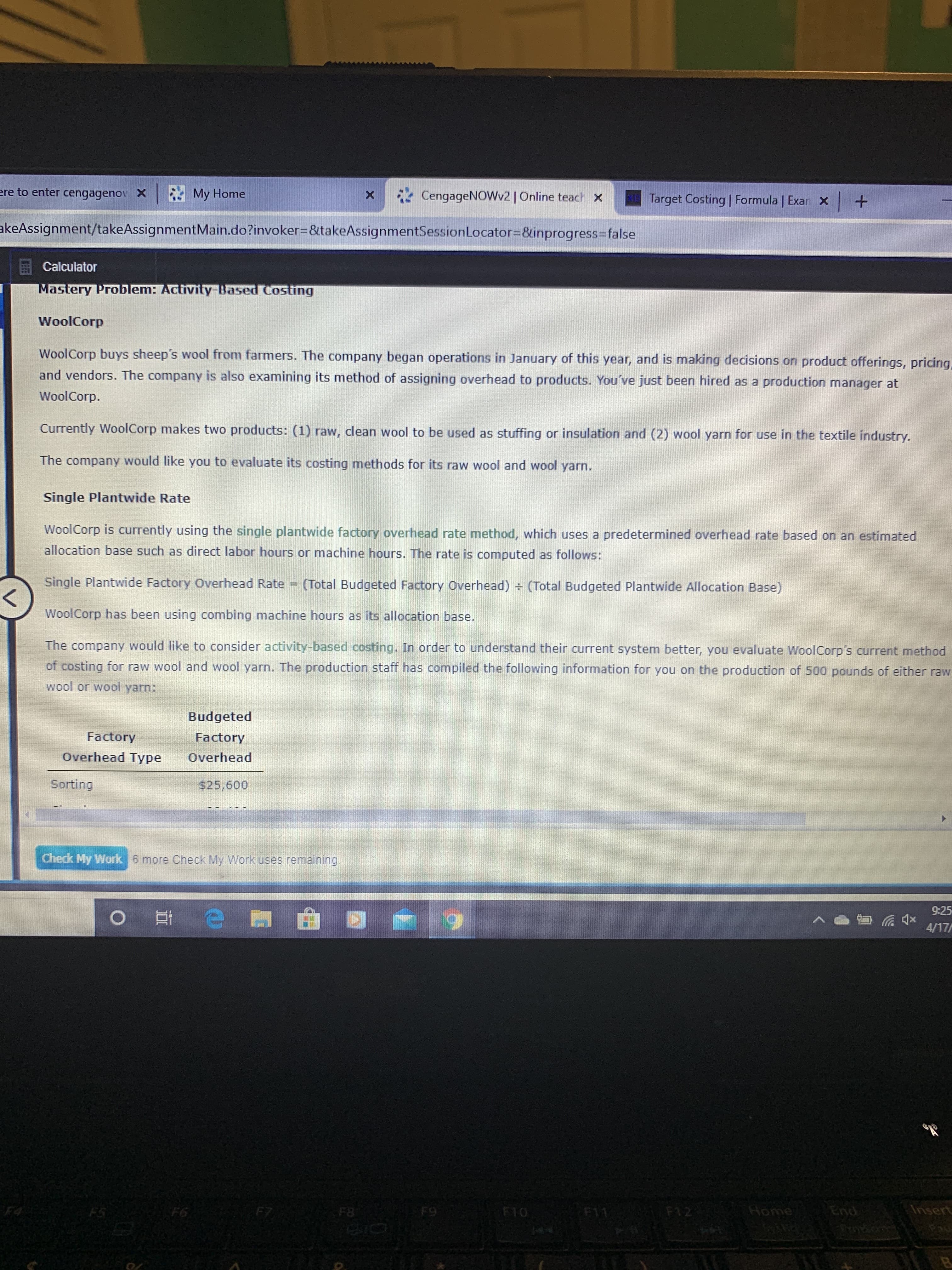

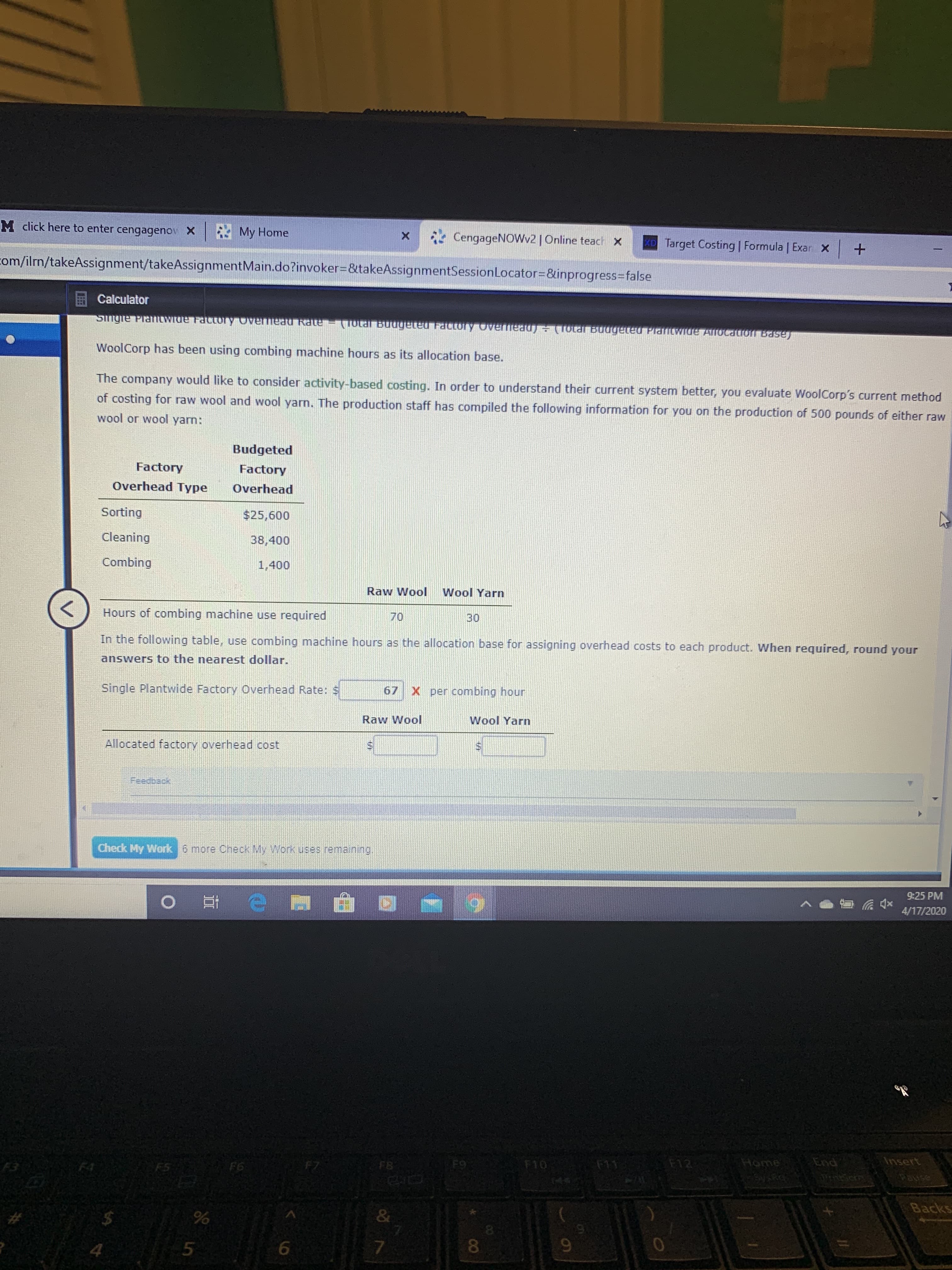

ere to enter cengagenov X * My Home CengageNOWv2 | Online teach x KE Target Costing | Formula | Exan x + akeAssignment/takeAssignmentMain.do?invoker%3&takeAssignmentSessionLocator=&inprogress3Dfalse Calculator Mastery Problem: Activity-Based Costing WoolCorp WoolCorp buys sheep's wool from farmers. The company began operations in January of this year, and is making decisions on product offerings, pricing, and vendors. The company is also examining its method of assigning overhead to products. You've just been hired as a production manager at WoolCorp. Currently WoolCorp makes two products: (1) raw, clean wool to be used as stuffing or insulation and (2) wool yarn for use in the textile industry. The company would like you to evaluate its costing methods for its raw wool and wool yarn. Single Plantwide Rate WoolCorp is currently using the single plantwide factory overhead rate method, which uses a predetermined overhead rate based on an estimated allocation base such as direct labor hours or machine hours. The rate is computed as follows: Single Plantwide Factory Overhead Rate = (Total Budgeted Factory Overhead) (Total Budgeted Plantwide Allocation Base) WoolCorp has been using combing machine hours as its allocation base. The company would like to consider activity-based costing. In order to understand their current system better, you evaluate WoolCorp's current method of costing for raw wool and wool yarn. The production staff has compiled the following information for you on the production of 500 pounds of either raw wool or wool yarn: Budgeted Factory Factory Overhead Type Overhead Sorting $25,600 Check My Work 6 more Check My Work uses remaining. 