Exercise 5bis: Collusion with asymmetric costs and Bertrand competition Two firms compete in a market for a homogeneous product. In this market there are N=1 consumers (the normalization N=1 eliminates one parameter); each consumer buys one unit if the price of the product does not exceed 10, and nothing otherwise. Consumers buy from the firm selling at the lowest price. Assume also that firm 1 has lower marginal costs: c1=0

Exercise 5bis: Collusion with asymmetric costs and Bertrand competition Two firms compete in a market for a homogeneous product. In this market there are N=1 consumers (the normalization N=1 eliminates one parameter); each consumer buys one unit if the price of the product does not exceed 10, and nothing otherwise. Consumers buy from the firm selling at the lowest price. Assume also that firm 1 has lower marginal costs: c1=0

Managerial Economics: A Problem Solving Approach

5th Edition

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Chapter16: Bargaining

Section: Chapter Questions

Problem 16.1IP

Related questions

Question

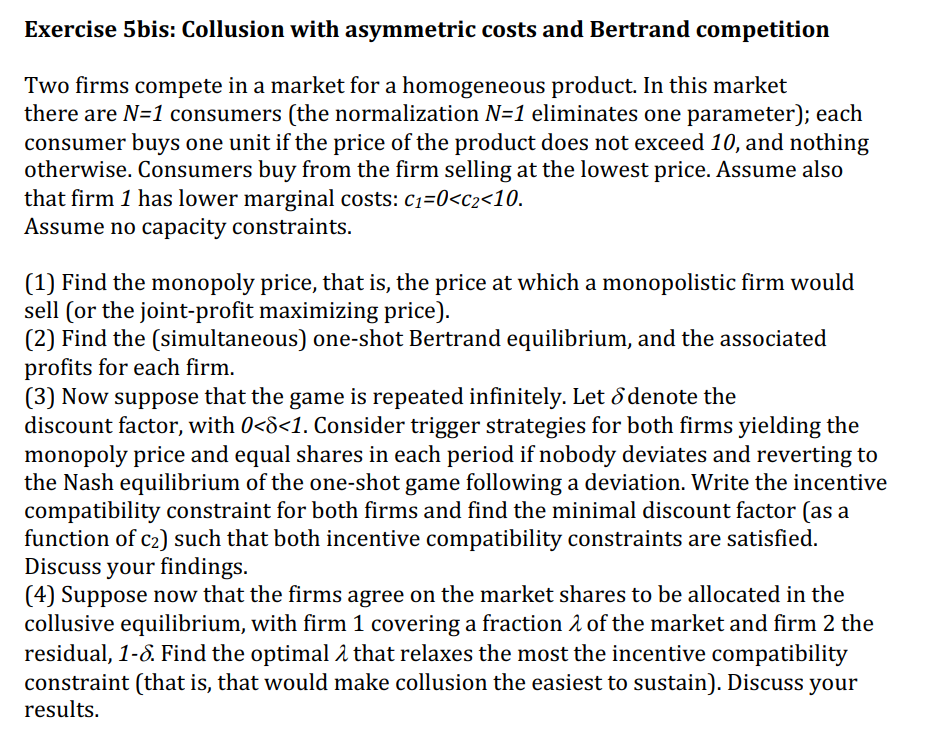

Transcribed Image Text:Exercise 5bis: Collusion with asymmetric costs and Bertrand competition

Two firms compete in a market for a homogeneous product. In this market

there are N=1 consumers (the normalization N=1 eliminates one parameter); each

consumer buys one unit if the price of the product does not exceed 10, and nothing

otherwise. Consumers buy from the firm selling at the lowest price. Assume also

that firm 1 has lower marginal costs: c1=0<c2<10.

Assume no capacity constraints.

(1) Find the monopoly price, that is, the price at which a monopolistic firm would

sell (or the joint-profit maximizing price).

(2) Find the (simultaneous) one-shot Bertrand equilibrium, and the associated

profits for each firm.

(3) Now suppose that the game is repeated infinitely. Let d denote the

discount factor, with 0<8<1. Consider trigger strategies for both firms yielding the

monopoly price and equal shares in each period if nobody deviates and reverting to

the Nash equilibrium of the one-shot game following a deviation. Write the incentive

compatibility constraint for both firms and find the minimal discount factor (as a

function of c2) such that both incentive compatibility constraints are satisfied.

Discuss your findings.

(4) Suppose now that the firms agree on the market shares to be allocated in the

collusive equilibrium, with firm 1 covering a fraction 2 of the market and firm 2 the

residual, 1-8. Find the optimal 2 that relaxes the most the incentive compatibility

constraint (that is, that would make collusion the easiest to sustain). Discuss your

results.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Economics: A Problem Solving Approach

Economics

ISBN:

9781337106665

Author:

Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:

Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:

9781337106665

Author:

Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:

Cengage Learning