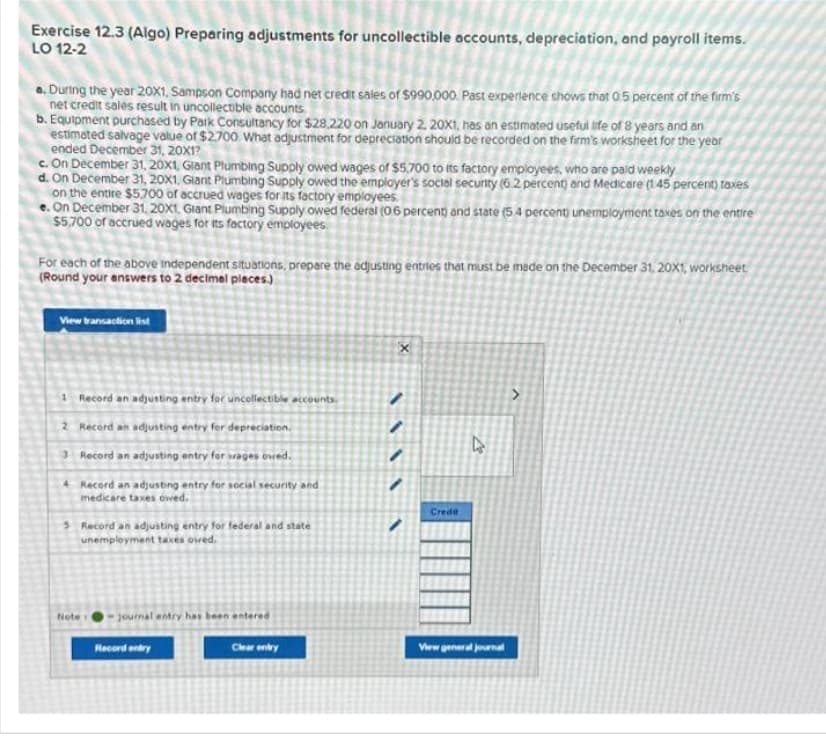

Exercise 12.3 (Algo) Preparing adjustments for uncollectible accounts, depreciation, and payroll items. LO 12-2 a. During the year 20X1, Sampson Company had net credit sales of $990,000. Past experience shows that 0.5 percent of the firm's net credit sales result in uncollectible accounts. b. Equipment purchased by Park Consultancy for $28,220 on January 2, 20x1, has an estimated useful life of 8 years and an estimated salvage value of $2.700 What adjustment for depreciation should be recorded on the firm's worksheet for the year ended December 31, 20X1? c. On December 31, 20x1, Giant Plumbing Supply owed wages of $5.700 to its factory employees, who are paid weekly d. On December 31, 20x1, Glarit Plumbing Supply owed the employer's social security (6.2 percent) and Medicare (145 percent) taxes on the entire $5700 of accrued wages for its factory employees. e. On December 31, 20X1, Giant Plumbing Supply owed federal (06 percent) and state (5.4 percent unemployment taxes on the entire $5,700 of accrued wages for its factory employees. For each of the above independent situations, prepare the adjusting entries that must be made on the December 31, 20X1, worksheet (Round your answers to 2 decimal places.)

Bad Debts

At the end of the accounting period, a financial statement is prepared by every company, then at that time while preparing the financial statement, the company determines among its total receivable amount how much portion of receivables is collected by the company during that accounting period.

Accounts Receivable

The word “account receivable” means the payment is yet to be made for the work that is already done. Generally, each and every business sells its goods and services either in cash or in credit. So, when the goods are sold on credit account receivable arise which means the company is going to get the payment from its customer to whom the goods are sold on credit. Usually, the credit period may be for a very short period of time and in some rare cases it takes a year.

Subject-accounting

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images