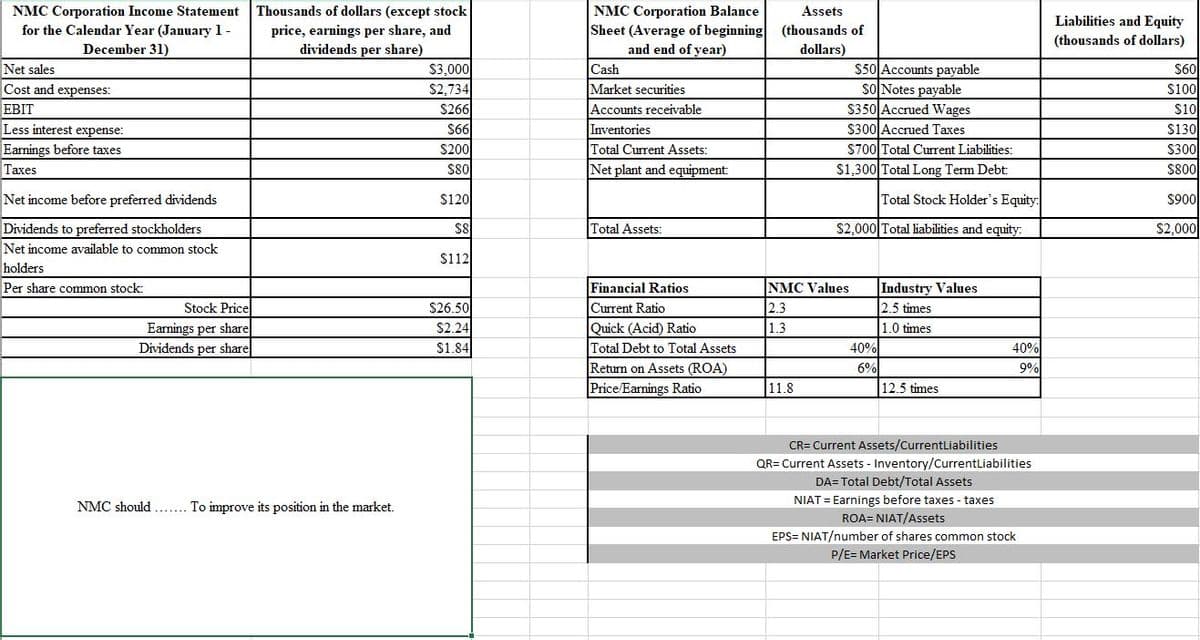

Financial Ratios Current Ratio Quick (Acid) Ratio Total Debt to Total Assets Return on Assets (ROA) Price/Earnings Ratio Industry Values 2.5 times 1.0 times 40% 6% 12.5 times NMC Values 2.3 1.3 40% 9% 11.8

Financial Ratios Current Ratio Quick (Acid) Ratio Total Debt to Total Assets Return on Assets (ROA) Price/Earnings Ratio Industry Values 2.5 times 1.0 times 40% 6% 12.5 times NMC Values 2.3 1.3 40% 9% 11.8

Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Chapter15: Financial Statement Analysis

Section: Chapter Questions

Problem 52E: Juroe Company provided the following income statement for last year: Juroes balance sheet as of...

Related questions

Question

What should NMC do to improve its position in the market?

Transcribed Image Text:Thousands of dollars (except stock

NMC Corporation Income Statement

for the Calendar Year (January 1-

December 31)

NMC Corporation Balance

Sheet (Average of beginning (thousands of

and end of year)

Assets

Liabilities and Equity

price, earnings per share, and

dividends per share)

(thousands of dollars)

dollars)

Net sales

Cost and expenses:

EBIT

Less interest expense:

$3,000

$2,734

$266

$50 Accounts payable

soNotes payable

$350 Accrued Wages

Cash

$60

Market securities

$100

$10

$130

Accounts receivable

$66

Inventories

Total Current Assets:

$300 Accrued Taxes

S700 Total Current Liabilities:

$1,300 Total Long Term Debt:

$300

$800

Earnings before taxes

$200

Taxes

80

Net plant and equipment:

Net income before preferred dividends

$120

Total Stock Holder's Equity:

$900

Dividends to preferred stockholders

S8

Total Assets:

$2,000 Total liabilities and equity:

$2,000|

Net income available to common stock

S112

holders

NMC Values

2.3

1.3

Industry Values

2.5 times

Per share common stock:

Financial Ratios

Stock Price

Earnings per share

Dividends per share

$26.50

Current Ratio

Quick (Acid) Ratio

Total Debt to Total Assets

S2.24

1.0 times

$1.84

40%

40%

Return on Assets (ROA)

Price/Earnings Ratio

6%

12.5 times

9%

11.8

CR= Current Assets/CurrentLiabilities

QR= Current Assets - Inventory/CurrentLiabilities

DA= Total Debt/Total Assets

NIAT = Earnings before taxes - taxes

ROA= NIAT/Assets

NMC should

To improve its position in the market.

EPS= NIAT/number of shares common stock

P/E= Market Price/EPS

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,