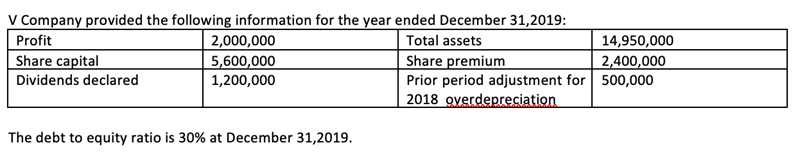

V Company provided the following information for the year ended December 31,2019: 2,000,000 5,600,000 Total assets Share premium Prior period adjustment for 500,000 2018 overdepreciation Profit Share capital Dividends declared 14,950,000 2,400,000 1,200,000 The debt to equity ratio is 30% at December 31,2019.

Q: The changes in account balances of ENIGMA Co. during 2020 are as follows: Assets: P133,500 increase…

A: Assets: P133,500 increase Liabilities: P40,500 decrease Ordinary share capital: P90,000 increase…

Q: During 2019, Minh Corporation had a net income of $144,000. Ordinary share capital was $200,000…

A: Cash flow statement is a statement which is prepared to find out the cash comes in and goes out , by…

Q: The changes in account balances of Smile Co. during 2020 are as follows: Assets: P133,500 increase…

A: Net income is the worth which is ascertained by deducting all the operating expenses from the gross…

Q: re the information of Talc Inc. for the year 2020 · Net assets, Jan.1, 2020- P1,000,000 ·…

A: Solution: Net assets are equal to equity of the company.

Q: Presented below is information related to Sheridan Corp. for the year 2020. The information is…

A: Income Statement - It is a financial statement which shows the company's income and expenses over a…

Q: At the beginning of its fiscal year July 1, 2020, RPC had a balance of $2,150,000. It generated…

A: Statement of retained earnings: Particulars $ Beginning Balance of Retained Earnings XXX Add:…

Q: Computing Retained Earnings and Net Income The following selected balance sheet amounts are from…

A: The Closing Retained earnings is the balancing figure for this balance sheet.

Q: On January 1, 2020, Anderson Corporation had retained earnings of $400,000. During 2020, Anderson…

A: Ending retained earnings = Beginning retained earnings + Net income - Dividends

Q: Royalbird Co. reports the following information for 2020: sales revenue $762,900, cost of goods sold…

A:

Q: On December 31, 2020, the balance sheet of Legend Corporation shows a total equity of P1,260,000.…

A: Retained Earning at the end of the year = Current Retained Earnings + Profit/Loss – Dividends

Q: Hello Guys here is the Income statement, balance sheet for Marriot and average stock price for 20…

A: Please note that we have answered the first question here. Please resubmit the other questions…

Q: On January 1, 2020, Cave Corporation had retained earnings of $7,900,000. During 2020, Cave reported…

A: Retained earnings is the part of net income which is retained by the entity and not paid as…

Q: The account balance information for Miller Company at the end of 2019 and 2020 and related 2020…

A: Cash flow statement: It is a statement which reports the cash inflows and outflows of a business…

Q: Kingbird Corporation has retained earnings of $710,000 at January 1, 2020. Net income during 2020…

A: Retained Earnings are the amount of a business's profits left to the company after the distribution…

Q: Portman Corporation has retained earnings of $675,000 at January 1, 2020. Net income during 2020 was…

A: Given information is: Portman Corporation has retained earnings of $675,000 at January 1, 2020. Net…

Q: The December 31, 2018, balance sheet of Whelan, Inc, showed long-term debt of $1,385,000, $137.000…

A: Computation of new net borrowing: New net borrowing = Long term debt of 2019 - Long term debt 2018…

Q: RED Corporation's account balances during 2021 showed the following changes, all increases: Assets…

A: Solution Concept Using accounting equation Change in assets =change in liabilities +…

Q: The following information was obtained from the financial records of Roger Ltd for the year ended 30…

A: Statement showing changes in equity: It is a financial statement showing the details of the change…

Q: Balance Sheet Calculations Fermer Company's balance sheet information at the end of 2019 and 2020…

A: Balance Sheet is the statement showing financial position of an entity as on a given date It…

Q: What is the retained earnings balance on January 1,2019 before restatement? * V Company provided the…

A: Retained earnings are the accumulated earnings in the business, which belongs to the owners and…

Q: 0 at GHC12.50 each] 500,000 Preference shares [20,000 at GHC8.00 each] 160,000 660,000 Long term…

A: Budget : A Budget is a financial plan for future concerning the revenue and cost of business.…

Q: The changes in account balances of ENIGMA Co. during 2020 are as follows: Assets: P133,500 increase…

A: Liabilities: It is the amount the company is liable to payoff in the accounting life of the company.…

Q: Nash Corporation had net sales of $2,401,300 and interest revenue of $36,200 during 2020. Expenses…

A: Under Multi-Step Income Statement, All the line items are required to be shown in the specific…

Q: Shilling Company reports the following information for its fiscal year-end of March 31, 2019: Common…

A: Paid-in capital in excess of par – Common = Total stockholders’ equity - Common stock - Retained…

Q: The December 31, 2018, balance sheet of Whelan, Inc., showed long-term debt of $1,420,000, $144,000…

A: Cash flow is the movement of money into and out of the business by purchasing or selling goods. It…

Q: Pong Corp has retained earnings of 693.600 at January 1, 2020. Net income during 2020 was 1,546,000,…

A: Retained earnings are the amount which was retained by the organisation after all of its expenses…

Q: Presented below is X Corporation's selected data for 2020: Retained Eamings, January 1, 2020…

A: "Since you have posted multiple questions, we will solve the first question for you. To get the…

Q: National Co. has the following balance sheet as of December 31, 2022. Current assets P 600,000 Fixed…

A: Additional Needed Fund: AFN is a financial term utilised when a company wants to grow. To put it…

Q: Blue Corporation had net sales of $2,401,600 and interest revenue of $36,800 during 2020. Expenses…

A: A multistep income statement is the income statement which computes income at various stages like…

Q: BALANCE SHEET, YEAR-END, 2019 Assets Liabilities Current assets Current liabilities Accounts payable…

A: Financing is the process of providing funds for Business Activities, making purchases, or investing.

Q: Please calculate the verticle and horizontal analysis of the Income statement. Consolidated…

A: Common Size Statement is also known as the vertical analysis method. The Company uses this method to…

Q: The December 31, 2018, balance sheet of Whelan, Inc., showed long-term debt of $1,380,000, $136,000…

A: The question is based on the concept of Financial Management.

Q: operating

A: Formula to calculate operating cashflows: Cashflow from assets + Net capital spending + Net change…

Q: The following information was available for the year ended December 31, 2019: Sales $600,000 85,600…

A: Solution a i) Margin ratio = net income/ sales*100 =$85600 / 600,000*100 = 14.27% ii). Assets…

Q: For the Year ended December 2019. Alaska company , reported net income of $ 4,200 on revenues of $…

A: Financial ratios show the relationship between two financial items on a balance sheet, income…

Q: On January 1, 2020, Jack and Jill Companies had condensed balance sheets as shown below: Jack…

A: Acquisition - When one company purchases most of shares of other company for gaining control of…

Q: V Company provided the following information for the year ended December 31,2019: Total assets Share…

A: Retained earnings: These are the accumulated earnings of the company. These earnings were…

Q: Swifty Co. reports the following information for 2020: sales revenue $768,300, cost of goods sold…

A: Net Income: Deduction of cost of goods sold and other operating expenses etc from Total revenues in…

Q: Glendale Ltd. reported the following selected data at December 31, 2021 and 2020: 2021 2020 Total…

A: Solution a: Debt to Total assets = Total liabilities / total assets 2021 = $309,000 / $515,000 =…

Q: Computing Financial Statement Measures The following pretax amounts are taken from the adjusted…

A: Gross profit is the money a business makes after deducting the costs of producing and selling its…

Q: 1. As of December 31, 2019, XYZ Company reported assets of $7,400,000, liabilities of $2,200,000,…

A: Statement of financial position forms a part of financial statements of the company and is prepared…

Q: Here is financial information for Glitter Inc. December 31, 2020 December 31, 2019 Current assets…

A: Horizontal analysis is prepared to calculate the variance from the previous year by showing an…

Q: The financial position as at 31st December, 2019 was as follows: EQUITY AND LIABILITIES GH¢ GH¢…

A: BUDGET:- A budget is a financial plan for future concerning the revenue and cost of business.…

Q: On January 1, 2020, Jack and Jill Companies had condensed balance sheets as shown below: Jack…

A: Journal entry: it is the second step in the accounts, it is the passing on the basis of the…

Q: The statement of financial position of KY Limited at 31 December 2019 shows the following.…

A: Here in this question, Return on capital employed is a profitability ratio which indicates how much…

Q: The following information was available for the year ended December 31, 2019. Net income Average…

A: DPS (dividend per share) indicates the amount of dividend that corporation offers with respect to…

Q: The financial position as at 31st December, 2019 was as follows: EQUITY AND LIABILITIES GH¢ GH¢…

A: The cash budget is as follows: Amasaman Ltd Cash Budget January 2020 February 2020 March…

Q: Balance Sheet Calculations Fermer Company's balance sheet information at the end of 2019 and 2020 is…

A: 1. Balance Sheet - This Statement shows the balance of assets liabilities and Equity as at the…

Q: Prepare a schedule showing a horizontal analysis for 2022, using 2021 as the base year.

A: Horizontal Analysis: It is a technique of analysing the financial statements of an organization…

What is the retained earnings balance on January 1,2019 before restatement?

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

- Refer to the information in RE13-5. Assume that on December 31, 2019, the investment in Smith Corporation bonds has a market value of 12,500. Prepare the year-end journal entry to record the unrealized gain or loss.Leverage Cook Corporation issued financial statements at December 31, 2019, that include the following information: Balance sheet at December 31,2019 Assets $8,000,000 Liabilities $1,200,000 Stockholders' equity (300,000 shares) $6,800,000 Income statement for 2019: Income from operations $1,200,000 Less: Interest expense (100,000) Income before taxes $1,100,000 Less: Income taxes expense (0,30) (330,000) Net income $ 770,000 The levels of assets, liabilities, stockholders' equity, and operating income have been stable in recent years; however, Cook Corporation is planning a 51,800,000 expansion program that will increase income from operations by $350,000 to $1,550,000, Cook is planning to sell 8.5% notes at par to finance the expansion. Required: What earnings per share does Cook report before the expansion?Net Income and Comprehensive Income At the beginning of 2019, JR Companys shareholders equity was as follows: During 2019, the following events and transactions occurred: 1. JR recognized sales revenues of 108,000. It incurred cost of goods sold of 62,000 and operating expenses of 12,000, 2. JR issued 1,000 shares of its 5 par common stock for 14 per share. 3. JR invested 30,000 in available-for-sale securities. At the end of the year, the securities had a fair value of 35,000. 4. JR paid dividends of 6,000. The income tax rate on all items of income is 30%. Required: 1. Prepare a 2019 income statement for JR which includes net income and comprehensive income ignore earnings per share). 2. For 2016 prepare a separate (a) income statement (ignore earnings per share) and (b) statement of comprehensive income.

- During 2021, Anthony Company purchased debt securities as a long-term investment and classified them as trading. All securities were purchased at par value. Pertinent data are as follows: The net holding gain or loss included in Anthonys income statement for the year should be: a. 0 b. 3,000 gain c. 9,000 loss d. 12,000 lossFrost Company has accumulated the following information relevant to its 2019 earningsper share. 1. Net income for 2019: 150,500. 2. Bonds payable: On January 1, 2019, the company had issued 10%, 200,000 bonds at 110. The premium is being amortized in the amount of 1,000 per year. Each 1,000 bond is currently convertible into 22 shares of common stock. To date, no bonds have been converted. 3. Bonds payable: On December 31, 2017, the company had issued 540,000 of 5.8% bonds at par. Each 1,000 bond is currently convertible into 11.6 shares of common stock. To date, no bonds have been converted. 4. Preferred stock: On July 3, 2018, the company had issued 3,800 shares of 7.5%, 100 par, preferred stock at 108 per share. Each share of preferred stock is currently convertible into 2.45 shares of common stock. To date, no preferred stock has been converted and no additional shares of preferred stock have been issued. The current dividends have been paid. 5. Common stock: At the beginning of 2019, 25,000 shares were outstanding. On August 3, 7,000 additional shares were issued. During September, a 20% stock dividend was declared and issued. On November 30, 2,000 shares were reacquired as treasury stock. 6. Compensatory share options: Options to acquire common stock at a price of 33 per share were outstanding during all of 2019. Currently, 4,000 shares may be acquired. To date, no options have been exercised. The unrecognized compens Frost Company has accumulated the following information relevant to its 2019 earnings ns is 5 per share. 7. Miscellaneous: Stock market prices on common stock averaged 41 per share during 2019, and the 2019 ending stock market price was 40 per share. The corporate income tax rate is 30%. Required: 1. Compute the basic earnings per share. Show supporting calculations. 2. Compute the diluted earnings per share. Show supporting calculations. 3. Indicate which earnings per share figure(s) Frost would report on its 2019 income statement.Prince Corporations accounts provided the following information at December 31, 2019: What should be the current balance of retained earnings? a. 520,000 b. 580,000 c. 610,000 d. 670,000

