A My Home * CengageNOWv2 | Online teachin X ter cengagenowh x ament/takeAssignmentMain.do?invoker=D&takeAssignmentSessionLocator3D&inprogress%3Dfalse Calculator Print Item eBook Indirect labor $507,000 Cutting Department 156,000 Finishing Department 192,000 Total $855,000 The activity base associated with the two production departments is direct labor hours. The indirect labor can be assigned to two different activities as follows: Budgeted Activity Activity Cost Activity Base Production control $237,000 Number of production runs Materials handling 270,000 Number of moves Total $507,000 The activity-base usage quantities and units produced for the two products follow: Number of Direct Labor Direct Labor Production Number of Hours- Units Hours-Cutting Runs Moves Finishing Produced Snowboards 430 5,000 4,000 2,000 6,000 Skis 70 2,500 2,000 4,000 6,000 Check My Work Previous 7:02 PM 4/18/2020 F5 F6 F7 F8 F9 F10 F11 F12 Home End Insert De SysRa PrntScrm 1Paure 144 LL * CengageNOWv2 |Online teachin X rer cengagenow h x My Home ment/takeAssignmentMain.do?invoker=&takeASsignmentSessionLocator%3D&inprogress%3Dfalse Calculator Print Item eBook Direct Labor Number of Direct Labor Hours- Units Production Number of Hours-Cutting Produced Finishing Runs Moves 5,000 4,000 2,000 6,000 Snowboards 430 2,500 2,000 4,000 6,000 Skis 70 7,500 6,000 6,000 12,000 Total 500 Required: 1. Determine the factory overhead rates under the multiple production department rate method. Assume that indirect labor is associated with the production departments, so that the total factory overhead is $315,000 and $540,000 for the Cutting and Finishing departments, respectively. Round per unit amounts to the nearest whole cent. Department Production Department Rate Cutting Department 26 X per direct labor hour Finishing Department %$1 32 X per direct labor hour 2. Determine the total and per-unit factory overhead costs allocated to each product, using the multiple production department overhead rates in (1). Round per unit amounts to the nearest whole cent. Product Total Factory Overhead Factory Overhead Per Unit Snowboards Skis 3. Determine the activity rates, assuming that the indirect labor is associated with activities rather than with the production departments. Round Der unit amounts to the nearest whole cent. Check My Work Previous 7:02 PM 4/18/2020 F5 F6 F7 F8 F9 F10 F11 F12 BIO Home End Insert K4 SysRq PmtSon %24 %24 %24

A My Home * CengageNOWv2 | Online teachin X ter cengagenowh x ament/takeAssignmentMain.do?invoker=D&takeAssignmentSessionLocator3D&inprogress%3Dfalse Calculator Print Item eBook Indirect labor $507,000 Cutting Department 156,000 Finishing Department 192,000 Total $855,000 The activity base associated with the two production departments is direct labor hours. The indirect labor can be assigned to two different activities as follows: Budgeted Activity Activity Cost Activity Base Production control $237,000 Number of production runs Materials handling 270,000 Number of moves Total $507,000 The activity-base usage quantities and units produced for the two products follow: Number of Direct Labor Direct Labor Production Number of Hours- Units Hours-Cutting Runs Moves Finishing Produced Snowboards 430 5,000 4,000 2,000 6,000 Skis 70 2,500 2,000 4,000 6,000 Check My Work Previous 7:02 PM 4/18/2020 F5 F6 F7 F8 F9 F10 F11 F12 Home End Insert De SysRa PrntScrm 1Paure 144 LL * CengageNOWv2 |Online teachin X rer cengagenow h x My Home ment/takeAssignmentMain.do?invoker=&takeASsignmentSessionLocator%3D&inprogress%3Dfalse Calculator Print Item eBook Direct Labor Number of Direct Labor Hours- Units Production Number of Hours-Cutting Produced Finishing Runs Moves 5,000 4,000 2,000 6,000 Snowboards 430 2,500 2,000 4,000 6,000 Skis 70 7,500 6,000 6,000 12,000 Total 500 Required: 1. Determine the factory overhead rates under the multiple production department rate method. Assume that indirect labor is associated with the production departments, so that the total factory overhead is $315,000 and $540,000 for the Cutting and Finishing departments, respectively. Round per unit amounts to the nearest whole cent. Department Production Department Rate Cutting Department 26 X per direct labor hour Finishing Department %$1 32 X per direct labor hour 2. Determine the total and per-unit factory overhead costs allocated to each product, using the multiple production department overhead rates in (1). Round per unit amounts to the nearest whole cent. Product Total Factory Overhead Factory Overhead Per Unit Snowboards Skis 3. Determine the activity rates, assuming that the indirect labor is associated with activities rather than with the production departments. Round Der unit amounts to the nearest whole cent. Check My Work Previous 7:02 PM 4/18/2020 F5 F6 F7 F8 F9 F10 F11 F12 BIO Home End Insert K4 SysRq PmtSon %24 %24 %24