9:25 4/17/ F5 F6 F8 F9 F10 F11 F12 Home End Insert M click here to enter cengagenov X A My Home CengageNOWv2 | Online teach x D Target Costing | Formula | Exar X com/ilrn/takeAssignment/takeAssignmentMain.do?invoker=&takeAssignmentSessionLocator=&inprogress3false Calculator Singre PlaILwide Factory overmeauRate Total Budgeteu Factory overnead (1otar Budgeted Plancwide AMocation Base WoolCorp has been using combing machine hours as its allocation base. The company would like to consider activity-based costing. In order to understand their current system better, you evaluate WoolCorp's current method of costing for raw wool and wool yarn. The production staff has compiled the following information for you on the production of 500 pounds of either raw wool or wool yarn: Budgeted Factory Factory Overhead Type Overhead Sorting $25,600 Cleaning 38,400 Combing 1,400 Raw Wool Wool Yarn Hours of combing machine use required 70 30 In the following table, use combing machine hours as the allocation base for assigning overhead costs to each product. When required, round your answers to the nearest dollar. Single Plantwide Factory Overhead Rate: $ 67 X per combing hour Raw Wool Wool Yarn Allocated factory overhead cost Feedback Check My Work 6 more Check My Workk uses remaining, 9:25 PM 4/17/2020 F3 F5 F6 F7 FB F9 F10 F11 F12 Home End Insert Backs & 4. 08.

Variance Analysis

In layman's terms, variance analysis is an analysis of a difference between planned and actual behavior. Variance analysis is mainly used by the companies to maintain a control over a business. After analyzing differences, companies find the reasons for the variance so that the necessary steps should be taken to correct that variance.

Standard Costing

The standard cost system is the expected cost per unit product manufactured and it helps in estimating the deviations and controlling them as well as fixing the selling price of the product. For example, it helps to plan the cost for the coming year on the various expenses.

Could you help me find the single plant wide

Trending now

This is a popular solution!

Step by step

Solved in 5 steps with 5 images