- Wilbury Corporation issued 1 million of 13.5% bonds for 985,071.68. The bonds are dated and issued October 1, 2019, are due September 30, 2020, and pay interest semiannually on March 31 and September 30. Assume an effective yield rate of 14%. Required: 1. Prepare a bond interest expense and discount amortization schedule using the straight-line method. 2. Prepare a bond interest expense and discount amortization schedule using the effective interest method. 3. Prepare adjusting entries for the end of the fiscal year December 31, 2019, using the: a. straight-line method of amortization b. effective interest method of amortization 4. If income before interest and income taxes of 30% in 2020 is 500,000, compute net income under each alternative. 5. Assume the company retired the bonds on June 30, 2020, at 98 plus accrued interest. Prepare the journal entries to record the bond retirement using the: a. straight line method of amortization b. effective interest method of amortization 6. Compute the companys times interest earned (pretax operating income divided by interest expense) for 2020 under each alternative.Roseau Company is preparing its annual earnings per share amounts to be disclosed on its 2019 income statement. It has collected the following information at the end of 2019: 1. Net income: 120,400. Included in the net income is income from continuing operations of 130,400 and a loss from discontinued operations (net of income taxes) of 10,000. Corporate income tax rate: 30%. 2. Common stock outstanding on January 1, 2019: 20,000 shares. 3. Common stock issuances during 2019: July 6, 4,000 shares; August 24, 3,000 shares. 4. Stock dividend: On October 19, 2019, the company declared a 10% stock dividend that resulted in 2,700 additional outstanding shares of common stock. 5. Common stock prices: 2019 average market price, 30 per share; 2019 ending market price, 27 per share. 6. 7% preferred stock outstanding on January 1, 2019: 1,000 shares. Terms: 100 par, nonconvertible. Current dividends have been paid. No preferred stock issued during 2019. 7. 8% convertible preferred stock outstanding on January 1, 2019: 800 shares. The stock was issued in 2018 at 130 per share. Each 100 par preferred stock is currently convertible into 1.7 shares of common stock. Current dividends have been paid. To date, no preferred stock has been converted. 8. Bonds payable outstanding on January 1, 2019: 100,000 face value. These bonds were issued several years ago at 97 and pay annual interest of 9.6%. The discount is being amortized in the amount of 300 per year. Each 1,000 bond is currently convertible into 22 shares of common stock. To date, no bonds have been converted. 9. Compensatory share options outstanding: Key executives may currently acquire 3,000 shares of common stock at 20 per share. The options were granted in 2018. To date, none have been exercised. The unrecognized compensation cost (net of tax) related to the options is 4 per share. Required: 1. Compute the basic earnings per share. Show supporting calculations. 2. Compute the diluted earnings per share. Show supporting calculations. 3. Show how Roseau would report these earnings per share figures on its 2019 income statement. Include an explanatory note to the financial statements.Ratio Analysis Rising Stars Academy provided the following information on its 2019 balance sheet and state mcnt of cash flows: Long-term debt S 4,400 Interest expense S 398 Total liabilities 8,972 Net income 559 Total assets 38,775 Interest payments 432 Total equity 29,803 Cash flows from operations 1.015 Operating income 1.223 Income tax expenses 266 Income taxes paid 150 Required: Calculate the following ratios for Rising Stars: (a) debt to equity, (b) debt to total assets, (c) long-term debt to equity, (d) times interest earned (accrual basis), and (e) times interest earned (cash basis). (Note: Round answers to three decimal places.) CONCEPTUAL CONNECTION Interpret these results. 3.What does it mean if a bond is callable