SWFT Essntl Tax Individ/Bus Entities 2020

23rd Edition

ISBN:9780357391266

Author:Nellen

Publisher:Nellen

Chapter2: Working With The Tax Law

Section: Chapter Questions

Problem 1RP

Related questions

Question

Could you help me find the blanks

Transcribed Image Text:A My Home

* CengageNOWv2 | Online teachin X

ter cengagenowh x

ament/takeAssignmentMain.do?invoker=D&takeAssignmentSessionLocator3D&inprogress%3Dfalse

Calculator

Print Item

eBook

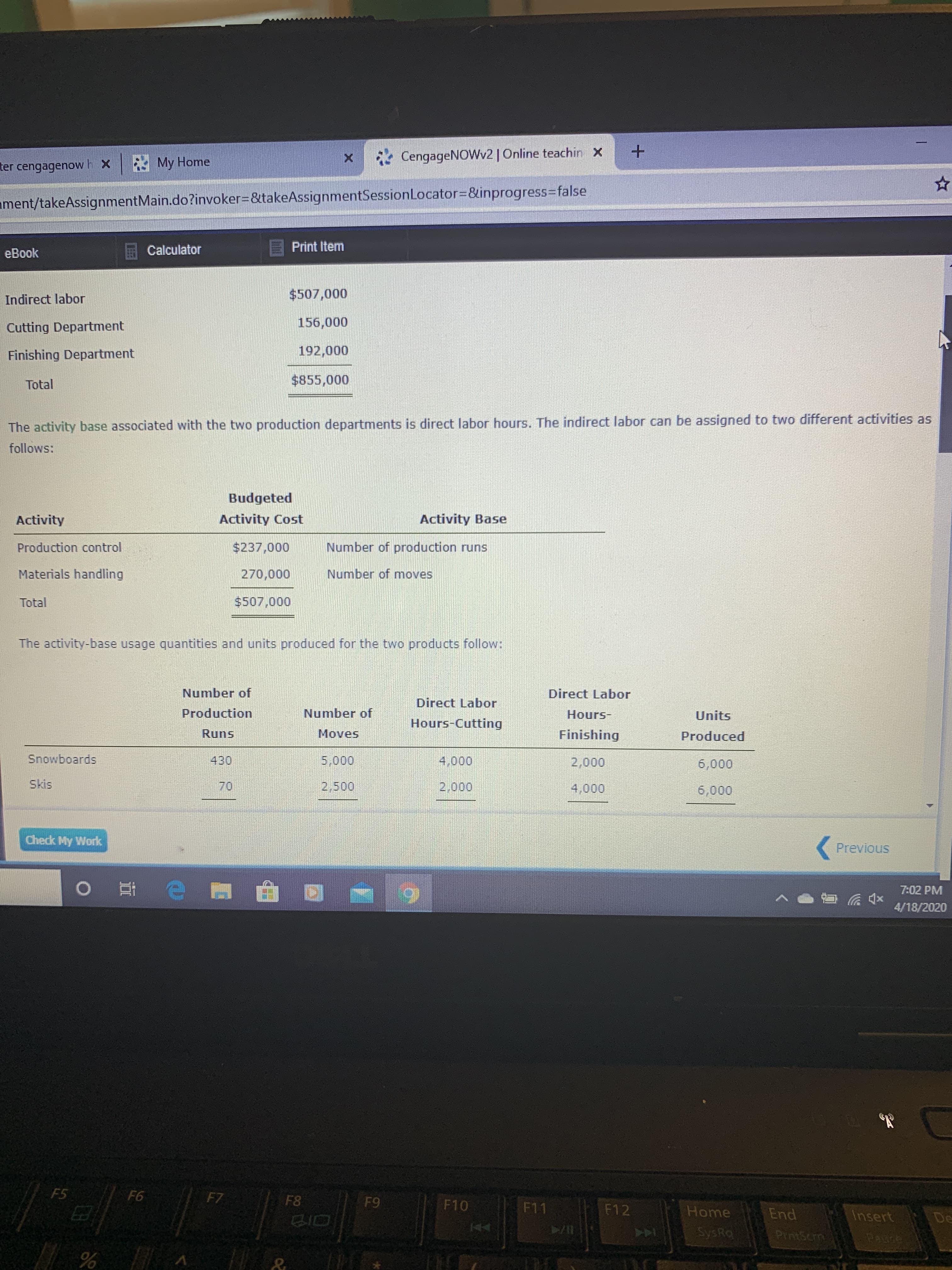

Indirect labor

$507,000

Cutting Department

156,000

Finishing Department

192,000

Total

$855,000

The activity base associated with the two production departments is direct labor hours. The indirect labor can be assigned to two different activities as

follows:

Budgeted

Activity

Activity Cost

Activity Base

Production control

$237,000

Number of production runs

Materials handling

270,000

Number of moves

Total

$507,000

The activity-base usage quantities and units produced for the two products follow:

Number of

Direct Labor

Direct Labor

Production

Number of

Hours-

Units

Hours-Cutting

Runs

Moves

Finishing

Produced

Snowboards

430

5,000

4,000

2,000

6,000

Skis

70

2,500

2,000

4,000

6,000

Check My Work

Previous

7:02 PM

4/18/2020

F5

F6

F7

F8

F9

F10

F11

F12

Home

End

Insert

De

SysRa

PrntScrm

1Paure

144

LL

Transcribed Image Text:* CengageNOWv2 |Online teachin X

rer cengagenow h x My Home

ment/takeAssignmentMain.do?invoker=&takeASsignmentSessionLocator%3D&inprogress%3Dfalse

