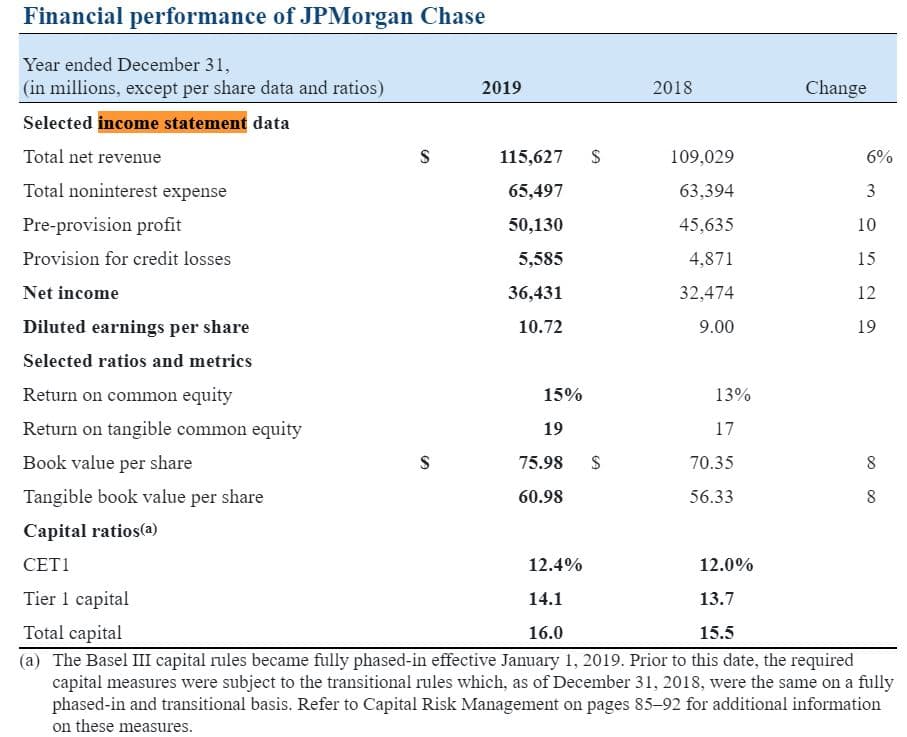

Financial performance of JPMorgan Chase Year ended December 31, (in millions, except per share data and ratios) 2019 2018 Change Selected income statement data Total net revenue 115,627 109,029 6% Total noninterest expense 65,497 63,394 Pre-provision profit 50,130 45,635 10 Provision for credit losses 5,585 4,871 15 Net income 36,431 32,474 12 Diluted earnings per share 10.72 9.00 19 Selected ratios and metrics Return on common equity 15% 13% Return on tangible common equity 19 17 Book value per share 75.98 70.35 Tangible book value per share 60.98 56.33 Capital ratios(a) CET1 12.4% 12.0% Tier 1 capital 14.1 13.7 Total capital 16.0 15.5 (a) The Basel III capital rules became fully phased-in effective January 1, 2019. Prior to this date, the required capital measures were subject to the transitional rules which, as of December 31, 2018, were the same on a fully phased-in and transitional basis. Refer to Capital Risk Management on pages 85-92 for additional information on these measures.

Financial performance of JPMorgan Chase Year ended December 31, (in millions, except per share data and ratios) 2019 2018 Change Selected income statement data Total net revenue 115,627 109,029 6% Total noninterest expense 65,497 63,394 Pre-provision profit 50,130 45,635 10 Provision for credit losses 5,585 4,871 15 Net income 36,431 32,474 12 Diluted earnings per share 10.72 9.00 19 Selected ratios and metrics Return on common equity 15% 13% Return on tangible common equity 19 17 Book value per share 75.98 70.35 Tangible book value per share 60.98 56.33 Capital ratios(a) CET1 12.4% 12.0% Tier 1 capital 14.1 13.7 Total capital 16.0 15.5 (a) The Basel III capital rules became fully phased-in effective January 1, 2019. Prior to this date, the required capital measures were subject to the transitional rules which, as of December 31, 2018, were the same on a fully phased-in and transitional basis. Refer to Capital Risk Management on pages 85-92 for additional information on these measures.

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter9: Long-term Liabilities

Section: Chapter Questions

Problem 103.4C

Related questions

Question

Practice Pack

Hello-

Please help me find Net Profit Margin.

Thanks,

Transcribed Image Text:Financial performance of JPMorgan Chase

Year ended December 31,

(in millions, except per share data and ratios)

2019

2018

Change

Selected income statement data

Total net revenue

115,627

109,029

6%

Total noninterest expense

65,497

63,394

Pre-provision profit

50,130

45,635

10

Provision for credit losses

5,585

4,871

15

Net income

36,431

32,474

12

Diluted earnings per share

10.72

9.00

19

Selected ratios and metrics

Return on common equity

15%

13%

Return on tangible common equity

19

17

Book value per share

75.98

70.35

Tangible book value per share

60.98

56.33

Capital ratios(a)

CET1

12.4%

12.0%

Tier 1 capital

14.1

13.7

Total capital

16.0

15.5

(a) The Basel III capital rules became fully phased-in effective January 1, 2019. Prior to this date, the required

capital measures were subject to the transitional rules which, as of December 31, 2018, were the same on a fully

phased-in and transitional basis. Refer to Capital Risk Management on pages 85-92 for additional information

on these measures.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Includes step-by-step video

Trending now

This is a popular solution!

Learn your way

Includes step-by-step video

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning