Cornerstones of Financial Accounting

4th Edition

ISBN: 9781337690881

Author: Jay Rich, Jeff Jones

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:奋

ezto.mheducation.com

my Chapt...

V My C...

P Pears...

M Confir...

PHighe...

Googl...

M Inbox...

nike 1...

M

omework i

Saved

H

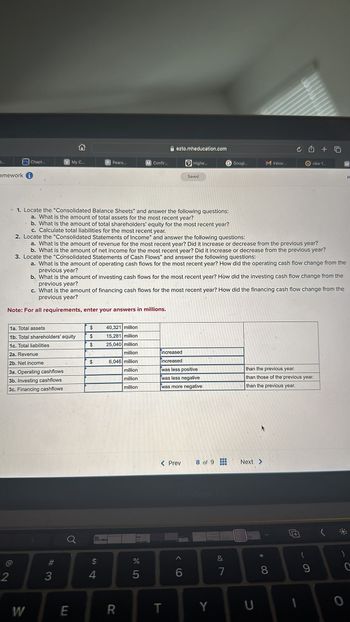

1. Locate the "Consolidated Balance Sheets" and answer the following questions:

a. What is the amount of total assets for the most recent year?

b. What is the amount of total shareholders' equity for the most recent year?

c. Calculate total liabilities for the most recent year.

2. Locate the "Consolidated Statements of Income" and answer the following questions:

a. What is the amount of revenue for the most recent year? Did it increase or decrease from the previous year?

b. What is the amount of net income for the most recent year? Did it increase or decrease from the previous year?

3. Locate the "Consolidated Statements of Cash Flows" and answer the following questions:

a. What is the amount of operating cash flows for the most recent year? How did the operating cash flow change from the

previous year?

b. What is the amount of investing cash flows for the most recent year? How did the investing cash flow change from the

previous year?

c. What is the amount of financing cash flows for the most recent year? How did the financing cash flow change from the

previous year?

Note: For all requirements, enter your answers in millions.

1a. Total assets

$

40,321 million

1b. Total shareholders' equity

$

15,281 million

1c. Total liabilities

$

2a. Revenue

2b. Net income

$

25,040 million

million

6,046 million

increased

3a. Operating cashflows

million

increased

was less positive

than the previous year.

3b. Investing cashflows

million

was less negative

than those of the previous year.

3c. Financing cashflows

million

was more negative

than the previous year.

2

@

905

$

%

94

#3

< Prev

8 of 9

Next >

MacBook Pro

&

6

7

29

W

E

R

T

Y

C

80

9

)

O

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- The following information came from a recent balance sheet of Apple Computer, Inc.:End of Year Beginning of YearAssets . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $53.9 billion $39.6 billionLiabilities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $26.0 billion ?Owners’ Equity . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ? $21.0 billiona. Determine the amount of total liabilities reported in Apple Computer ’s balance sheet at thebeginning of the year.b. Determine the amount of total owners’ equity reported in Apple Computer ’s balance sheet atthe end of the year.c. Retained earnings was reported in Apple Computer ’s year-end balance sheet at $19.5 billion.If retained earnings was $13.8 billion at the beginning of the year, determine net income forthe year if no dividends were declared.arrow_forwardBoscia Corporation's balance sheet appears below: Comparative Balance Sheet Ending Balance Beginning Balance Assets: Cash and cash equivalents......................... $ 44 $ 38 Accounts receivable .................................. 82 69 Inventory ................................................... 71 69 Plant and equipment .................................. 537 500 Accumulated depreciation......................... ( 240) ( 201) Total assets................................................ $494 $475 Liabilities and stockholders’ equity: Accounts payable ...................................... $ 70 $ 60 Wages payable........................................... 24 21 Taxes payable ............................................ 19 22 Bonds payable ........................................... 226 300 Deferred taxes............................................ 19 18 Common stock........................................... 22 20 Retained earnings...................................... 114 34 Total…arrow_forwardUse the following information from XYZ Company's balance sheet to answer the next six questions: Assets a. b. c. d. a. b. 30. C. d. Cash........ Marketable Securities Accounts Receivable Inventory........ Property and Equipment. Accumulated Depreciation. Total Assets a. b. c. d. Liabilities and Stockholders' Equity Accounts Payable. Notes Payable (current). Mortgage Payable (long-term). Bonds Payable (long-term). Common Stock, $50 Par.. The average number of common stock shares outstanding during the year was 840 shares. Net earnings for the year were $6,300. 25. XYZ's current ratio is 6.0 to 1. 5.5 to 1. 26. XYZ's quick (acid-test) ratio is 4.0 to 1. 4.5 to 1. 3.5 to 1. 3.0 to 1. Paid-in Capital in Excess of Par......... Retained Earnings............ Total Liabilities, and Stockholders' Equity 4.0 to 1. 4.5 to 1. ***** 27. XYZ's earnings per share is $7.50 per share. $7.00 per share. $0.13 per share. $6,300 per share. 28. XYZ's return on assets is a. 6.9% b. 7.9% C. 14.6% d. 23.4% 29.…arrow_forward