Calculator

Print Item

eBook

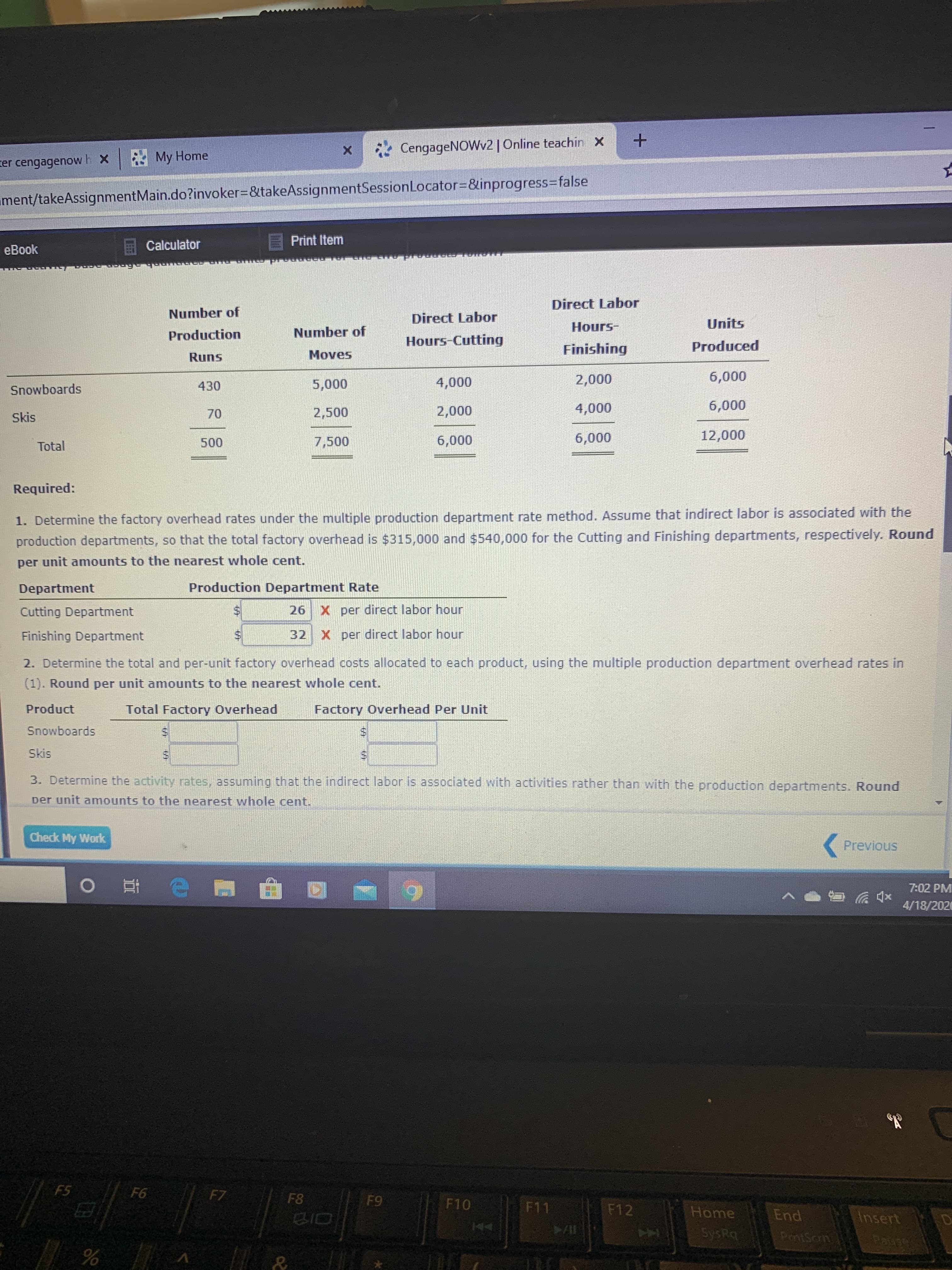

Direct Labor

Number of

Direct Labor

Hours-

Units

Production

Number of

Hours-Cutting

Produced

Finishing

Runs

Moves

5,000

4,000

2,000

6,000

Snowboards

430

2,500

2,000

4,000

6,000

Skis

70

7,500

6,000

6,000

12,000

Total

500

Required:

1. Determine the factory overhead rates under the multiple production department rate method. Assume that indirect labor is associated with the

production departments, so that the total factory overhead is $315,000 and $540,000 for the Cutting and Finishing departments, respectively. Round

per unit amounts to the nearest whole cent.

Department

Production Department Rate

Cutting Department

26

X per direct labor hour

Finishing Department

%$1

32 X per direct labor hour

2. Determine the total and per-unit factory overhead costs allocated to each product, using the multiple production department overhead rates in

(1). Round per unit amounts to the nearest whole cent.

Product

Total Factory Overhead

Factory Overhead Per Unit

Snowboards

Skis

3. Determine the activity rates, assuming that the indirect labor is associated with activities rather than with the production departments. Round

Der unit amounts to the nearest whole cent.

Check My Work

Previous

7:02 PM

4/18/2020

F5

F6

F7

F8

F9

F10

F11

F12

BIO

Home

End

Insert

K4

SysRq

PmtSon

%24

%24

%24

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you