- Comprehensive The following are Farrell Corporations balance sheets as of December 31, 2019, and 2018, and the statement of income and retained earnings for the year ended December 31, 2019: Additional information: a. On January 2, 2019, Farrell sold equipment costing 45,000, with a book value of 24,000, for 19,000 cash. b. On April 2, 2019, Farrell issued 1, 000 shares of common stock for 23,000 cash. c. On May 14, 2019, Farrell sold all of its treasury stock for 25,000 cash. d. On June 1, 2019, Farrell paid 50, 000 to retire bonds with a face value (and book value) of 50, 000. e. On July 2, 2019, Farrell purchased equipment for 63, 000 cash. f. On December 31, 2019, land with a fair market value of 150,000 was purchased through the issuance of a long-term note in the amount of 150,000. The note bears interest at the rate of 15% and is due on December 31, 2021. g. Deferred taxes payable represent temporary differences relating to the use of accelerated depreciation methods for income tax reporting and the straight-line method for financial statement reporting. Required: 1. Prepare a spreadsheet to support a statement of cash flows for Farrell for the year ended December 31, 2019, based on the preceding information. 2. Prepare the statement of cash flows. (Appendix 21.1) Spreadsheet and Statement Refer to the information for Farrell Corporation in P21-13. Required: 1. Using the direct method for operating cash flows, prepare a spreadsheet to support a 2019 statement of cash flows. (Hint: Combine the income statement and December 31, 2019, balance sheet items for the adjusted trial balance. Use a retained earnings balance of 291,000 in this adjusted trial balance.) 2. Prepare the statement of cash flows. (A separate schedule reconciling net income to cash provided by operating activities is not necessary.)Comprehensive The following are Farrell Corporations balance sheets as of December 31, 2019, and 2018, and the statement of income and retained earnings for the year ended December 31, 2019: Additional information: a. On January 2, 2019, Farrell sold equipment costing 45,000, with a book value of 24,000, for 19,000 cash. b. On April 2, 2019, Farrell issued 1,000 shares of common stock for 23,000 cash. c. On May 14, 2019, Farrell sold all of its treasury stock for 25,000 cash. d. On June 1, 2019, Farrell paid 50,000 to retire bonds with a face value (and book value) of 50,000. e. On July 2, 2019, Farrell purchased equipment for 63,000 cash. f. On December 31, 2019. land with a fair market value of 150,000 was purchased through the issuance of a long-term note in the amount of 150,000. The note bears interest at the rate of 15% and is due on December 31, 2021. g. Deferred taxes payable represent temporary differences relating to the use of accelerated depreciation methods for income tax reporting and the straight-line method for financial statement reporting. Required: 1. Prepare a spreadsheet to support a statement of cash flows for Farrell for the year ended December 31, 2019, based on the preceding information. 2. Prepare the statement of cash flows.Comprehensive Colt Company reports pretax financial income of 143,000 in 2019. In addition to pretax income from continuing operations (of which revenues are 295,000), the following items are included in this pretax income: Colts taxable income totals 93,000 in 2019. The difference between the pretax financial income and the taxable income is due to the excess of tax depreciation over financial depreciation on assets used in continuing operations. At the beginning of 2019, Colt had a retained earnings balance of 310.000 and a deferred tax liability of 8,100. During 2019, Colt declared and paid dividends of 48,000. It is subject to tax rates of 15% on the first 50,000 of income and 30% on income in excess of 50,000. Based on proper interperiod tax allocation procedures, Colt has determined that its 2019 ending deferred tax liability is 14,100. Required: 1. Prepare a schedule for Colt to allocate the total 2019 income tax expense to the various components of pretax income. 2. Prepare Colts income tax journal entry at the end of 2019. 3. Prepare Colts 2019 income statement. 4. Prepare Colts 2019 statement of retained earnings. 5. Show the related income tax disclosures on Colts December 31, 2019, balance sheet.