- Find the following using the data bellow a. Accounts receivable B. Current assets C. Total assets D. Return on assets E. Common equity F. Quick ratioarrow_forwardThe comparative balance sheet for Proctor Precision appears below: PROCTOR PRECISION Comparative Balance Sheet Dec. 31, 2017Dec. 31, 2016 Assets Cash................................................$30,500$6,000 Accounts receivable...................................2,5004,000 Inventory............................................5,5003,500 Prepaid expenses.....................................1,0001,500 Building.............................................10,00010,000 Accumulated depreciation—building....................... (1,500) (1,000) Total assets..........................................$48,000$24,000 Liabilities and Stockholders' Equity Accounts payable.....................................$ 1,000$ 2,000 Long-term note payable................................6,5007,000 Common stock........................................19,0009,000 Retained earnings..................................... 21,500 6,000 Total liabilities and stockholders'…arrow_forwardPlease help with those question.arrow_forward

- Following are data from the statements of two companies selling comparable products: Current Year-End Balance Sheets SunCompany ZengCompany Cash......................................................................................... 119.00 180.00 Notes receivable....................................................................... 77.00 32.00 Accounts receivable, net........................................................... 420.00 640.00 Merchandise inventory.............................................................. 588.00 877.00 Prepaid expenses...................................................................... 16.00 55.00 Plant and equipment, net........................................................... 2,321.00 2,744.00 Total assets...............................................................................…arrow_forwardACCOUNTING ASAP Assume the following data: EBIT = 100; Depreciation = 40; Interest = 20; Dividends = 10. Calculate the cash coverage ratio. Select one: a. 7.0x b. 4.7x c. 14.0x d. 5.0xarrow_forwardI need questions 28, 29, and 30arrow_forward

- Vertical Analysis of Balance Sheet Balance sheet data for a company for the years ended December 31, 20Y2 and 20Y1, are shown below. 20Y2 20Υ1 Current assets $ 752,000 $ 602,000 Property, plant, and equipment 6,248,000 5,397,000 Intangible assets 1,000,000 1,001,000 Current liabilities 504,000 427,000 Long-term liabilities 1,504,000 1,197,000 Common stock 1,248,000 1,253,000 Retained earnings 4,744,000 4,123,000 | Prepare a comparative balance sheet for 20Y2 and 20Y1, stating each asset as a percent of total assets and each liability and stockholders' equity item as a percent of the total liabilities and stockholders' equity. Round your answers to one decimal place. Comparative Balance Sheet December 31, 20Y2 and 20Y1 20Y2 Amount 20Y2 Percent 20Y1 Amount 20Y1 Percent Assets Current assets $752,000 % $602,000 % Property, plant, and equipment 6,248,000 5,397,000 Intangible assets 1,000,000 1,001,000arrow_forwardRequired: 1. Express all of the asset, liability, and sales data in trend percentages. Use Year 1 as the base year. (Round your percentage answers to 1 decimal place (i.e., 0.1234 should be entered as 12.3).) Sales Current assets: Cash Accounts receivable, net Inventory Total current assets Current liabilities Year 1 % % % % % % Year 2 % % % % % % Year 3 % % % % % % Year 4 % % % % % Year 5 % % % % %arrow_forward1. If current assets amounted to P600,000 and current liabilities amounted to P200,000, what is the current ratio of the entity? *a. P800,000b. P400,000c. 3d. 1/3 3. If net sales is P200,000 and the average accounts receivable is P50,000, what is the accounts receivable turnover ratio? *a. 4b. 1/4c. P150,000d. P250,000 5. If total assets amounted to P800,000 and total liabilities amounted to P200,000, what is the debt to equity ratio? *a. 4b. 0.3333c. 0.25d. 3arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:9781337679503

Author:Gilbertson

Publisher:Cengage