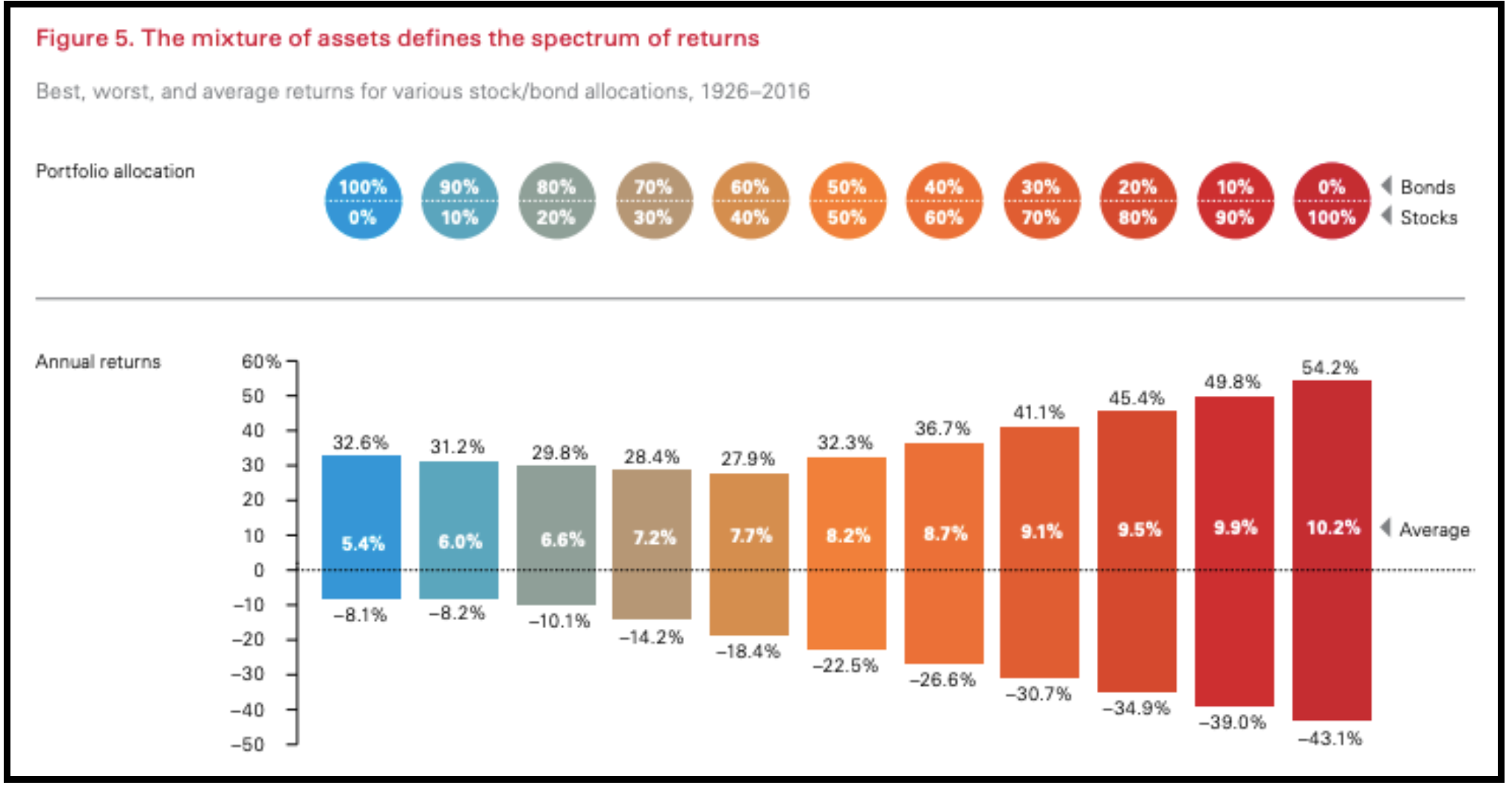

Figure 5. The mixture of assets defines the spectrum of returns Best, worst, and average returns for various stock/bond allocations, 1926-2016 Portfolio allocation 100% 80% 10% 70% 30% 90% 60% 50% 40% 30% 20% 0% Bonds 0% 10% 20% 40% 50% 60% 70% 80% 90% 100% Stocks Annual returns 60% 54.2% 49.8% 50 45.4% 41.1% 40 36.7% 32.6% 31.2% 32.3% 29.8% 28.4% 27.9% 30 20 10 7.2% 7.7% 8.2% 8.7% 9.1% 9.5% 9.9% 10.2% Average 5.4% 6.0% 6.6% -10 -8.1% -8.2% -10.1% -20 -14.2% -18.4% -22.5% -30 -26.6% -30.7% -40 -34.9% -39.0% -50 -43.1%

Figure 5. The mixture of assets defines the spectrum of returns Best, worst, and average returns for various stock/bond allocations, 1926-2016 Portfolio allocation 100% 80% 10% 70% 30% 90% 60% 50% 40% 30% 20% 0% Bonds 0% 10% 20% 40% 50% 60% 70% 80% 90% 100% Stocks Annual returns 60% 54.2% 49.8% 50 45.4% 41.1% 40 36.7% 32.6% 31.2% 32.3% 29.8% 28.4% 27.9% 30 20 10 7.2% 7.7% 8.2% 8.7% 9.1% 9.5% 9.9% 10.2% Average 5.4% 6.0% 6.6% -10 -8.1% -8.2% -10.1% -20 -14.2% -18.4% -22.5% -30 -26.6% -30.7% -40 -34.9% -39.0% -50 -43.1%

Fundamentals of Financial Management, Concise Edition (with Thomson ONE - Business School Edition, 1 term (6 months) Printed Access Card) (MindTap Course List)

8th Edition

ISBN:9781285065137

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Eugene F. Brigham, Joel F. Houston

Chapter8: Risk And Rates Of Return

Section: Chapter Questions

Problem 22SP

Related questions

Question

- Calculate the range of potential annual returns if you invested 10% in bonds and 90% in stocks. How does this range compare with the range of annual returns if you invested 10% in stocks and 90% bonds?

- What might you say to someone whose reason for investing in 90% bonds and 10% stocks is that they want a 6% return on investment?

- Use evidence from this graph to explain the value of investing in both stocks and bonds - not just one or the other.

Transcribed Image Text:Figure 5. The mixture of assets defines the spectrum of returns

Best, worst, and average returns for various stock/bond allocations, 1926-2016

Portfolio allocation

100%

80%

10%

70%

30%

90%

60%

50%

40%

30%

20%

0%

Bonds

0%

10%

20%

40%

50%

60%

70%

80%

90%

100%

Stocks

Annual returns

60%

54.2%

49.8%

50

45.4%

41.1%

40

36.7%

32.6%

31.2%

32.3%

29.8%

28.4%

27.9%

30

20

10

7.2%

7.7%

8.2%

8.7%

9.1%

9.5%

9.9%

10.2%

Average

5.4%

6.0%

6.6%

-10

-8.1%

-8.2%

-10.1%

-20

-14.2%

-18.4%

-22.5%

-30

-26.6%

-30.7%

-40

-34.9%

-39.0%

-50

-43.1%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781285065137

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781305635937

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781285867977

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781285065137

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781305635937

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781285867977

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning